Latest

Hot

Hey guys, this is my first time starting a topic. I've found reviewing my trades to be really helpful, so I was thinking why not start discussing trading topics once a month? I hope to continue doing this in the future.

Anyway, I hope this trades review is something funny! This is the place you can like scream and vent your feelings or share your experiences and stories about trading, investing or anytging else!!

My goal is to have a connected community and i think i...

Anyway, I hope this trades review is something funny! This is the place you can like scream and vent your feelings or share your experiences and stories about trading, investing or anytging else!!

My goal is to have a connected community and i think i...

loading...

19

1

3

In February, I started adding Gold into my portfolio to hedge against the dollar as mentioned in this post:

I started "WHEELing" Gold ( $Gold Trust Ishares (IAU.US)$) in February. In May, there was some action on my Gold position as we can see from the transactions below.

Firstly, my gold got called away and it was sold at $37 each due to a covered CALL position. For that trade, I made $50 from selling options and $195 from selling gold.

...

I started "WHEELing" Gold ( $Gold Trust Ishares (IAU.US)$) in February. In May, there was some action on my Gold position as we can see from the transactions below.

Firstly, my gold got called away and it was sold at $37 each due to a covered CALL position. For that trade, I made $50 from selling options and $195 from selling gold.

...

21

6

3

So, this topic actually reminds me a passage I read the othe day, i will summarize the basic idea, and leave you the links for you guys who are interested.

The passage firstly gives the status quo, that the stock market volatility in the US is at its lowest in over 20 months, despite concerns over a slowing economy, geopolitical risks and banking turmoil.

According to the head of asset allocation research at Goldman Sachs, the buoyancy of the US economy, wh...

The passage firstly gives the status quo, that the stock market volatility in the US is at its lowest in over 20 months, despite concerns over a slowing economy, geopolitical risks and banking turmoil.

According to the head of asset allocation research at Goldman Sachs, the buoyancy of the US economy, wh...

3

1

$NVIDIA (NVDA.US)$ has been going strong, but not such when it will hit a road block to slow it's pace ![]()

Will it continue be like PIE, long long forever![]()

Will it continue be like PIE, long long forever

1

By investing in more etfs and put money into safe funds regulated by MAS! I have place almost about thirty thousands in the fund and the ROI is good! always recommended my friends and family to trust moomoo!!

One of the better apps out there as compared to a certain animal app

One of the better apps out there as compared to a certain animal app

2

1

Join Moomoo in May and Started trading.Did not lose a dollar till now which i use to do while trading on commec sec.Moomoo is a very good platform to trade on with lots of tools and even very helpful in learning investing.

1

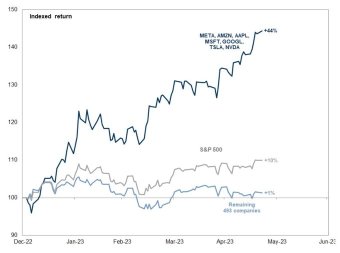

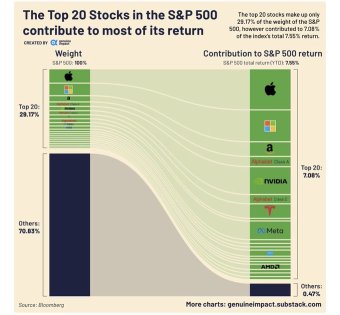

Year-to-Date Performance:

1. S&P 500: +10%

2. 7 Tech Stocks in S&P 500: +45%

3. S&P 493 (S&P 500 - 7 Tech Stocks): +1%

A few stocks are literally holding up the entire market.

If you take out AI-related stocks, the S&P 500 is not up this year.

The AI hype is REAL.

Here are the 7 stocks accounting for all of the $S&P 500 Index (.SPX.US)$ ’s gain this year:

$Meta Platforms (META.US)$ , $Amazon (AMZN.US)$ , $Microsoft (MSFT.US)$ , $Apple (AAPL.US)$ , $Alphabet-A (GOOGL.US)$ , $NVIDIA (NVDA.US)$ and $Tesla (TSLA.US)$ .��������...

1. S&P 500: +10%

2. 7 Tech Stocks in S&P 500: +45%

3. S&P 493 (S&P 500 - 7 Tech Stocks): +1%

A few stocks are literally holding up the entire market.

If you take out AI-related stocks, the S&P 500 is not up this year.

The AI hype is REAL.

Here are the 7 stocks accounting for all of the $S&P 500 Index (.SPX.US)$ ’s gain this year:

$Meta Platforms (META.US)$ , $Amazon (AMZN.US)$ , $Microsoft (MSFT.US)$ , $Apple (AAPL.US)$ , $Alphabet-A (GOOGL.US)$ , $NVIDIA (NVDA.US)$ and $Tesla (TSLA.US)$ .��������...

6

"The world has $1 trillion of data center installed, and it used to be 100% CPUs.

In the next 5-10 years, most of that $1 trillion...will be largely gen AI."

-Jensen Huang

___

CPU -> GPU

This means more Capex but also more revenue stream for cloud host companies.

It also means a restructuring or/and new infrastructure to be built. An incredible new revenue source for an already growing environment.

Let us dissect the winners for this shift from central processing unit to graphics processing unit...

In the next 5-10 years, most of that $1 trillion...will be largely gen AI."

-Jensen Huang

___

CPU -> GPU

This means more Capex but also more revenue stream for cloud host companies.

It also means a restructuring or/and new infrastructure to be built. An incredible new revenue source for an already growing environment.

Let us dissect the winners for this shift from central processing unit to graphics processing unit...

18

1

2

TeslaSmurf : Good.

Of course, everybody has to do his own RESEARCH, develop a STRATEGY according to his experience, keep refining it and, when it constantly works (=makes you money), just stick to it and improve it. Diversification is not a strategy and it is not good by itself but it certainly helps reducing the risk. Too many companies are difficult to follow (data, news, etc) and, in case, ONE company per specific sector is generally enough. As for the long term portfolio 1 to 3 stocks are enough if well chosen. For day trading you can vary more, of course, according to which novelties and opportunities the market may bring.