Latest

Hot

News Highlights

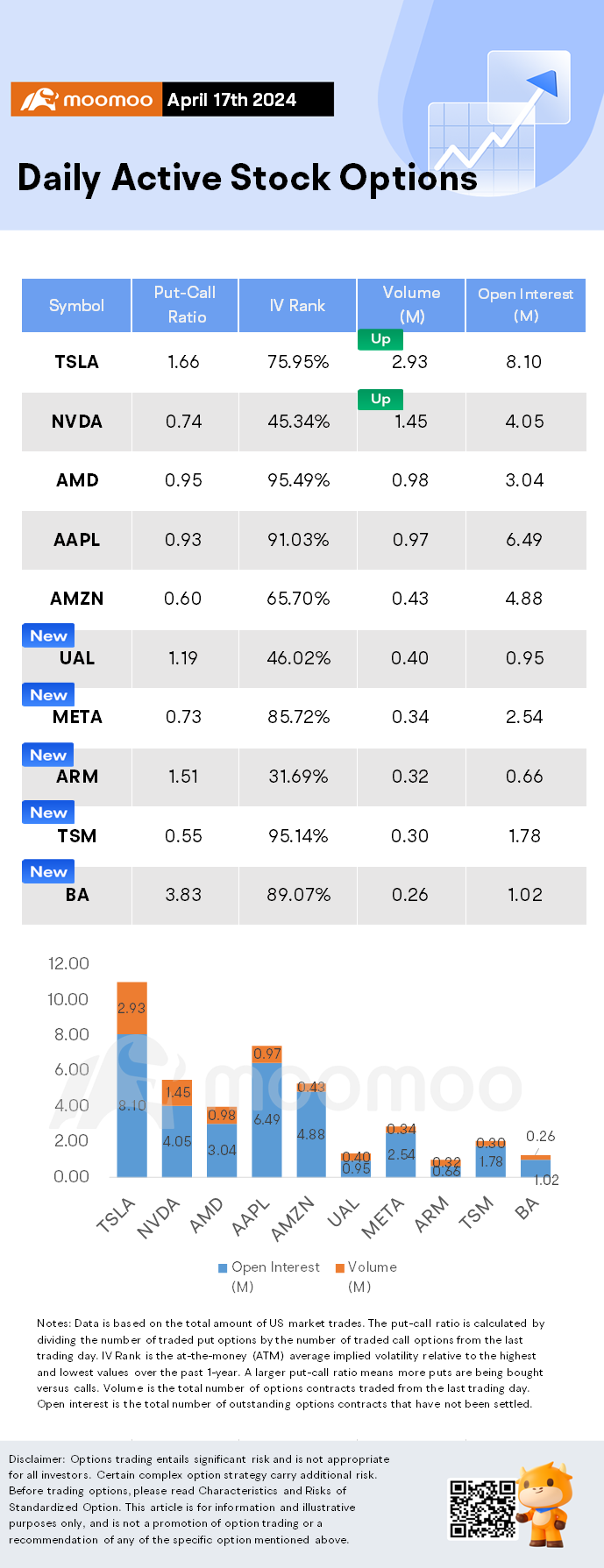

$NVIDIA (NVDA.US)$ shares fell by 3.87%, closing at $840.35. Its options trading volume was 1.45 million. Call contracts account for 57.5% of the total trading volume. The most traded calls are contracts of $900 strike price that expire on Apr. 19th. The total volume reaches 66,284 with an open interest of 20,475. The most traded puts are contracts of a $850 strike price that expires on Apr. 19th; t...

$NVIDIA (NVDA.US)$ shares fell by 3.87%, closing at $840.35. Its options trading volume was 1.45 million. Call contracts account for 57.5% of the total trading volume. The most traded calls are contracts of $900 strike price that expire on Apr. 19th. The total volume reaches 66,284 with an open interest of 20,475. The most traded puts are contracts of a $850 strike price that expires on Apr. 19th; t...

34

2

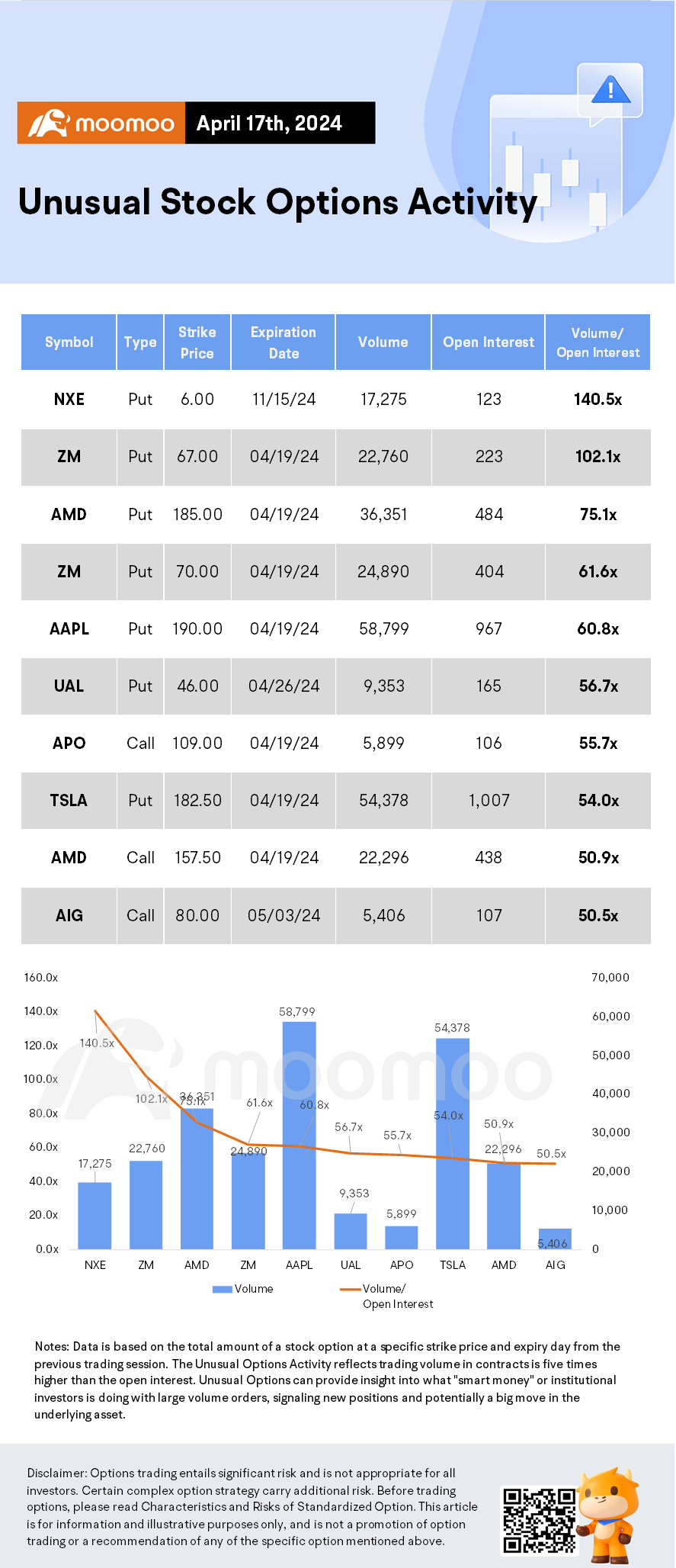

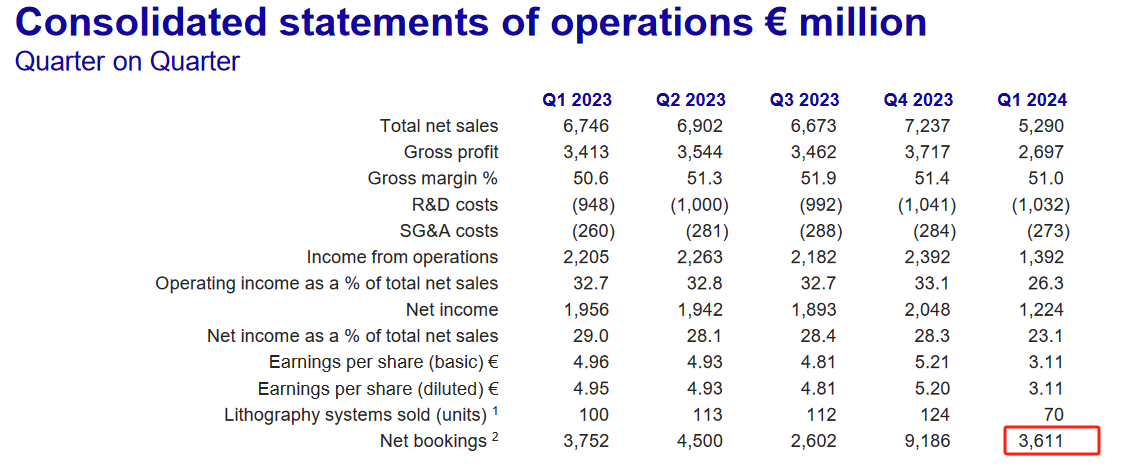

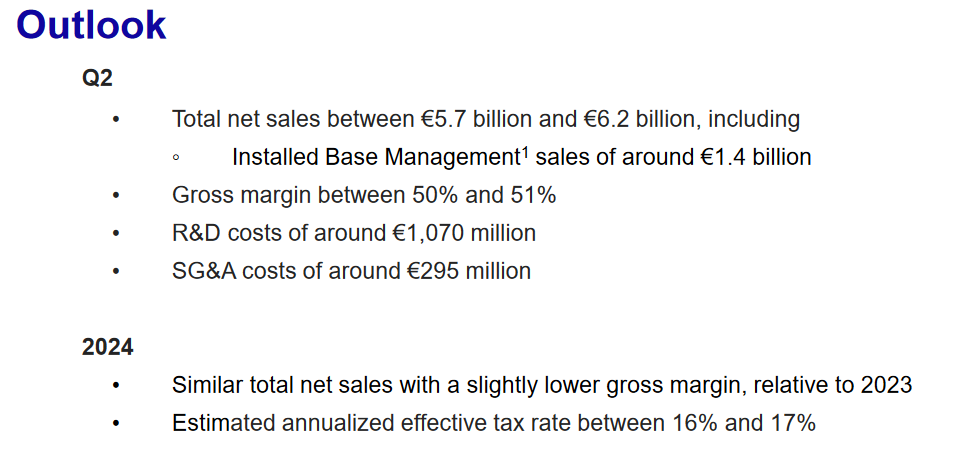

$ASML Holding (ASML.US)$, the sole producer of equipment for manufacturing the most advanced chips, reported orders that were below analysts' expectations, as chipmakers in Taiwan and South Korea delayed purchases of the Dutch company's high-end machines.

The company's bookings dropped 61% to €3.6 billion in the first quarter, falling short of the anticipated €4.63 billion. This decline is attributed to major chipmakers li...

The company's bookings dropped 61% to €3.6 billion in the first quarter, falling short of the anticipated €4.63 billion. This decline is attributed to major chipmakers li...

29

3

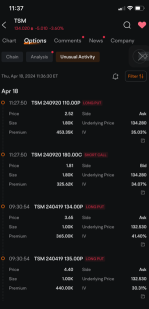

$Taiwan Semiconductor (TSM.US)$'s bleak outlook on the semiconductor industry is fueling the biggest sell-off in call options that give the holder the right to buy the stock at $135 by tomorrow, as shares slumped deeper below that strike price.

TSMC, as the world's largest contract chipmaker is known, saw its shares tumble 3.9% after the company cut its forecast for this year's total market growth, excluding memory chips, to 10%, from...

TSMC, as the world's largest contract chipmaker is known, saw its shares tumble 3.9% after the company cut its forecast for this year's total market growth, excluding memory chips, to 10%, from...

+1

22

3

My opinion as to why this drop is very simple. Over the past few days this stock is supposed to drop even more but it held out at 139 to 141 levels (price during earthquake) because of its incoming earnings. Investors are reluctant to sell in case it sky rocket.

Now earnings come out already, the price only went up to max 146, investors think it's not gonna be like another Micron, so it's time for it to take the price cut, as what was seen across the semiconductor board.

What do you guys think?...

Now earnings come out already, the price only went up to max 146, investors think it's not gonna be like another Micron, so it's time for it to take the price cut, as what was seen across the semiconductor board.

What do you guys think?...

4

5

4

5

In the early stages of AI development, due to high market demand, chip stocks were highly sought after, resulting in a surge in the stock prices of chip giants such as $NVIDIA (NVDA.US)$ , $Advanced Micro Devices (AMD.US)$ , and $Micron Technology (MU.US)$ . 📈🔥

But recently, various chip stocks have entered a consolidation phase one after another.![]()

Yesterday, the leader $NVIDIA (NVDA.US)$ is a day of decline of 3.87% market value ...

But recently, various chip stocks have entered a consolidation phase one after another.

Yesterday, the leader $NVIDIA (NVDA.US)$ is a day of decline of 3.87% market value ...

11

2

Bank of America Merrill Lynch said in its latest research report that with the rapid development of AI technology, the electricity demand of the US power grid will face unprecedented growth. 📈 From 2023 to 2030, U.S. electricity demand is expected to grow at a compound annual growth rate (CAGR) of 2.8%. ![]()

![]()

Leading analysts have also pointed out that as AI infrastructure construction progresses, the power infrastructure and energy sector will become a major trading theme...

Leading analysts have also pointed out that as AI infrastructure construction progresses, the power infrastructure and energy sector will become a major trading theme...

+1

6

3

$E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ my guess TSMC will beat earnings. the US government pour a lot of printer money into them. maybe they use TSMC chips to build rockets for war.

4

16

$Taiwan Semiconductor (TSM.US)$

It’s acting a little menopausal. Up and down. My idea is to buy every time it goes down. This is an awesome company. Probably something to do with war or Trump or something. I’m staying with them.![]()

It’s acting a little menopausal. Up and down. My idea is to buy every time it goes down. This is an awesome company. Probably something to do with war or Trump or something. I’m staying with them.

5

2

. I bought it before the night market picked up. Also, when the night market was about to close, the press conference said that the previous forecast for future profits of 10% or more is now within 10%, and expectations for automotive chips have declined in various areas. As a result, expectations deteriorate and imagination decreased. It led to a decline. Wait for market guidance after opening.

. I bought it before the night market picked up. Also, when the night market was about to close, the press conference said that the previous forecast for future profits of 10% or more is now within 10%, and expectations for automotive chips have declined in various areas. As a result, expectations deteriorate and imagination decreased. It led to a decline. Wait for market guidance after opening.

Lars : Awesome!

102105632 : Is this results good?

71086261 : Up up up

Edwar Dli : come on!!!

102105632 : Is this results good?

View more comments...