Latest

Hot

AI Weekly Review![]() :

:

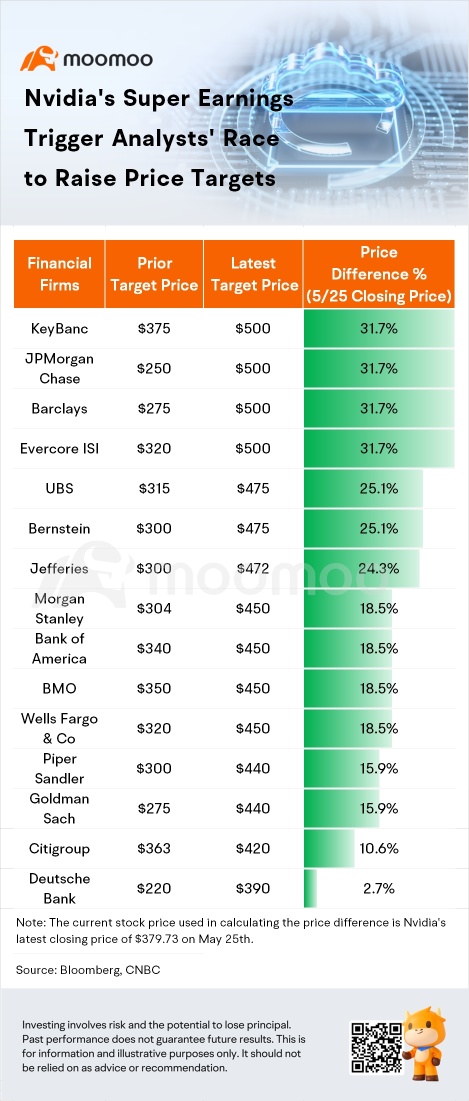

1.Nvidia's data center demand was underestimated, and Wall Street raised its target price.

2.The Philadelphia Semiconductor Index soared to its highest level in 14 months.

3.Nvidia's big move ignited the gaming sector, a new round of industry outbreak is imminent?

4.Is it too early to call the AI stock craze a bubble as retail investors are still holding back?

5.Looking ahead to this week's financial report lin...

1.Nvidia's data center demand was underestimated, and Wall Street raised its target price.

2.The Philadelphia Semiconductor Index soared to its highest level in 14 months.

3.Nvidia's big move ignited the gaming sector, a new round of industry outbreak is imminent?

4.Is it too early to call the AI stock craze a bubble as retail investors are still holding back?

5.Looking ahead to this week's financial report lin...

+1

57

10

What's New

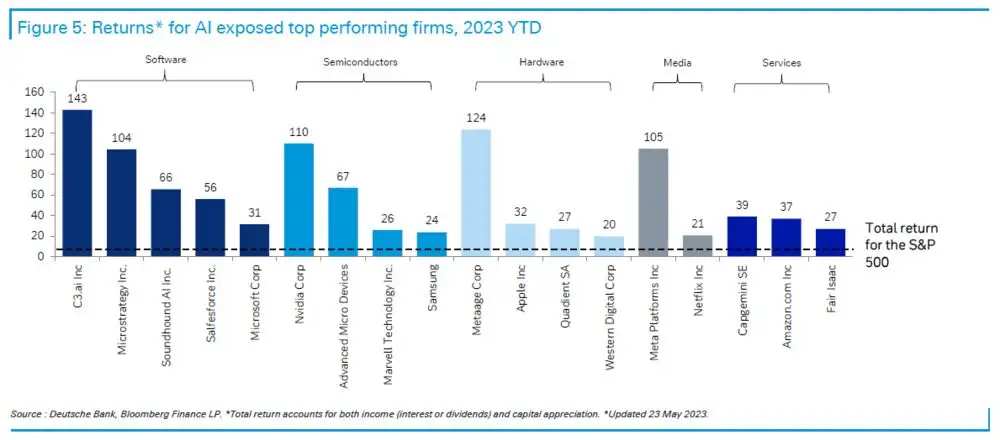

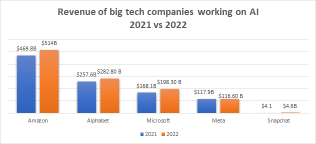

(FACTSET)--- Artificial intelligence has been a focus topic for the market in recent months. Given the heightened interest, 110 of S&P 500 companies cited the term “AI” during their earnings call for the first quarter. This number is well above the 5-year average of 57 and the 10-year average of 34.

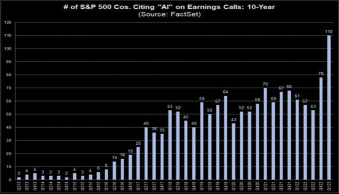

AI in full swing

With the rapid popularity of OpenAI's large language model ChatGPT, other major tech companies have followed suit and rele...

(FACTSET)--- Artificial intelligence has been a focus topic for the market in recent months. Given the heightened interest, 110 of S&P 500 companies cited the term “AI” during their earnings call for the first quarter. This number is well above the 5-year average of 57 and the 10-year average of 34.

AI in full swing

With the rapid popularity of OpenAI's large language model ChatGPT, other major tech companies have followed suit and rele...

26

11

Earnings highlights

For the quarter ended in April:

EPS: $1.09, adjusted, versus 92 cents FactSet consensus expected

Revenue: $7.19 billion, versus $6.53 billion expected

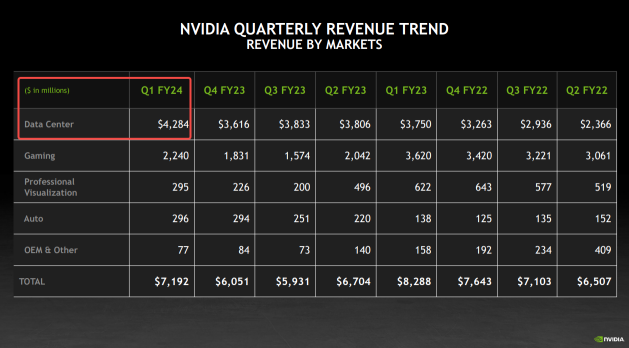

Record Data Center revenue of $4.28 billion

Prior to Wednesday's earnings, Nvidia had already experienced over 100% growth in its stock price in 2023 due to its leading position in the artificial intelligence chip market.

After the company released a strong ...

For the quarter ended in April:

EPS: $1.09, adjusted, versus 92 cents FactSet consensus expected

Revenue: $7.19 billion, versus $6.53 billion expected

Record Data Center revenue of $4.28 billion

Prior to Wednesday's earnings, Nvidia had already experienced over 100% growth in its stock price in 2023 due to its leading position in the artificial intelligence chip market.

After the company released a strong ...

+3

19

4

Is it a good time to own chip stock?

Yes, investing in chip stocks can be profitable due to the chip industry's importance in numerous technological industries. Factors such as rising semiconductor demand due to the popularity of devices such as smartphones, tablets, and IoT devices, as well as emerging technologies such as AI and autonomous vehicles, technological advancements leading to smaller, faster, and more energy-efficient chips, all contribute to the sector's long-term growth pote...

Yes, investing in chip stocks can be profitable due to the chip industry's importance in numerous technological industries. Factors such as rising semiconductor demand due to the popularity of devices such as smartphones, tablets, and IoT devices, as well as emerging technologies such as AI and autonomous vehicles, technological advancements leading to smaller, faster, and more energy-efficient chips, all contribute to the sector's long-term growth pote...

18

1

Columns NVIDIA - The AI boom is real

The most anticipated quarterly results did not disappoint.

In fact, it was a treat that no one expected.

Post results, and after-market, $NVIDIA (NVDA.US)$ shares went up 30%.

So what made the shares pop so much?

1. Partly due to good results

Where $Advanced Micro Devices (AMD.US)$falter, NVIDIA seemed to prosper. Revenue was up 19% QoQ, albeit down 13% YoY.

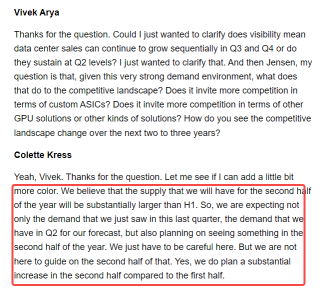

Data center revenues smashed records, up 14% a year ago, led by demand for generative AI and large language model...

In fact, it was a treat that no one expected.

Post results, and after-market, $NVIDIA (NVDA.US)$ shares went up 30%.

So what made the shares pop so much?

1. Partly due to good results

Where $Advanced Micro Devices (AMD.US)$falter, NVIDIA seemed to prosper. Revenue was up 19% QoQ, albeit down 13% YoY.

Data center revenues smashed records, up 14% a year ago, led by demand for generative AI and large language model...

+1

16

2

$NVIDIA (NVDA.US)$ the king of chipmakers, has seen their shares absolutely skyrocket >24%!

This comes as a result of a massive spike in demand for artificial intelligence (AI) processors. These guys are blowing Wall Street's predictions out of the water, forecasting sales of about $11 billion in the quarter ending in July, crushing the average analyst estimate of $7.18 billion. And here's the kicker - this tidal wave of demand has also juiced the stocks of other chip creat...

This comes as a result of a massive spike in demand for artificial intelligence (AI) processors. These guys are blowing Wall Street's predictions out of the water, forecasting sales of about $11 billion in the quarter ending in July, crushing the average analyst estimate of $7.18 billion. And here's the kicker - this tidal wave of demand has also juiced the stocks of other chip creat...

8

5

Nvidia $NVIDIA (NVDA.US)$ delivered impressive financial results and provided a promising revenue forecast for the upcoming quarter. The company reported strong earnings for the April quarter, with adjusted earnings per share surpassing Wall Street's expectations. Despite a decline in gaming revenue, Nvidia experienced a 14% increase in sales for its data center segment, primarily driven by the growing...

8

3

$NVIDIA (NVDA.US)$ shares surged 25% to at an all-time high after it said a surge in demand for its AI-focused semiconductors powered a first quarter earnings beat and a robust near-term outlook for what is now the world's most-valuable chipmaker with a market capitalisation of more than USD940 b.

Nvidia sees current quarter revenues of around USD11 b, compared with the Wall Street consensus of USD7.15 b, with a gross margin of around 70%. That likely equates to ear...

Nvidia sees current quarter revenues of around USD11 b, compared with the Wall Street consensus of USD7.15 b, with a gross margin of around 70%. That likely equates to ear...

10

3

- Nvidia hits record high on upbeat forecast

- Heavyweight AI players, Microsoft, Alphabet rise

- Two ratings agencies put US credit on negative watch

- Indexes close: S&P 500 +0.88%, Nasdaq +1.71%, Dow -0.11%

Wall Street ended sharply higher on Thursday after a blowout forecast from Nvidia sent the chipmaker's stock soaring and fueled a rally in AI-related companies, while investors watched for signs of progress in U.S. debt ceiling tal...

- Heavyweight AI players, Microsoft, Alphabet rise

- Two ratings agencies put US credit on negative watch

- Indexes close: S&P 500 +0.88%, Nasdaq +1.71%, Dow -0.11%

Wall Street ended sharply higher on Thursday after a blowout forecast from Nvidia sent the chipmaker's stock soaring and fueled a rally in AI-related companies, while investors watched for signs of progress in U.S. debt ceiling tal...

8

Deep Value : How's it going?

Dieguito : Hi

102715498 : up??

71388579 : Hi

Cypher : Buying calls

View more comments...