Latest

Hot

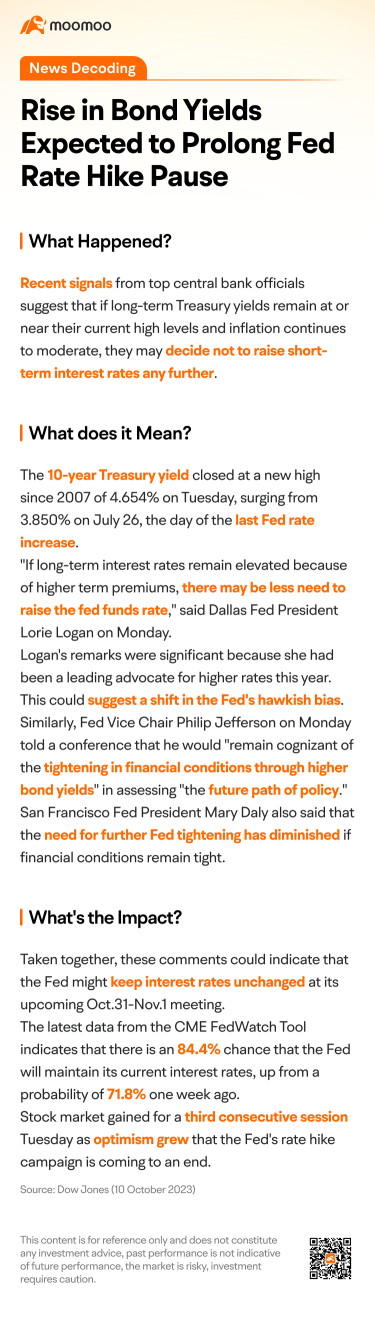

The Federal Reserve's historic rate hiking cycle may come to an end as long-term Treasury yields have soared over the past two months, tightening financial conditions. Fed officials have hinted that they may not raise short-term interest rates and will decide whether to raise them in December based on the state of the economy and financial situation next month.

Let's take a look at today's news decoding.![]()

Let's take a look at today's news decoding.

Expand

Expand 23

1

From YouTube

3

The yield on 10-year US Treasury bonds has recently reached a very high level.

A strong labor market has led to an increase in the expected interest rate hike in the US, which is one reason for the increase in bond yields. In September, the US added 336,000 non-farm jobs, almost twice the Wall Street expectations.

Today, I want to share with you another reason for the rise in yields, that is, while the supply of US Trea...

A strong labor market has led to an increase in the expected interest rate hike in the US, which is one reason for the increase in bond yields. In September, the US added 336,000 non-farm jobs, almost twice the Wall Street expectations.

Today, I want to share with you another reason for the rise in yields, that is, while the supply of US Trea...

3

“If the Fed Chairman were to whisper to me what his monetary policy was going to be over the next two years, it wouldn’t change one thing I do.”

— Warren Buffett

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Bank of America (BAC.US)$ $Citigroup (C.US)$

3

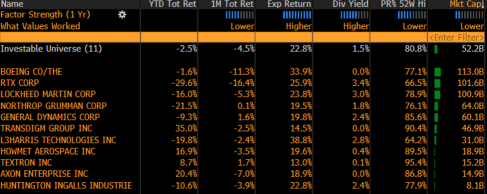

We cover why the oil price could continue to rebound from last week's 8% sell-off, with energy companies to watch, which have been upgraded by analysts. Plus, why look at domestic stingy pre-Christmas spending beneficiaries' stocks, and glance at defence companies that could rally amid the strikes in Israel. Plus, what to watch amid US inflation being released. And...

26

1

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$

Last Friday saw some major bullishness in the major indices. This came after some very worrying premarket price action. A huge gap down in premarket trading immediately followed the release of US employment and wage data. The S&P 500 initially fell over 1%. Things were looking very bearish.

Where Did the Bullishness Come From?

During intraday trading, the S&P finished over 1% in the green, completely reversing the ver...

Last Friday saw some major bullishness in the major indices. This came after some very worrying premarket price action. A huge gap down in premarket trading immediately followed the release of US employment and wage data. The S&P 500 initially fell over 1%. Things were looking very bearish.

Where Did the Bullishness Come From?

During intraday trading, the S&P finished over 1% in the green, completely reversing the ver...

+3

56

1

Bernie Sanders this year said income over $1 billion should be taxed at 100%.

Do you agree?

$Nasdaq Composite Index (.IXIC.US)$ $SPDR S&P 500 ETF (SPY.US)$

Do you agree?

$Nasdaq Composite Index (.IXIC.US)$ $SPDR S&P 500 ETF (SPY.US)$

1

I don't understand why? Why do they want to see unemployment go up??? Why does the market go down when employment numbers go up?? Someone enlightenment my regarded mind

$Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Apple (AAPL.US)$ $Eli Lilly and Co (LLY.US)$

$Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Apple (AAPL.US)$ $Eli Lilly and Co (LLY.US)$

3

SpyderCall : PPI this morning and CPI tomorrow.