Posts

News

Latest

Hot

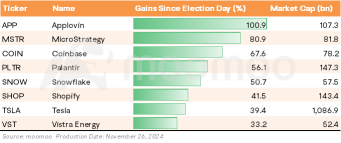

Three weeks after the election, investors are zeroing in on the Trump administration’s policy trajectory. The Trump 2.0 cabinet is nearly set, with nominees for key economic roles like Treasury and Commerce Secretary mostly decided.

In this environment, U.S. equities have been volatile. The 'Trump trade' initially surged, pulled back on concerns about reflation, and then began to rebound. Since election day, the $S&P 500 Index (.SPX.US)$ has risen...

In this environment, U.S. equities have been volatile. The 'Trump trade' initially surged, pulled back on concerns about reflation, and then began to rebound. Since election day, the $S&P 500 Index (.SPX.US)$ has risen...

+1

76

10

$Bitcoin (BTC.CC)$ when you have the right person leading a team, leading a company, leading a country great things can happen.

with Elon Musk and Trump and many others fixing the screw-ups of the left the United States May embark on a new tomorrow a dawn of a new day.

one of the problems and many people have talked about this and been critical of and myself is in that group, deals with social security. the cost is enormous and people have always said if I would have just invested my money mys...

with Elon Musk and Trump and many others fixing the screw-ups of the left the United States May embark on a new tomorrow a dawn of a new day.

one of the problems and many people have talked about this and been critical of and myself is in that group, deals with social security. the cost is enormous and people have always said if I would have just invested my money mys...

8

2

$Trump Media & Technology (DJT.US)$ this definitely gonna squeeze next month

3

3

$MicroStrategy (MSTR.US)$ all the shares are going down today except for this in my portfolio. It seems to move opposite direction from common stocks.

2

2

$Bitcoin (BTC.CC)$ told you Trump is still surrounding himself with 💩 swamp ass . Scott Basset Hound managed the George Soros fund, the major donor to Antifa, anti-conservative group that started all the riots during Trump's first term.....holy shit what a joke.

$Tesla (TSLA.US)$ $NVIDIA (NVDA.US)$

$Tesla (TSLA.US)$ $NVIDIA (NVDA.US)$

1

3

Why do I still believe % $NVIDIA (NVDA.US)$ will hit $200 before it hits $100?

• $Alphabet-A (GOOGL.US)$ ordered 400K GB200 chips valued at $10B.

• $Microsoft (MSFT.US)$ purchased 60K GB200 chips worth $2B.

• $Meta Platforms (META.US)$ acquired 360K GB200 chips for $8B.

Demand for Nvidia's Blackwell chip is absolutely INSANE![]()

• $Alphabet-A (GOOGL.US)$ ordered 400K GB200 chips valued at $10B.

• $Microsoft (MSFT.US)$ purchased 60K GB200 chips worth $2B.

• $Meta Platforms (META.US)$ acquired 360K GB200 chips for $8B.

Demand for Nvidia's Blackwell chip is absolutely INSANE

6

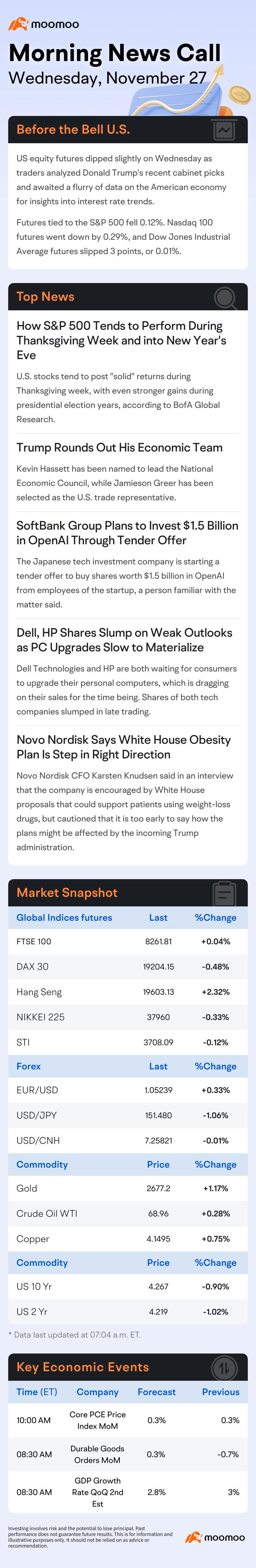

Goldman forecasts gold will hit $3,000/oz by 2025, driven by central bank demand, Fed rate cuts, and risk aversion.

Brent oil prices may hover at $70-$85/bbl in 2025 due to OPEC+ and Trump tariffs but could fall to $61/bbl by late 2026.

$Crude Oil Futures(JAN5) (CLmain.US)$ $Brent Last Day Financial Futures(FEB5) (BZmain.US)$ $Occidental Petroleum (OXY.US)$ $Exxon Mobil (XOM.US)$

Brent oil prices may hover at $70-$85/bbl in 2025 due to OPEC+ and Trump tariffs but could fall to $61/bbl by late 2026.

$Crude Oil Futures(JAN5) (CLmain.US)$ $Brent Last Day Financial Futures(FEB5) (BZmain.US)$ $Occidental Petroleum (OXY.US)$ $Exxon Mobil (XOM.US)$

2

$Trump Media & Technology (DJT.US)$

panda puts loaded see u at 27

panda puts loaded see u at 27

3

$SPDR S&P 500 ETF (SPY.US)$

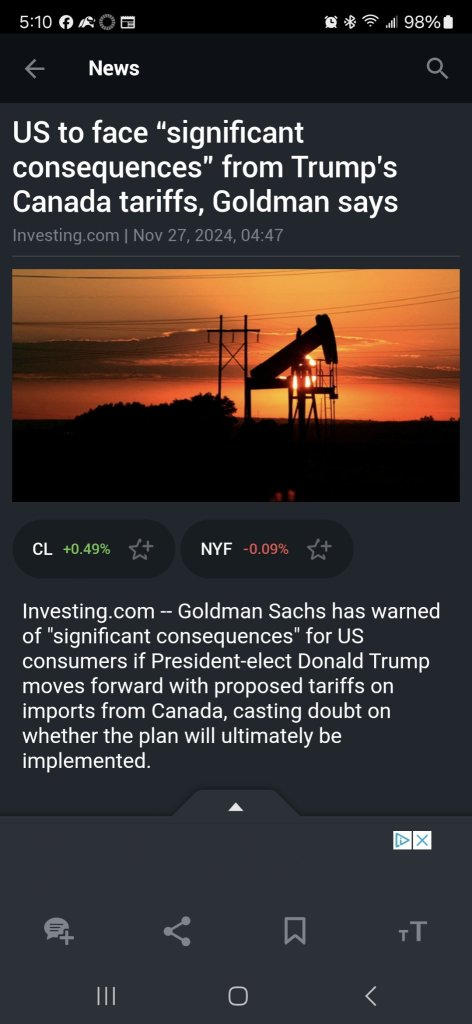

"US to face “significant consequences” from Trump’s Canada tariffs, Goldman says"

US to face “significant consequences” from Trump’s Canada tariffs, Goldman says By Investing.com

"US to face “significant consequences” from Trump’s Canada tariffs, Goldman says"

US to face “significant consequences” from Trump’s Canada tariffs, Goldman says By Investing.com

1

1

103492837 : Thank you for sharing

MsMay : P

104088143 : How is it?

103811630 : “Q

103681739 : good to know that year end is a good time to deploy capital

View more comments...