Latest

Hot

One of the reasons for the sell-off in the US stock market and market crashes worldwide was due to an interest rate hike in Japan. Japan had maintained a 0% interest rate for a long time, allowing many investors and institutions to borrow money from Japan to invest elsewhere. With the interest rate hike, these investors now have to pay interest, which could be very heavy for them as they have borrowed substantial amounts. This leads to a significant sell-off in the stoc...

32

3

2

is done deal ..increase no doubt

1

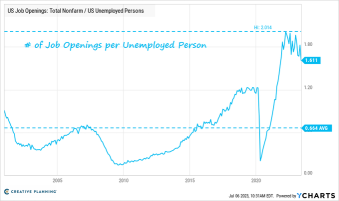

Job openings fell in June but there are still 1.6 openings for every unemployed person in the US, which is well above the historical average.

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

4

The CPI data shows inflation is comming down even though the economy appears resilient. It's the feds job to keep inflation low but to also ensure there is a strong labour market.

if inflation was rising with strong labour data then yes raise the rates.

if inflation was rising with strong labour data then yes raise the rates.

3

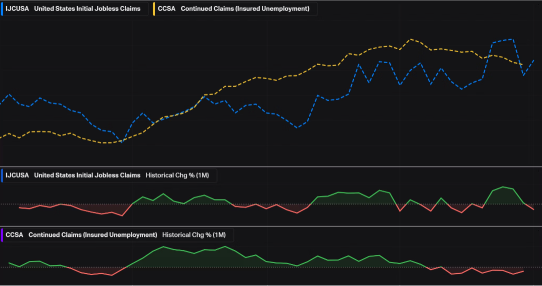

Stocks are having a shaky Thursday as investors are worried that a strong payroll report could signal more rate hikes. Stocks are coming off a losing day yesterday as we digested the June FOMC minutes. The minutes showed that almost all FOMC members supported further rate hikes, though at a slower pace than what the last year brought.

For economic data today, the ADP Employment Report showed that private payrolls added 497k jobs in June, easily beating the expe...

For economic data today, the ADP Employment Report showed that private payrolls added 497k jobs in June, easily beating the expe...

+1

2

Private payrolls exploded in June, with job growth totaling 497,000 on the month, according to a report from payrolls processing firm ADP.

The total was more than double the 220,000 Dow Jones estimate and was boosted by growth of 232,000 in the pivotal leisure and hospitality sector. Construction added 97,000 while trade, transportation and utilities grew by 90,000.

The monthly total also was the highest since July 2022. May’s total was revised...

The total was more than double the 220,000 Dow Jones estimate and was boosted by growth of 232,000 in the pivotal leisure and hospitality sector. Construction added 97,000 while trade, transportation and utilities grew by 90,000.

The monthly total also was the highest since July 2022. May’s total was revised...

6

Stock futures fell Thursday after better-than-expected jobs data increased investors’ anxiety around the path of interest rates.

Futures tied to the $Dow Jones Industrial Average (.DJI.US)$ lost 256 points, or 0.7%. $S&P 500 Index (.SPX.US)$ and $Invesco QQQ Trust (QQQ.US)$ Nasdaq-100 futures fell 0.8% and 0.9%, respectively.

Private sector jobs increased by 497,000 in June, according to data from payroll process...

Futures tied to the $Dow Jones Industrial Average (.DJI.US)$ lost 256 points, or 0.7%. $S&P 500 Index (.SPX.US)$ and $Invesco QQQ Trust (QQQ.US)$ Nasdaq-100 futures fell 0.8% and 0.9%, respectively.

Private sector jobs increased by 497,000 in June, according to data from payroll process...

5

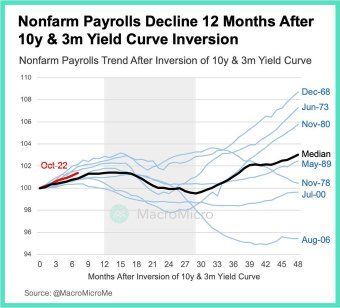

Nonfarm payrolls have shown strong growth recently, but history suggests that they typically decline 12 months after the 10y and 3m yield curve inversion. Will this time be any different?

$S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $SPDR S&P 500 ETF (SPY.US)$

$S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $SPDR S&P 500 ETF (SPY.US)$

2

1

Trading Interns OP : For more bursa updates, check out my bio.

Market has been pretty weak, have to becareful in trading!

104175567 : don't get fooled by the market, in the long run your cash will crash

ByUncle Trading Interns OP : ok sir