Latest

Hot

Columns Long-Term U.S. Treasury Yields Soared to Their Highest Levels Since 2007; What Are the Implications?

The U.S. Treasury market - widely recognized as the world's most liquid - has experienced violent turbulence akin to junk stocks recently. The surge in long-term Treasury yields has been especially remarkable, as both the 10-year and 30-year U.S. Treasury yields reached their highest levels in sixteen years on October 3rd. Following a stronger-than-expected jobs report released on October 6th, the...

+2

50

5

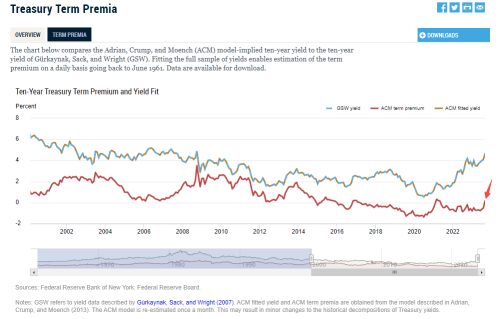

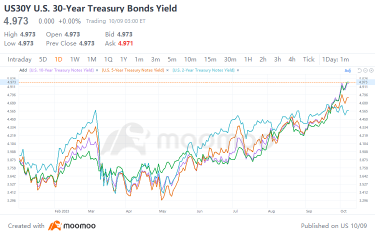

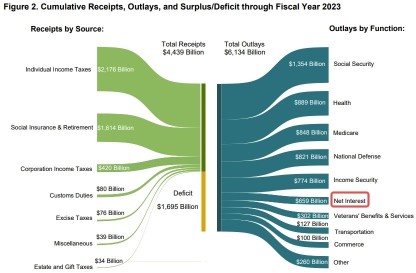

Heading into October, surging U.S. Treasury yields are once again causing turbulence in global financial markets and raising investor concerns. Last week saw the $U.S. 30-Year Treasury Bonds Yield (US30Y.BD)$ surge above 5%, a level not seen in 16 years. After the $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ climbed to 4.85%, market experts predict that the benchmark yield will reach5% for the first time since 2007.

...

...

+3

33

3

RECAP

U.S. stocks ended sharply lower after a strong year-end rally lost momentum on Wednesday, putting an end to a string of record finishes for the Dow Jones Industrial Average and a pause on the S&P 500's push toward an all-time closing high.

$Dow Jones Industrial Average (.DJI.US)$ ended down by more than 470 points, or 1.3%, at around 37,082, based on preliminary figures. $S&P 500 Index (.SPX.US)$ closed lower by 1.5% at around 4,6...

U.S. stocks ended sharply lower after a strong year-end rally lost momentum on Wednesday, putting an end to a string of record finishes for the Dow Jones Industrial Average and a pause on the S&P 500's push toward an all-time closing high.

$Dow Jones Industrial Average (.DJI.US)$ ended down by more than 470 points, or 1.3%, at around 37,082, based on preliminary figures. $S&P 500 Index (.SPX.US)$ closed lower by 1.5% at around 4,6...

30

2

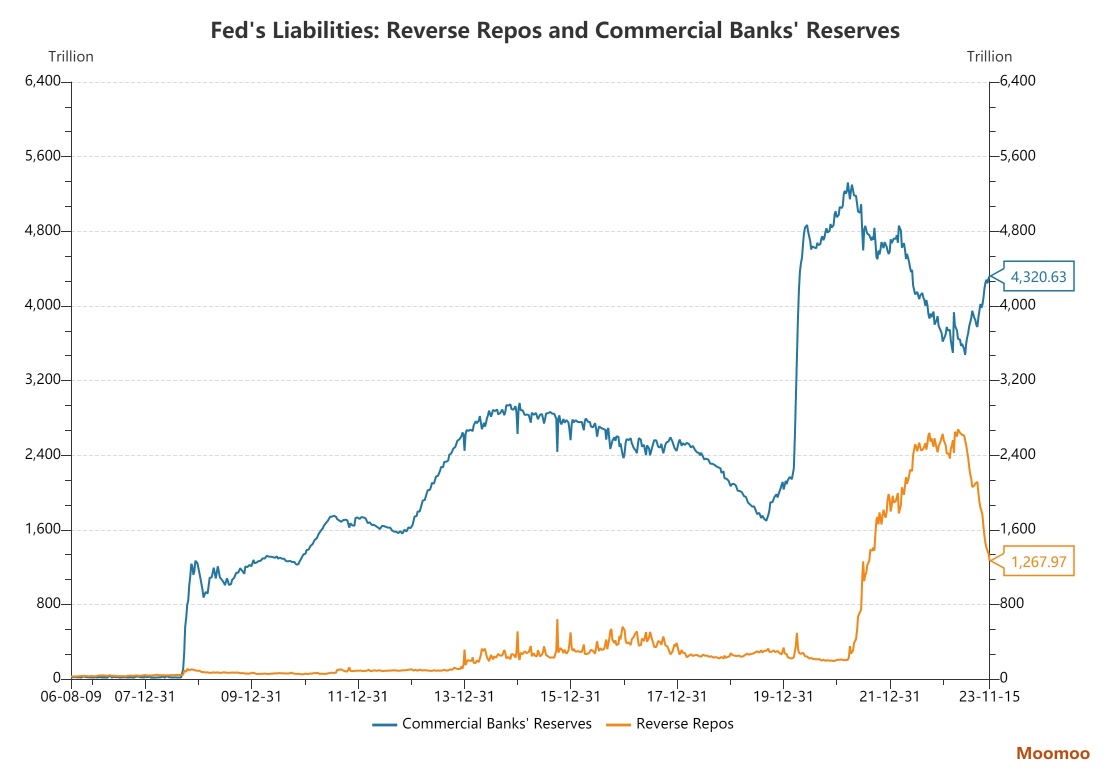

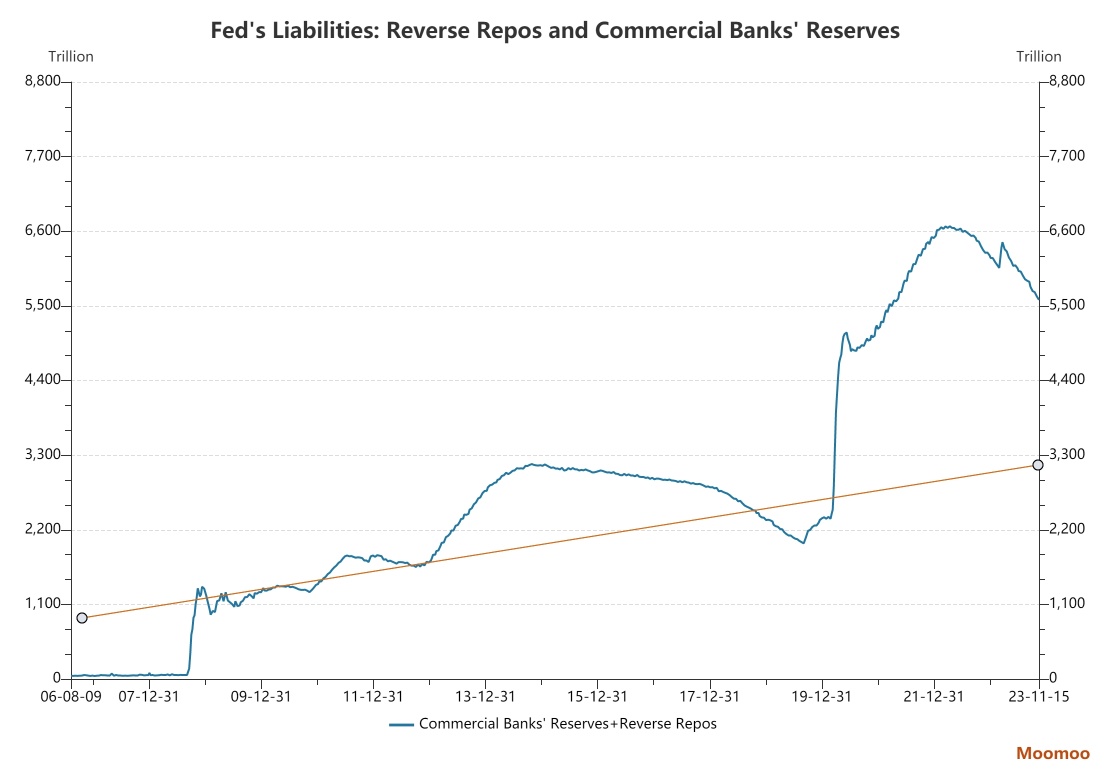

As interest rate hiking comes closer to an end, quantitative tightening has gradually become another topic of market concern.

The central banks have only got a couple of experiences of QT. Japan did it in 2006 and 2007. The US did it from 2017 to 2019. During both periods, stock markets had above-average volatility.

Is quantitative tightening necessarily as scary as it seems?

■ First, the liquidity is far from scarce

We can observe li...

The central banks have only got a couple of experiences of QT. Japan did it in 2006 and 2007. The US did it from 2017 to 2019. During both periods, stock markets had above-average volatility.

Is quantitative tightening necessarily as scary as it seems?

■ First, the liquidity is far from scarce

We can observe li...

28

1

RECAP

U.S. stocks closed at year highs Tuesday afternoon as investors awaited the Federal Reserve’s interest rate announcement Wednesday and hope the latest inflation data doesn’t crimp optimism around rate cuts.

The $Dow Jones Industrial Average (.DJI.US)$ gained 173 points, or 0.48% to 36,577. The $S&P 500 Index (.SPX.US)$ rose 21 points, or 0.46% to 4,643. The $Nasdaq Composite Index (.IXIC.US)$ rose 100 points, o...

U.S. stocks closed at year highs Tuesday afternoon as investors awaited the Federal Reserve’s interest rate announcement Wednesday and hope the latest inflation data doesn’t crimp optimism around rate cuts.

The $Dow Jones Industrial Average (.DJI.US)$ gained 173 points, or 0.48% to 36,577. The $S&P 500 Index (.SPX.US)$ rose 21 points, or 0.46% to 4,643. The $Nasdaq Composite Index (.IXIC.US)$ rose 100 points, o...

25

2

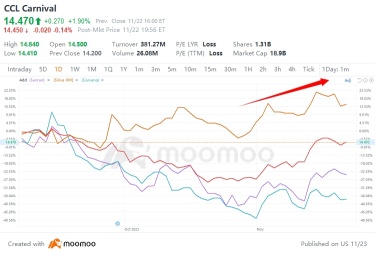

Recently, US stocks have experienced a robust rebound, propelled by growing optimism that the Federal Reserve will soon put an end to its interest rate hike cycle and renewed hopes for a "Goldilocks" economy in America. The sudden surge, however, has caused a brutal "short squeeze," resulting in short sellers suffering significant losses. According to data from S3 Partners, hedge funds lost $43.2 billion on ...

21

7

By moomoo news Kiki

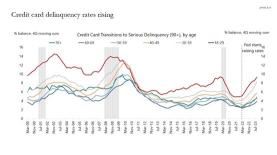

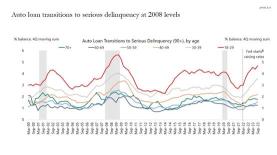

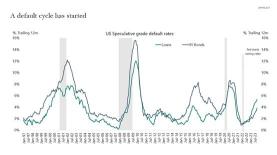

With the release of October CPI report, the rapid cooling in US inflation supports many analysts' expectations that the economy will achieve a soft landing. However, some leading economic indicators are not optimistic. Markets are focusing closely on immaculate disinflation, while ignoring the deterioration of some leading indicators that may indicate an economic recession.

Credit card ...

With the release of October CPI report, the rapid cooling in US inflation supports many analysts' expectations that the economy will achieve a soft landing. However, some leading economic indicators are not optimistic. Markets are focusing closely on immaculate disinflation, while ignoring the deterioration of some leading indicators that may indicate an economic recession.

Credit card ...

+1

24

1

RECAP

U.S. stocks pushed to back-to-back records Thursday, with the Dow Jones Industrial Average up less than 60 points after carving out a fresh record. Optimism about the Federal Reserve's interest-rate-cut projections delivered a day ago had been fueling a powerful rally. Treasury yields fell, and interest rate-dependent stocks in the housing or auto sector flew.

The $Dow Jones Industrial Average (.DJI.US)$ adv...

U.S. stocks pushed to back-to-back records Thursday, with the Dow Jones Industrial Average up less than 60 points after carving out a fresh record. Optimism about the Federal Reserve's interest-rate-cut projections delivered a day ago had been fueling a powerful rally. Treasury yields fell, and interest rate-dependent stocks in the housing or auto sector flew.

The $Dow Jones Industrial Average (.DJI.US)$ adv...

26

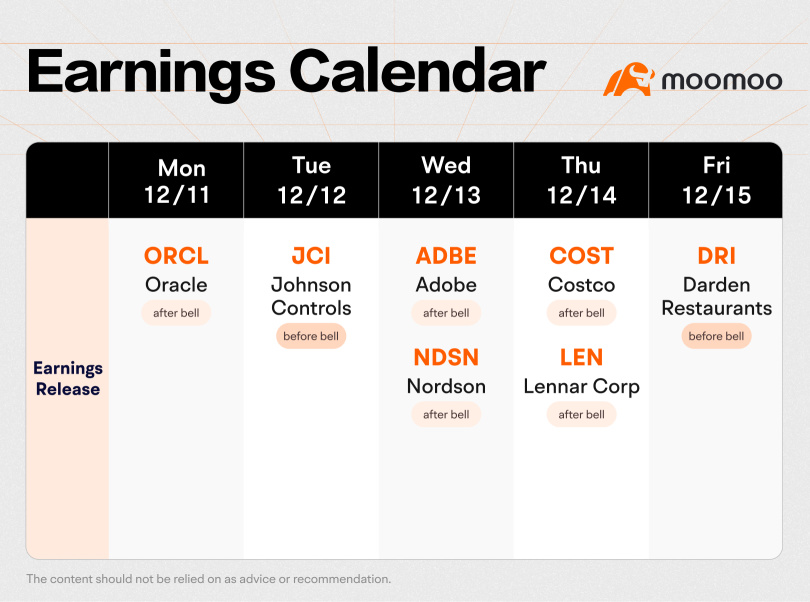

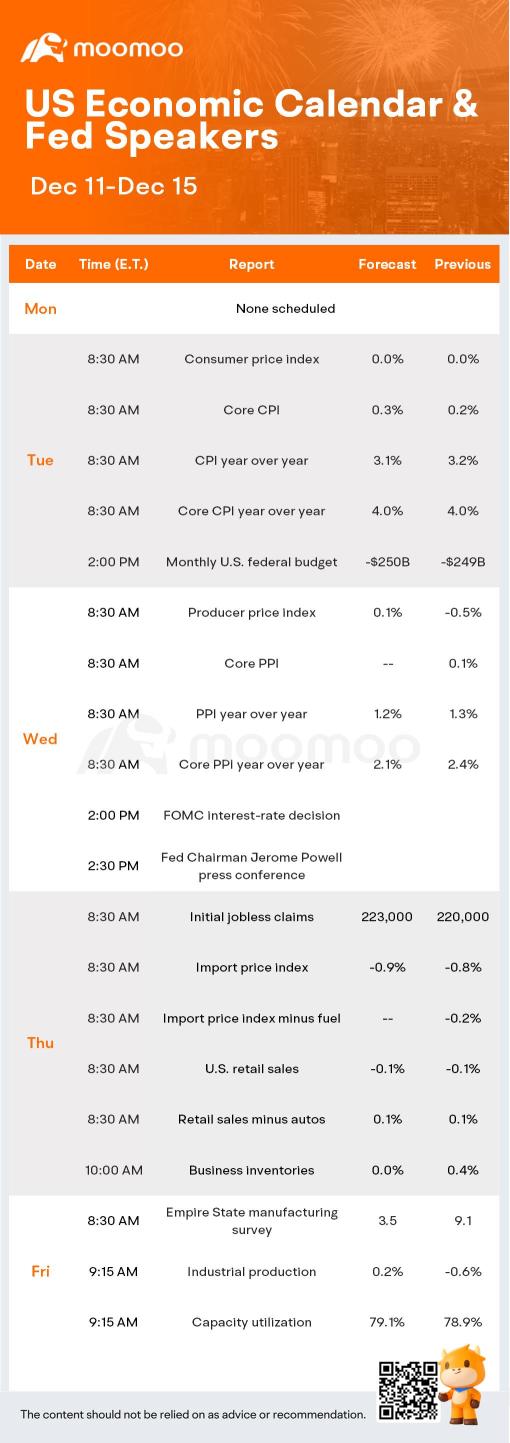

The main events this week will be the latest inflation data and the Federal Reserve's policy committee's December meeting, with a decision on what they will do with interest rates due on Wednesday afternoon.

The market is overwhelmingly expecting no change to rates. Fed officials' latest projections for the economy and interest rates will offer clues into the future path of monetary policy.

Earnings reports...

The market is overwhelmingly expecting no change to rates. Fed officials' latest projections for the economy and interest rates will offer clues into the future path of monetary policy.

Earnings reports...

+3

25

RECAP

US Stocks Slip, Yields Creep Higher

US stocks slipped, while yields creeped higher as investors await more economic data that could offer clues on the trajectory of interest rates after US Federal Reserve Chair Jerome Powell last week pushed back against market expectations of aggressive cuts next year.

The $S&P 500 Index (.SPX.US)$ fell 0.5% to 4,569.78 while the $Dow Jones Industrial Average (.DJI.US)$ slipped 0....

US Stocks Slip, Yields Creep Higher

US stocks slipped, while yields creeped higher as investors await more economic data that could offer clues on the trajectory of interest rates after US Federal Reserve Chair Jerome Powell last week pushed back against market expectations of aggressive cuts next year.

The $S&P 500 Index (.SPX.US)$ fell 0.5% to 4,569.78 while the $Dow Jones Industrial Average (.DJI.US)$ slipped 0....

23

1

safri_moomoor : hi thanks

TheOtherGuy2022 : depends on how fake the numbers are but if they were authentic and natural numbers....that should mean lower stock pricing

amiable Llama_6295 : high rates strong usd drags all![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104252802 : we want economic resilience not to punich economic growth...

Future Dc : Hii