Latest

Hot

One technical indicator that can be used in conjunction with the RSI and helps confirm the validity of RSI indications is another widely-used momentum indicator, the moving average convergence divergence (MACD). This indicator calculates momentum differently from the RSI by comparing the relative positions of a short- and long-term moving average.

Traders primarily monitor the MACD for signs of momentum diverging from price. While the price may continue to move up, with the RSI maintaini...

Traders primarily monitor the MACD for signs of momentum diverging from price. While the price may continue to move up, with the RSI maintaini...

11

2

2

Indicator redundancy means that a trader uses different indicators which belong to the same indicator class and then show the same information on a trader’s charts.

The screenshot below shows a chart with 3 momentum indicators (MACD, RSI and the Stochastic). Essentially, all 3 indicators provide the same information because they examine momentum in price behavior.

You can see that all indicators rise and fall simultaneously, turn together and also are flat...

The screenshot below shows a chart with 3 momentum indicators (MACD, RSI and the Stochastic). Essentially, all 3 indicators provide the same information because they examine momentum in price behavior.

You can see that all indicators rise and fall simultaneously, turn together and also are flat...

5

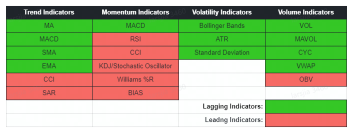

TA uses technical indicators and chart patterns. Technical indicators are mathematical calculations based on the price and/or volume of a stock that help traders identify potential trade opportunities . Chart patterns are unique formations within a price chart used by technical analysts in stock trading. Chart patterns are not technical indicators. So I will just discuss technical indicators.

There are 4 types of technical indicators: ...

There are 4 types of technical indicators: ...

83

11

18

Is it always better to take more technical indicators into account?

How many technical indicators do I need exactly?

Which indicators complement each other the most?

...

Do you often ask yourself these questions while studying technical analysis? You are not alone!

Welcome, mooers! In our TA Challenge Special today, we will take a break from our journey of learning technical indicators and ask ourselves an important question: ...

How many technical indicators do I need exactly?

Which indicators complement each other the most?

...

Do you often ask yourself these questions while studying technical analysis? You are not alone!

Welcome, mooers! In our TA Challenge Special today, we will take a break from our journey of learning technical indicators and ask ourselves an important question: ...

24

18

13

A Chartists is a technical analysts that rely majorly on naked charts and use the patterns to analyze the current price movements so as to predict future market movements.

To pinpoint when to buy and sell you have to identify these patterns, so I use lines to connect the common points or swing points, such as highs or lows, to see the kind of pattern that emerges.

You know when to trade by the chart formation and the nature of the price movement preceding it so that you are able to...

To pinpoint when to buy and sell you have to identify these patterns, so I use lines to connect the common points or swing points, such as highs or lows, to see the kind of pattern that emerges.

You know when to trade by the chart formation and the nature of the price movement preceding it so that you are able to...

11

8

Hey, mooers!

In our previous technical analysis (TA) challenges, we explored various technical indicators, each with its unique strengths and weaknesses. Combining various indicators might lead to a more comprehensive perspective on market trends and conditions.

Have you ever used a combination of TA indicators in your trades? We'd love to hear from you about the combinations that have worked best for you:

![]() What's your g...

What's your g...

In our previous technical analysis (TA) challenges, we explored various technical indicators, each with its unique strengths and weaknesses. Combining various indicators might lead to a more comprehensive perspective on market trends and conditions.

Have you ever used a combination of TA indicators in your trades? We'd love to hear from you about the combinations that have worked best for you:

14

1

$Geo Energy Res (RE4.SG)$ has been trading rather weak as the 5 day chart show that it is trending downwards.

I was looking for some opportunities in the Singapore Stock and AI model did provide me a potential stock that could be coming.

I shall share in this article on how I use Technical Analysis to identify if RE4.SG does have potential for a proper uptrend.

RE4.SG On Average Directional Index (ADX)

RE4.SG is having a strong trend as ADX line is ...

I was looking for some opportunities in the Singapore Stock and AI model did provide me a potential stock that could be coming.

I shall share in this article on how I use Technical Analysis to identify if RE4.SG does have potential for a proper uptrend.

RE4.SG On Average Directional Index (ADX)

RE4.SG is having a strong trend as ADX line is ...

6

8

1

These few days especially yesterday (17 Jul 23). $Palantir (PLTR.US)$ have a pretty good trade. Rising to above $17.40.

In this article, I would like to share with you the 3 indicators that I am using to predict if PLTR can reach $20 and beyond and what could be the challengers and surprise that came prevent this.

Technical Analysis - Relative Strength Index (RSI)

I am using RSI to check if PLTR is currently overbought or oversold, apparent...

In this article, I would like to share with you the 3 indicators that I am using to predict if PLTR can reach $20 and beyond and what could be the challengers and surprise that came prevent this.

Technical Analysis - Relative Strength Index (RSI)

I am using RSI to check if PLTR is currently overbought or oversold, apparent...

9

1

1

The company delivered impressive earnings results for the last quarter of 2023, surpassing analysts’ estimates on both revenue and earnings per share. The company also increased its full-year revenue outlook.

The company got a positive rating from Wedbush analyst Dan Ives, who started covering Palantir with an “outperform” rating and a $25 price target. Dan has recently upgrade the price target from $25 to $30.

The company commercial business s...

The company got a positive rating from Wedbush analyst Dan Ives, who started covering Palantir with an “outperform” rating and a $25 price target. Dan has recently upgrade the price target from $25 to $30.

The company commercial business s...

+1

5

2

Hey mooers! ![]()

We'd like to express our appreciation for your active participation in the TA activity "What are the effective indicator combos that can help reduce false signals". We were truly impressed by the insightful ideas presented in your posts.![]()

Without further ado, it's time to announce the winners! Congratulations to @Mcsnacks H Tupack @Singh Rahul @PREMOSULTRAA @bullrider_21 for winning 1000 points and for @Fahrenheit @RainGrowz @ragamuffin @shy Cheetah_0241 @Mario Timberlake @flyawayhome @OttoDyda @ceerup @alsmoov @Alexle0 @Rizzu winning ...

We'd like to express our appreciation for your active participation in the TA activity "What are the effective indicator combos that can help reduce false signals". We were truly impressed by the insightful ideas presented in your posts.

Without further ado, it's time to announce the winners! Congratulations to @Mcsnacks H Tupack @Singh Rahul @PREMOSULTRAA @bullrider_21 for winning 1000 points and for @Fahrenheit @RainGrowz @ragamuffin @shy Cheetah_0241 @Mario Timberlake @flyawayhome @OttoDyda @ceerup @alsmoov @Alexle0 @Rizzu winning ...

6

1

1

.. My heart..

.. My heart..

Hathaway : technical indicators mean nothing in a rigged system. AI algorithms and criminal hedge funds are ruining the stock market.

intuitive Jackal_354 : who cares