Latest

Hot

Aramco Stockpile is insane comapred to the other companies

$Chevron (CVX.US)$ $Exxon Mobil (XOM.US)$ $Shell (SHEL.US)$ $TotalEnergies (TTE.US)$ $Eni SpA (E.US)$ $BP PLC (BP.US)$

$Chevron (CVX.US)$ $Exxon Mobil (XOM.US)$ $Shell (SHEL.US)$ $TotalEnergies (TTE.US)$ $Eni SpA (E.US)$ $BP PLC (BP.US)$

3

Brent Crude Oil could plummet to $60/barrel in 2025 warns Citi

Could oil companies share price get massively affected by tihs?

$Shell (SHEL.US)$ $Exxon Mobil (XOM.US)$ $Occidental Petroleum (OXY.US)$

Could oil companies share price get massively affected by tihs?

$Shell (SHEL.US)$ $Exxon Mobil (XOM.US)$ $Occidental Petroleum (OXY.US)$

2

1

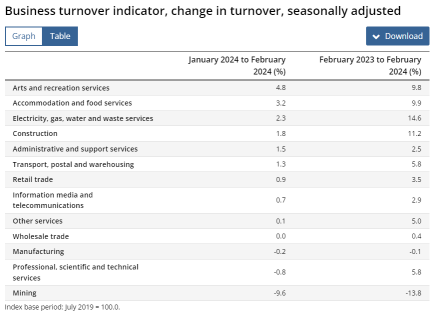

The Australian Bureau of Statistics (ABS) released new industry revenue statistics before the weekend last week, which showed that 10 out of 13 industries were operating at an increase.

While the ABS operates in a lag for information and this data is for February, the stats showed that the Australian mining industry recorded a 9.6% drop in revenue compared to last month, and 13.8% down compared to last ye...

While the ABS operates in a lag for information and this data is for February, the stats showed that the Australian mining industry recorded a 9.6% drop in revenue compared to last month, and 13.8% down compared to last ye...

16

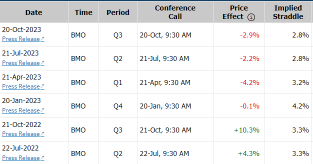

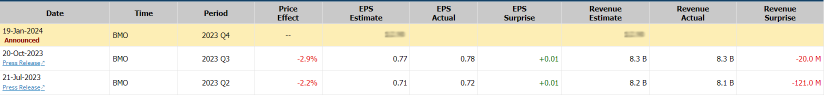

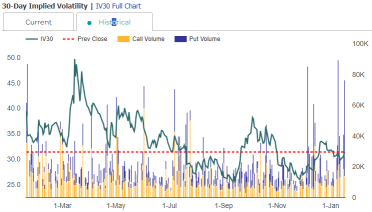

$Schlumberger (SLB.US)$ is expected to release earnings on Jan 19, 2024 before the market opens (BMO). The consensus EPS estimate is $0.83 (+16.9% Y/Y) and the consensus revenue estimate is $8.94B (+13.2% Y/Y). Over the last 2 years, SLB has beaten EPS estimates 100% of the time and has beaten revenue estimates 63% of the time.

We are facing a slowdown in the oil markets despite there are 2 conflicts in geopolitical, Schlumberger's busin...

We are facing a slowdown in the oil markets despite there are 2 conflicts in geopolitical, Schlumberger's busin...

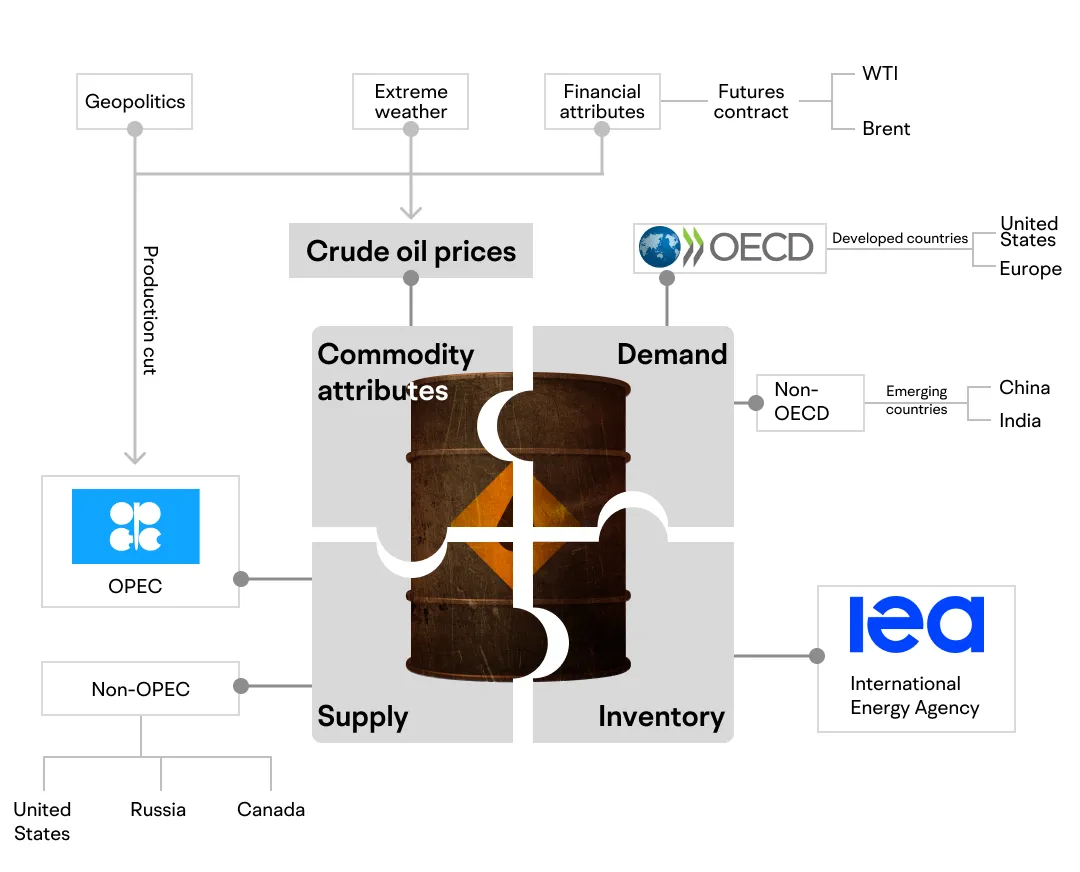

+3

Falling inventory should make oil price to go up but it did the exact opposite, therefore one can conclude that oil price is highly manipulated. The major players are obviously US/UK OPEC Russia and China. US in the past generally want to keep the oil prices low as it was the biggest importer, but after the shale oil revolution it became more ambivalent as it became the top oil producer. This year Biden wanted low oil prices to fight inflation. As to geopolitics, if US wants to weaken Russia it ...

7

1

I'll bite good thing or bad thing hmmmm? ![]()

5

1

$SIA (C6L.SG)$ : Wow ! Jia luk liao ! Must hold my gun liao. But oil price drop to US$73.38. Strange phenomenon !

3

5

$Hang Seng Index (800000.HK)$ dropped 62 points or 0.4% to open at 16,311 this morning (13th). $Hang Seng China Enterprises Index (800100.HK)$ fell 24 points or 0.4% to 5,589. $Hang Seng TECH Index (800700.HK)$ slid 26 points or 0.7% to 3,703.

The Central Economic Work Conference proposed to meet reasonable financing needs of real estate enterprises of different ownerships equally. Chinese developers rose this morning before dropping yesterday (12th). $LONGFOR GROUP (00960.HK)$ and �����...

The Central Economic Work Conference proposed to meet reasonable financing needs of real estate enterprises of different ownerships equally. Chinese developers rose this morning before dropping yesterday (12th). $LONGFOR GROUP (00960.HK)$ and �����...

2

1