Latest

Hot

[Rewards] Alibaba reports choppy Q1 FY24 earnings beat, new energy unleashed?

Claim your Earnings Season offer by winning Rewards Points and discovering Investment Opportunities!

KEY Figures:

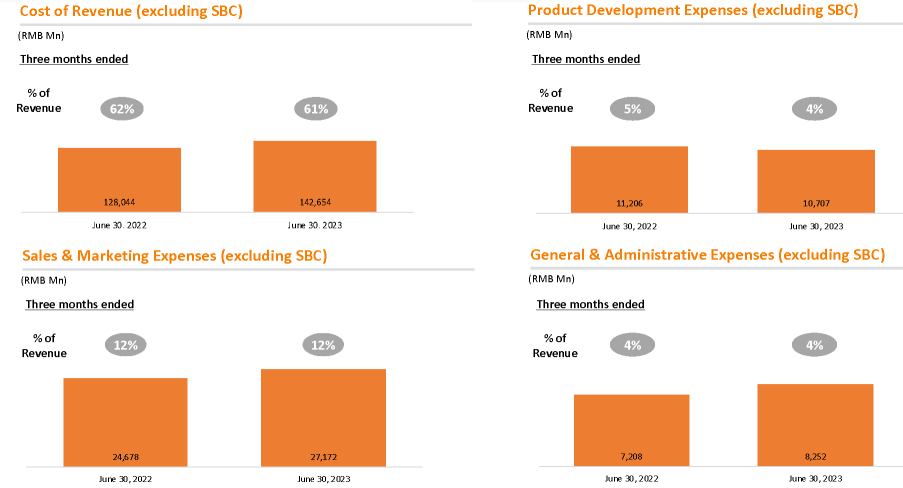

● Total revenue grew by 14% year-on-year (YoY) to $32,29 billion, above the Refinitiv consensus estimates of $31.02 billion.

● Net income (attributable to ordinary shareholders) was $4.73 billion, above the Refinitiv consensus estimates of $3.95 billion, up 51% YoY. Non-...

Claim your Earnings Season offer by winning Rewards Points and discovering Investment Opportunities!

KEY Figures:

● Total revenue grew by 14% year-on-year (YoY) to $32,29 billion, above the Refinitiv consensus estimates of $31.02 billion.

● Net income (attributable to ordinary shareholders) was $4.73 billion, above the Refinitiv consensus estimates of $3.95 billion, up 51% YoY. Non-...

38

9

There were many negative developments which have been surrounding the China’s economy for the past two months.

Delay in the recovery of the economy growth momentum mainly due to:

1) the slump in property market which lead to low level of spending confidence

2) the weak external demand that pull down the export performance

3) different grades of interest default payments by some big names such as $COUNTRY GARDEN (02007.HK)$ , $SINO-OCEAN GP (03377.HK)$ $EVERGRANDE (03333.HK)$ ��������...

Delay in the recovery of the economy growth momentum mainly due to:

1) the slump in property market which lead to low level of spending confidence

2) the weak external demand that pull down the export performance

3) different grades of interest default payments by some big names such as $COUNTRY GARDEN (02007.HK)$ , $SINO-OCEAN GP (03377.HK)$ $EVERGRANDE (03333.HK)$ ��������...

30

5

$Solowin (SWIN.US)$ I still don't want to talk, because I haven't made back what I lost because of the FUCKING BULLSHIT that BETR pulled two weeks ago and I was only going to start talking again when I fucking did, but this is important so I'm making the exception to tell you people. This looks like it's FINALLY listing tomorrow after a bunch of delays, and it's the next CHINESE IPO. And not only that, it's straight from HONG KONG. And if you're new or don't know why that's important, Chinese IPO...

12

18

1. A great company does not complain and keeps moving forward. For example, $PDD Holdings (PDD.US)$ $MEITUAN-W (03690.HK)$ keeps their heads down and plays their cards more smoothly. $Futu Holdings Ltd (FUTU.US)$ can continue to grow under extremely bad conditions. In the financial report management overview and Niu Niuquan, I have never seen any complaints,this is very powerful;

2. Some oth...

2. Some oth...

17

9

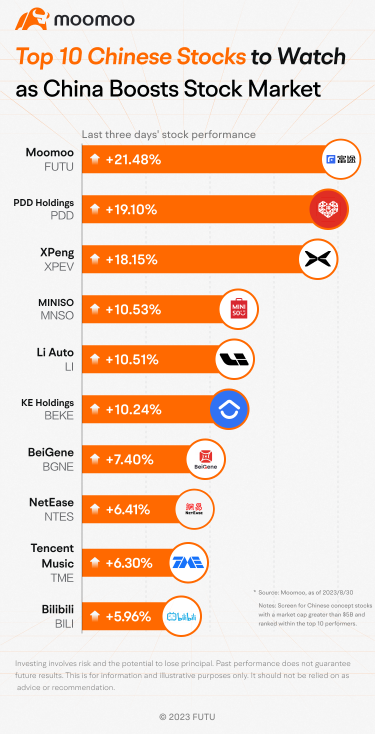

China has launched a campaign to boost its sluggish stock market and revive investor confidence in an economy experiencing challenges.

Over the weekend, a series of measures were announced to enhance China's stock market, including reducing stamp duty, slowing the pace of initial public offerings (IPOs), and encouraging margin financing. Furthermore, State-run banks could trim mortgage rates on existing home loans to spur spending, accor...

Over the weekend, a series of measures were announced to enhance China's stock market, including reducing stamp duty, slowing the pace of initial public offerings (IPOs), and encouraging margin financing. Furthermore, State-run banks could trim mortgage rates on existing home loans to spur spending, accor...

17

1

$Lion-OCBC Sec HSTECH S$ (HST.SG)$

China will make it easier for insurance companies to invest in domestic stocks, the latest in a series of measures aimed at shoring up market sentiment..

![]()

![]()

![]()

China will make it easier for insurance companies to invest in domestic stocks, the latest in a series of measures aimed at shoring up market sentiment..

11

2

$NIO Inc (NIO.US)$

Nio is just waiting for the 20-week MA to cross over the 50-week MA before rising. Maybe a week or two.

$BYD COMPANY (01211.HK)$ $BYD Co. (BYDDF.US)$ $XPeng (XPEV.US)$ $Li Auto (LI.US)$ $Tesla (TSLA.US)$

Nio is just waiting for the 20-week MA to cross over the 50-week MA before rising. Maybe a week or two.

$BYD COMPANY (01211.HK)$ $BYD Co. (BYDDF.US)$ $XPeng (XPEV.US)$ $Li Auto (LI.US)$ $Tesla (TSLA.US)$

5

17

Recent data signals that a gradual, consumer-led recovery is underway in China, and the two main short-term obstacles to a return to pre-pandemic growth levels are likely to recede in the coming quarters, Andy Rothman at Matthews Asia, an investment specialist said.

He asks, rhetorically: "It's in vogue to be pessimistic about China's economy, but is the consensus view too negative?"

Rothman highlighted that most of the developed world mov...

He asks, rhetorically: "It's in vogue to be pessimistic about China's economy, but is the consensus view too negative?"

Rothman highlighted that most of the developed world mov...

12

1

$BYD COMPANY (01211.HK)$ $Tesla (TSLA.US)$ Based on TrendForce data, BYD uses PHEV (Plug-in Hybrid Electric Vehicle) to push up the sales figure. Tesla produces only BEV (Battery Electric Vehicle). Some reports use the term NEV (New Energy Vehicle), which is rather confusing, is a mixture of PHEV and BEV. In a separate report, PHEV is not considered pure EV hence using BEV is a better comparison. You can read more in the post made recently:

Tesla dominates Global Battery Electric Vehicles Sales: InsideEVs Why not BYD?

���������...

Tesla dominates Global Battery Electric Vehicles Sales: InsideEVs Why not BYD?

���������...

+1

7

37

1. Beijing Restricts iPhones for Government Workers

Beijing directs some government workers in key departments to stop using iPhones for national security reasons, including investment, trade, and international affairs departments. The ban coincides with Huawei's Mate 60 Pro launch. It may signal further tech sector containment efforts, possibly extending to the private sector.

$Apple (AAPL.US)$ $Huawei Hongmong (LIST0795.SH)$ $XIAOMI-W (01810.HK)$ $Xiaomi Corp. Unsponsored ADR Class B (XIACY.US)$ $Xiaomi Corp. (XIACF.US)$

���������...

Beijing directs some government workers in key departments to stop using iPhones for national security reasons, including investment, trade, and international affairs departments. The ban coincides with Huawei's Mate 60 Pro launch. It may signal further tech sector containment efforts, possibly extending to the private sector.

$Apple (AAPL.US)$ $Huawei Hongmong (LIST0795.SH)$ $XIAOMI-W (01810.HK)$ $Xiaomi Corp. Unsponsored ADR Class B (XIACY.US)$ $Xiaomi Corp. (XIACF.US)$

���������...

5

4

. It is in the sweet spot in the current China’s economic situation, where most people are tightening their belt, to continue to capture a larger market share.

. It is in the sweet spot in the current China’s economic situation, where most people are tightening their belt, to continue to capture a larger market share.

romancer : concerns remain about Alibaba's future revenue growth and macro factors.

Srikanth Reddy : The company's operational efficiencies and cost reductions contributed to Alibaba's strong performance.

Deep Value : Alibaba's stock remains cheap and undervalued, despite risks such as competition in Chinese e-commerce and tense US-China relations.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Cloud D Investor : Alibaba is still the number one e-commerce company in China and when china grows, Alibaba will grow bigger as well.

小阿远 romancer : China's competitive pressure is increasing day by day, and objective factors such as the continuous decline in Taobao's net profit and market share all have an impact

View more comments...