Latest

Hot

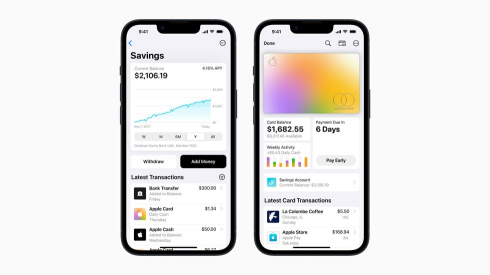

$Apple (AAPL.US)$ has rolled out an Apple Card high-yield savings account from $Goldman Sachs (GS.US)$ , the company said in a release dated Monday.

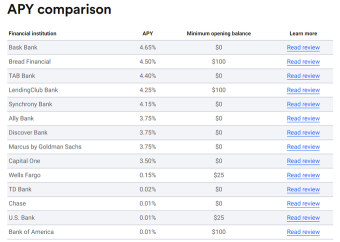

The account, which has no fees, no minimum deposits and no minimum balance requirements, offers an annual percentage yield of 4.15%, As of April 12, the national average yield for savings accounts is 0.24% APY, AAPL s offer would thus more than...

The account, which has no fees, no minimum deposits and no minimum balance requirements, offers an annual percentage yield of 4.15%, As of April 12, the national average yield for savings accounts is 0.24% APY, AAPL s offer would thus more than...

+1

12

1

Wow Apple offering saving accounts that give 4.15% interest rate. Will more big tech firms follow suit? If that happens, traditional banks will be at threat.

$Apple (AAPL.US)$ $Goldman Sachs (GS.US)$

$Apple (AAPL.US)$ $Goldman Sachs (GS.US)$

2

2

1.Asset/liability mismatch

Banking operations are based on financial mismatching, which is inherently risky.

This mismatch occurs when: (1) banks do not hold enough cash to pay all depositors, (2) their primary assets are not repaid in the short term, and (3) loan sales take a considerable amount of time, especially when selling close to face value. Banks face risks with interest expenses an...

Banking operations are based on financial mismatching, which is inherently risky.

This mismatch occurs when: (1) banks do not hold enough cash to pay all depositors, (2) their primary assets are not repaid in the short term, and (3) loan sales take a considerable amount of time, especially when selling close to face value. Banks face risks with interest expenses an...

3

Holy crap Apple! $Apple (AAPL.US)$ 🔥🔥🚀🚀

This is some serious competition to regular banks! Can this create bankruns on regular banks? Yes it could!

Apple is the largest corporation in the world. I guess they have the power to kill banks.

No Banks in Sweden give close to this return!

$Nasdaq Composite Index (.IXIC.US)$ $Credit Suisse (CS.US)$ $JPMorgan (JPM.US)$ $Goldman Sachs (GS.US)$

This is some serious competition to regular banks! Can this create bankruns on regular banks? Yes it could!

Apple is the largest corporation in the world. I guess they have the power to kill banks.

No Banks in Sweden give close to this return!

$Nasdaq Composite Index (.IXIC.US)$ $Credit Suisse (CS.US)$ $JPMorgan (JPM.US)$ $Goldman Sachs (GS.US)$

1

UFB direct offers a free savings account with 5.02% interest however I keep 90% in the stock market long term.

1

little baron :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)