Latest

Hot

How do you see Tesla’s global price cuts in the EV market?

Tesla’s global price cuts has raised a big question mark whether the demand for Tesla’s EV has been weak and triggered the panic button amongst many of its investors. However, I would see it as a strategic business decision for following reasons:

With more players in EV market nowadays, price cut is easiest to catch peoples’ attention and gain market share. 20% price cut for EV of this brand name is hardly irresistible for potenti...

Tesla’s global price cuts has raised a big question mark whether the demand for Tesla’s EV has been weak and triggered the panic button amongst many of its investors. However, I would see it as a strategic business decision for following reasons:

With more players in EV market nowadays, price cut is easiest to catch peoples’ attention and gain market share. 20% price cut for EV of this brand name is hardly irresistible for potenti...

8

Tesla shares dropped as much as 65% in 2022, their worst year on record. With the recent news of Tesla’s slowing sales growth and the company slashing prices by as much as 20%, some investors are worried that Tesla’s stock price will plummet further.

This month, Tesla announced to cut prices for U.S. buyers by as much as 20%. The Model Y starting price now is around $53,000, down from about $66,000. 🤯🤯

This is at least the fourth time the ...

This month, Tesla announced to cut prices for U.S. buyers by as much as 20%. The Model Y starting price now is around $53,000, down from about $66,000. 🤯🤯

This is at least the fourth time the ...

20

16

The EV giant reports Q4 revenue and profit beat, focus on cost control and innovation

Claim your Earnings Season offer by winning Rewards Points and discovering Investment Opportunities!

Key Takeaways:

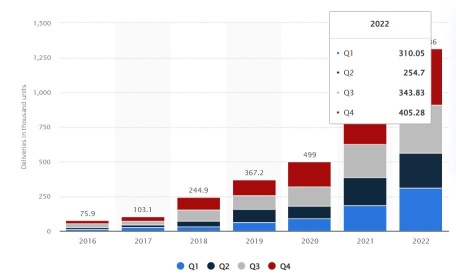

Attitude: "It was a fantastic year for Tesla, and it was our best year ever on every level." said Elon Musk. In 2022, Tesla delivered over 1.3 million cars and achieved a 17% operating margin, the highest among any volume carmaker. The company generated $12.5 billion ...

Claim your Earnings Season offer by winning Rewards Points and discovering Investment Opportunities!

Key Takeaways:

Attitude: "It was a fantastic year for Tesla, and it was our best year ever on every level." said Elon Musk. In 2022, Tesla delivered over 1.3 million cars and achieved a 17% operating margin, the highest among any volume carmaker. The company generated $12.5 billion ...

50

25

3

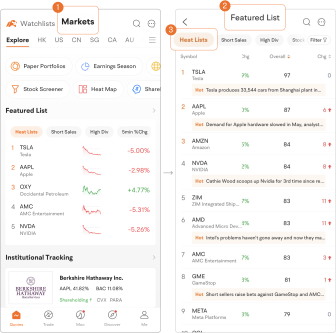

The tech-dominated Nasdaq Composite is off to a good start in 2023, up over 11% year-to-date as inflation has slowed and optimism from the Fed is on the rise.

Several star tech stocks are also performing well, with Tesla (TSLA.US) up over 40%^ YTD, Nvidia (NVDA.US) up nearly 40%^ YTD, and Meta Platforms (META.US) up over 26%^ YTD.![]()

![]()

![]()

The uptrend in tech stocks has remained strong in recent weeks, with Tesla up for 6 consecutive trading days sinc...

Several star tech stocks are also performing well, with Tesla (TSLA.US) up over 40%^ YTD, Nvidia (NVDA.US) up nearly 40%^ YTD, and Meta Platforms (META.US) up over 26%^ YTD.

The uptrend in tech stocks has remained strong in recent weeks, with Tesla up for 6 consecutive trading days sinc...

47

9

8

Hi, mooers!

Thanks for your participation in the earnings analysis events on Tesla. We are glad to see mooers give impressive comments and share insights concerning the companies!![]()

As always, let's start with a quick look at some of the most inspiring comments:

There was a 44.2% share price increase since Tesla's earnings release. (Data as of Feb. 21)![]() After reporting Q4 and full year earnings, 73% of mooers think Tesla will go straight t...

After reporting Q4 and full year earnings, 73% of mooers think Tesla will go straight t...

Thanks for your participation in the earnings analysis events on Tesla. We are glad to see mooers give impressive comments and share insights concerning the companies!

As always, let's start with a quick look at some of the most inspiring comments:

There was a 44.2% share price increase since Tesla's earnings release. (Data as of Feb. 21)

16

6

1

$Tesla (TSLA.US)$

Tesla's earnings are coming up. This is the next price catalyst for the ticker. If earnings surprise to the upside then they could be the one thing $Tesla (TSLA.US)$need to get out of this long-term downward trending price channel.

After seeing most of the market react very negatively after hours to Microsoft's earnings call, personally I would wait until Tesla's earnings are released before placing any bets.

On the long-term outlook Tesla is a great...

Tesla's earnings are coming up. This is the next price catalyst for the ticker. If earnings surprise to the upside then they could be the one thing $Tesla (TSLA.US)$need to get out of this long-term downward trending price channel.

After seeing most of the market react very negatively after hours to Microsoft's earnings call, personally I would wait until Tesla's earnings are released before placing any bets.

On the long-term outlook Tesla is a great...

8

7

4

In our previous posts, we talked about Tesla $Tesla (TSLA.US)$ facing Production and delivery risks, Regulatory and policy risks, as well as Competition risks.

Financial Risks:

Tesla operates in a capital-intensive industry and in order to maintain its technological advantage, it needs to invest heavily in R&D. Tesla has consistently been investing around 6-8% of its revenue in research and development. In 2020, the company reporte...

Financial Risks:

Tesla operates in a capital-intensive industry and in order to maintain its technological advantage, it needs to invest heavily in R&D. Tesla has consistently been investing around 6-8% of its revenue in research and development. In 2020, the company reporte...

5

1

Buy, Buy , Buy , court your money every day ..hahaha

3

1

Hi all,

First I would like to share I'm investing in TSLA for past 4+ years. so I have seen all his rides and recent downward trend 📈.

I expect it will be a trillion $ company by 2025 & share price will resemble by $500.

But the Q4 earnings won't be up to analysts estimates. Reason: price cut, less deliveries than manufacturers etc. Hence stock can see a downward path till $130. Every time it goes down it gives opportunity for long term Investor...

First I would like to share I'm investing in TSLA for past 4+ years. so I have seen all his rides and recent downward trend 📈.

I expect it will be a trillion $ company by 2025 & share price will resemble by $500.

But the Q4 earnings won't be up to analysts estimates. Reason: price cut, less deliveries than manufacturers etc. Hence stock can see a downward path till $130. Every time it goes down it gives opportunity for long term Investor...

Translated

3

1