Latest

Hot

$Cosmos Health(COSM.US$ $Tuniu(TOUR.US$ $Rent the Runway(RENT.US$ $CBOE Volatility S&P 500 Index(.VIX.US$ $NASDAQ(NASDAQ.US$ $Jaguar Health(JAGX.US$ $Hello Group(MOMO.US$ $Carvana(CVNA.US$ $Transcode Therapeutics(RNAZ.US$ $Bit Brother(BTB.US$ $Mirati Therapeutics(MRTX.US$ $COMSovereign(COMS.US$ $Apple(AAPL.US$ $Tesla(TSLA.US$ $NVIDIA(NVDA.US$ $Amazon(AMZN.US$ $Microsoft(MSFT.US$ $Advanced Micro Devices(AMD.US$ $Summit Therapeutics(SMMT.US$ $BioVie(BIVI.US$ $Mullen Automotive(MULN.US$ $Futu Holdings Ltd(FUTU.US$ $Phoenix Motor(PEV.US$ $Peabody Energy(BTU.US$ $Alphabet-C(GOOG.US$ $AMC Preferred Equity Unit(APE.US$ $Clover Health(CLOV.US$ $Vinco Ventures(BBIG.US$ $Aditxt(ADTX.US$ $Cinedigm(CIDM.US$ $First Wave BioPharma(FWBI.US$ $Digital World Acquisition Corp(DWAC.US$ $Meta Materials Inc. Class A Preferred Stock(MMTLP.US$ $Mullen Automotive(MULN.US$ $ �������...

13

2

Only 3 green candlesticks over the last 29 trading days. If I am a bull, I will be a little worried because VIX seems like a sleeping giant waiting to be awakened.

Can the Santa keep it asleep till early Jan 2023 for us to have a Santa rally?

Anyway, 19-20 is quite crucial in my opinion, as a double bottom pattern (bullish sign) for VIX is still potentially in play.

$CBOE Volatility S&P 500 Index(.VIX.US$

Can the Santa keep it asleep till early Jan 2023 for us to have a Santa rally?

Anyway, 19-20 is quite crucial in my opinion, as a double bottom pattern (bullish sign) for VIX is still potentially in play.

$CBOE Volatility S&P 500 Index(.VIX.US$

9

4

Bull market always start with bear

so

bull will continues to run as look for those continues grow revenue & soild P&L company!

$ASML Holding(ASML.US$

$Futu Holdings Ltd(FUTU.US$

$Pfizer(PFE.US$

so

bull will continues to run as look for those continues grow revenue & soild P&L company!

$ASML Holding(ASML.US$

$Futu Holdings Ltd(FUTU.US$

$Pfizer(PFE.US$

8

Speaker: Bruce Zhang CFA, CSOP Portfolio Manager, PM of the largest China government bond ETF in the World

Key Takeaways:

Part 1: About CSOP –The First Batch of China Managers Exploring Overseas Market

CSOP is established in HK in 2008 and our parent company is one of the largest Chinese AM with AUM at US$280bn as of last year*. CSOP is one of the largest ETF issuers in HK and manages half of the top 10 most actively...

Key Takeaways:

Part 1: About CSOP –The First Batch of China Managers Exploring Overseas Market

CSOP is established in HK in 2008 and our parent company is one of the largest Chinese AM with AUM at US$280bn as of last year*. CSOP is one of the largest ETF issuers in HK and manages half of the top 10 most actively...

![[Live Review] The New APAC in post-pandemic: Why this may be a perfect timing?](https://ussnsimg.moomoo.com/feed_image/71451441/abc000df187d388182b0ac545ca13c95.png/thumb)

![[Live Review] The New APAC in post-pandemic: Why this may be a perfect timing?](https://ussnsimg.moomoo.com/feed_image/71451441/5525eb582b6d3b879e1470a8d97c5124.png/thumb)

![[Live Review] The New APAC in post-pandemic: Why this may be a perfect timing?](https://ussnsimg.moomoo.com/feed_image/71451441/3a57ec50a69a3112a0551088da454ab7.png/thumb)

5

But interestingly, there are 2 bullish signs on the daily chart.

1. Macd is curling up with a so-called sub zero golden cross - which means the decline has slowed, and there could be a possible rebound. Noted the word “possible”![]()

2. Bullish divergence spotted on RSI

Not financial advice - just merely reading off the chart.

$Tesla(TSLA.US$

1. Macd is curling up with a so-called sub zero golden cross - which means the decline has slowed, and there could be a possible rebound. Noted the word “possible”

2. Bullish divergence spotted on RSI

Not financial advice - just merely reading off the chart.

$Tesla(TSLA.US$

3

1

Sales of electric vehicles in Europe rose steadily in October. In October, the sales of electric vehicles in Germany, France, Norway, the United Kingdom, Sweden, and Italy reached 6.8, 2.8, 1.1, 2.9, 1.3, and 10,000 units respectively, with a total of 159,000 units, a year-on-year increase of 14% and a month-on-month decrease of 17%; the six c...

4

Hello all, the broad market is showing a very potential key reversal signal after last session of bullish candle.

I think most investors are awaiting CPI and FOMC decision or minutes.

If it can break the previous swing high the current down trend is over.

The market will enter a consolidation phase or new bull market depends on the volume.

Two key events:

CPI data today 930am Singapore time.

FOMC statement on Thursday 3am

Will share the charts tonight

I think most investors are awaiting CPI and FOMC decision or minutes.

If it can break the previous swing high the current down trend is over.

The market will enter a consolidation phase or new bull market depends on the volume.

Two key events:

CPI data today 930am Singapore time.

FOMC statement on Thursday 3am

Will share the charts tonight

2

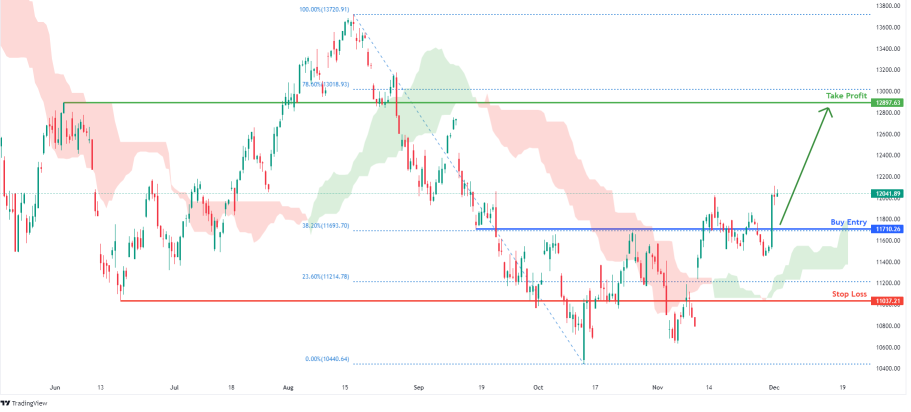

Hello, good day traders! 👋🤙

I'm looking for a potential buy 📈setup for $Nasdaq(NDAQ.US$ , with both fundamental and technical indicators to back it up.

📰Fundamentally,

Stocks rose across the board after Federal Reserve Chairman Jerome Powell signaled a slowing in the pace of tightening as early as December, while also indicating more hikes to combat inflation. Bond yields have fallen in tandem with the dollar.

The S&P500 reached a two-month high, marking...

I'm looking for a potential buy 📈setup for $Nasdaq(NDAQ.US$ , with both fundamental and technical indicators to back it up.

📰Fundamentally,

Stocks rose across the board after Federal Reserve Chairman Jerome Powell signaled a slowing in the pace of tightening as early as December, while also indicating more hikes to combat inflation. Bond yields have fallen in tandem with the dollar.

The S&P500 reached a two-month high, marking...

1

Hello, good day traders! 👋🤙

I'm looking for a potential buy📈 setup for $S&P 500 Index(.SPX.US$, with both fundamental and technical indicators to back it up.

📰Fundamentally,

The S&P 500 rallied and closed above its 200 day moving average for the first time since April after the release of Powell's remarks prepared for delivery at the Brookings Institution think tank in Washington.

Bets that the Fed will reduce the size of its rate hikes, as well as recent data pointing t...

I'm looking for a potential buy📈 setup for $S&P 500 Index(.SPX.US$, with both fundamental and technical indicators to back it up.

📰Fundamentally,

The S&P 500 rallied and closed above its 200 day moving average for the first time since April after the release of Powell's remarks prepared for delivery at the Brookings Institution think tank in Washington.

Bets that the Fed will reduce the size of its rate hikes, as well as recent data pointing t...

1

codygmoney : don't get emotionally attached, pull profits and find the next move and as always TRADE LIKE A SPOILD LITTLE BRAT

GetMeABeerDude codygmoney: preach. I have a stock that got up to $20, I held on, now it's .04! lol. oops.