Latest

Hot

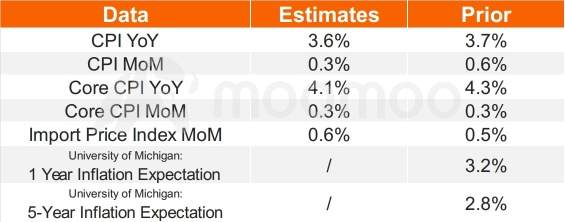

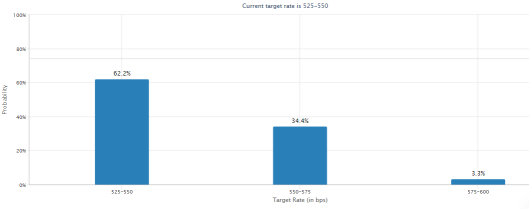

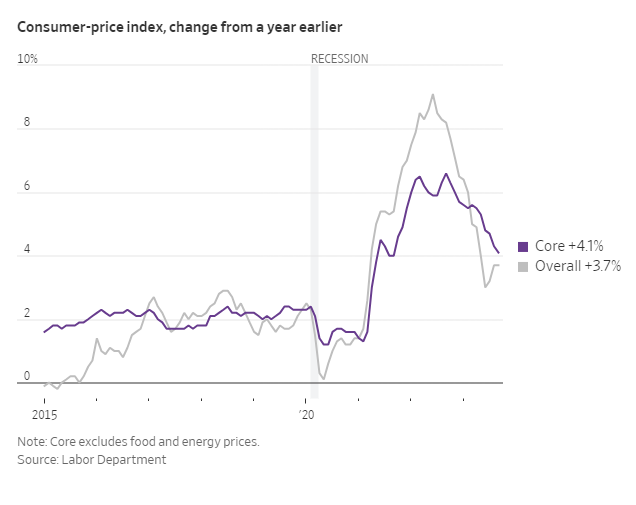

The Bureau of Labor Statistics will release the September CPI at 8:30 ET on Thursday. After two consecutive months of increases, economists expect inflation to reverse its upward trend in September.

Bloomberg data shows YoY CPI inflation will fall to 3.6% (vs. 3.7% prior), with annual core inflation decelerating to 4.1% from 4.3% prior. On a month-on-month basis, headline and core CPI inflation may both register a ...

Bloomberg data shows YoY CPI inflation will fall to 3.6% (vs. 3.7% prior), with annual core inflation decelerating to 4.1% from 4.3% prior. On a month-on-month basis, headline and core CPI inflation may both register a ...

+5

24

5

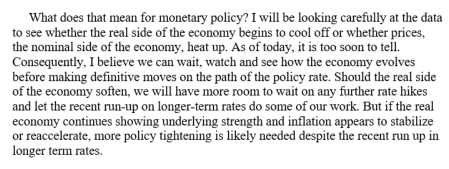

Fed governor Chris Waller blesses a November pause:

After that, if growth cools along the lines of the Sept SEP, then stay on hold

But if strong demand stalls recent progress on inflation, failing to respond "in a timely way” risks “unwinding the work that we have done to date"

$Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

After that, if growth cools along the lines of the Sept SEP, then stay on hold

But if strong demand stalls recent progress on inflation, failing to respond "in a timely way” risks “unwinding the work that we have done to date"

$Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

3

1

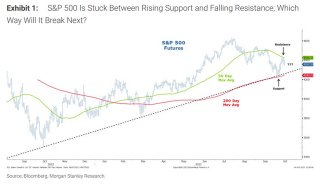

The S&P 500 equity risk premium is nearing zero for the first time in over two decades.

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

1

Singapore shares slipped when trading began on Thursday (Oct 19) following overnight losses on Wall Street and Europe.

$FTSE Singapore Straits Time Index (.STI.SG)$ headed down 0.8 per cent or 25.12 points to 3,111.50 as at 9.01 am. Across the broader market, losers outnumbered gainers 94 to 38, after 84.8 million securities worth S$84.1 million changed hands.

The most active counter by volume was $Seatrium (S51.SG)$ , which lost 1.7 ...

$FTSE Singapore Straits Time Index (.STI.SG)$ headed down 0.8 per cent or 25.12 points to 3,111.50 as at 9.01 am. Across the broader market, losers outnumbered gainers 94 to 38, after 84.8 million securities worth S$84.1 million changed hands.

The most active counter by volume was $Seatrium (S51.SG)$ , which lost 1.7 ...

2

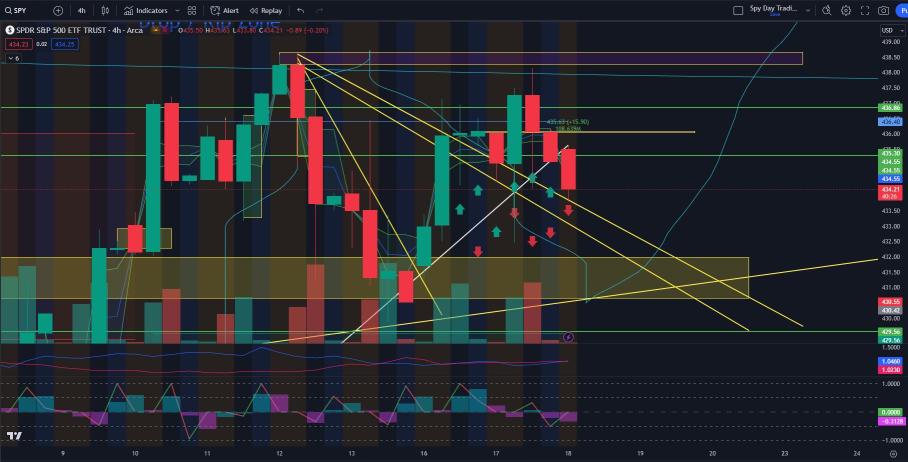

Good morning everyone and welcome, to The Market! The #1 underrated market analsys on MooMoo you will ever find.

If you havent already read yesterdays edition, you can do so here The Market where we analysed the market and provided different trading ideas.

We had an incredible day yesterday! We took a couple small losses, but nothing too huge after our big trade to the upside. We also were accurate that the market would reverse, but I cut the trade too early which is okay since my rule...

If you havent already read yesterdays edition, you can do so here The Market where we analysed the market and provided different trading ideas.

We had an incredible day yesterday! We took a couple small losses, but nothing too huge after our big trade to the upside. We also were accurate that the market would reverse, but I cut the trade too early which is okay since my rule...

+13

4

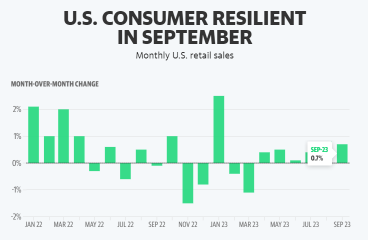

Despite high interest rates and concerns over a weakening economy, retail sales in September increased by 0.7%, which is well above the estimated 0.3%. Gas station sales played a significant role in this growth due to a rise of 0.9% triggered by an increase in gas prices.

Read Here: Here's the Breakdown for Monthly Retail Sales in September

The U.S. consumer cannot stop spending," said David Russell, global head of market strate...

Read Here: Here's the Breakdown for Monthly Retail Sales in September

The U.S. consumer cannot stop spending," said David Russell, global head of market strate...

18

Morgan Stanley's Mike Wilson predicts that the $S&P 500 Index (.SPX.US)$ will close at 3,900 points by the end of this year, which suggests that stocks will shed 10% of their value.

The S&P 500 has made steady gains this month, after suffering a volatile September in which it plummeted by 5%. So far this year, the index has returned almost 15%.

Consumer confidence is weakening, according to survey data from the University o...

The S&P 500 has made steady gains this month, after suffering a volatile September in which it plummeted by 5%. So far this year, the index has returned almost 15%.

Consumer confidence is weakening, according to survey data from the University o...

22

5

Harker sees possible Fed wait till next year to evaluate inflation containment. Reports suggest business slowdowns despite strong data. Rate cuts considered once inflation nears 2%. Possible slowdown of asset portfolio runoff discussed.

For basically all of its history, the Fed is self-funded, turns a profit and sends it to the Treasury (the taxpayer). Now the Fed is rapidly losing money, underwater on its investments and its liabilities will soon exceed its assets:

Technically since the Fed can fabricate money infinitely, it can't actually go bankrupt. But it will signal to the world the extent to which Fed is losing control of th...

Technically since the Fed can fabricate money infinitely, it can't actually go bankrupt. But it will signal to the world the extent to which Fed is losing control of th...

3

1. U.S. retail sales rose 0.7% on the month, more than double expectations for a 0.3% gain.

2. August retail sales were revised up to a 0.8% increase from a previously reported 0.6% rise.

3. After stripping out the auto and gas categories, core retail sales rose 0.6%, blowing past expectations for +0.2%.

4. Core retail sales for August were upwardly revised to 0.9% from 0.6%.

5. Despite higher gasoline and energy prices, the U.S. consumer remains res...

2. August retail sales were revised up to a 0.8% increase from a previously reported 0.6% rise.

3. After stripping out the auto and gas categories, core retail sales rose 0.6%, blowing past expectations for +0.2%.

4. Core retail sales for August were upwardly revised to 0.9% from 0.6%.

5. Despite higher gasoline and energy prices, the U.S. consumer remains res...

2

safri_moomoor : ok good

104281896 safri_moomoor : $Bitcoin (BTC.CC)$

KenParks Jr. : Koolness

Revelation 6 : The Fed should raise interest rates by .25%. This CPI report is a political joke and is nowhere near reality.

Smeltzer Gloria : Top Dogs offers exceptional house and roof washing services that go beyond traditional cleaning. With their professional expertise, they rejuvenate the exterior of your home, removing dirt, grime, and even stubborn stains. Their roof-washing services are a vital aspect of home maintenance, ensuring the longevity of your roof while enhancing its appearance. Top Dogs' commitment to quality and customer satisfaction shines through in every job, providing not only a cleaner home but also peace of mind. With their experienced team and top-notch equipment, they deliver a spotless and revitalized home exterior, leaving you with a fresh, clean, and appealing property that stands out in the neighborhood. For more information visit https://www.topdogslandscape.com/house-washing-roof-washing/