Latest

Hot

Not much people know about $Occidental Petroleum (OXY.US)$ other than being the O&G stock that Warren Buffett owns.

And stock prices have rallied since 2021, from USD 20 per share to USD 63.52 as of writing.

So what do the latest results entail?

1. Net sales are down

Prices came down as the crude oil market marked a 32% decline to an average of USD 73.59.

Even though production was marginally higher than planned, at 1.218 million barrels of oil equivalent daily, ...

And stock prices have rallied since 2021, from USD 20 per share to USD 63.52 as of writing.

So what do the latest results entail?

1. Net sales are down

Prices came down as the crude oil market marked a 32% decline to an average of USD 73.59.

Even though production was marginally higher than planned, at 1.218 million barrels of oil equivalent daily, ...

+1

15

Occidental Petroleum Corp $Occidental Petroleum (OXY.US)$ stock has gained 1.55% while the S&P 500 is lower by -0.04% as of 2:36 PM on Monday, Jul 31. OXY is up $0.96 from the previous closing price of $62.08 on volume of 6,407,250 shares. Over the past year the S&P 500 has risen 11.21% while OXY is lower by -3.36%. OXY earned $8.78 a per share in the over the last 12 months, giving it a price-to-earnings ratio of 7.18.

1

"Demand is quite healthy, which could be cause for optimism about the global economy were it not for the fact that supply is falling short of expectations. This is fueling concern about more inflation pain despite the efforts of central banks in Europe and North America to tame it with a series of rate hikes."

“We expect pretty sizable deficits in the second half with deficits of almost 2 million barrels per day in the third quarter as deman...

“We expect pretty sizable deficits in the second half with deficits of almost 2 million barrels per day in the third quarter as deman...

1

Occidental Petroleum's stock (OXY) $Occidental Petroleum (OXY.US)$ has dropped in value along with the fall in oil prices over the past year. Despite a recent improvement, the stock is still 16% lower than its peak in August last year.

While many investors have been selling their shares in this oil company, Warren Buffett's company, Berkshire Hathaway $Berkshire Hathaway-B (BRK.B.US)$ $Berkshire Hathaway-A (BRK.A.US)$, has been taking advantage of the lower prices and buying more ...

While many investors have been selling their shares in this oil company, Warren Buffett's company, Berkshire Hathaway $Berkshire Hathaway-B (BRK.B.US)$ $Berkshire Hathaway-A (BRK.A.US)$, has been taking advantage of the lower prices and buying more ...

1

Occidental Petroleum Corporation (OXY Quick QuoteOXY - Free Report) is scheduled to release second-quarter 2023 results on Aug 2 after market close. In the last reported quarter, the company delivered a negative surprise of 16.15%.

Let’s discuss the factors that are likely to get reflected in the upcoming quarterly results.

Factors to Consider

Occidental’s second-quarter production volume is expected to be the lowest of the year due to the ...

Let’s discuss the factors that are likely to get reflected in the upcoming quarterly results.

Factors to Consider

Occidental’s second-quarter production volume is expected to be the lowest of the year due to the ...

The supply cuts imposed by OPEC+ are reverberating in Middle Eastern crude markets, with Asian buyers turning to US barrels and putting a lid on a key light variety, while aiding more sulfurous, sludgy cargoes

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $Occidental Petroleum (OXY.US)$

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $Occidental Petroleum (OXY.US)$

1

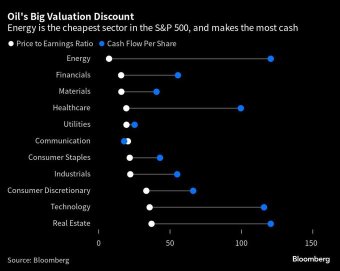

Energy is the least expensive sector in the S&P 500 but generates the most cash. Perhaps this explains why Warren Buffett continues to increase his position in Occidental Petroleum $Occidental Petroleum (OXY.US)$ $S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$

4

BULLISH data for Natural Gas prices continue

HEATWAVES, decreased Rig counts,China demand...NOW YOU CAN ADD BUFFETT- BERKSHIRE to the mix

get those buy prog. in our favor

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Occidental Petroleum (OXY.US)$ $United States Oil Fund LP (USO.US)$ $S&P 500 Index (.SPX.US)$ $Coca-Cola (KO.US)$

HEATWAVES, decreased Rig counts,China demand...NOW YOU CAN ADD BUFFETT- BERKSHIRE to the mix

get those buy prog. in our favor

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Occidental Petroleum (OXY.US)$ $United States Oil Fund LP (USO.US)$ $S&P 500 Index (.SPX.US)$ $Coca-Cola (KO.US)$

1

The world’s leading energy watchdog said global oil demand is now on track to climb by 2.2 million barrels per day in 2023 to reach an average of 102.1 million barrels per day.

China is set to account for 70% of this demand growth increase, the IEA said.

“Persistent macroeconomic headwinds, apparent in a deepening manufacturing slump, have led us to revise our 2023 growth estimate lower for the first tim...

China is set to account for 70% of this demand growth increase, the IEA said.

“Persistent macroeconomic headwinds, apparent in a deepening manufacturing slump, have led us to revise our 2023 growth estimate lower for the first tim...

4