Latest

Hot

$SVB Financial (SIVB.US)$ $DBS Group Holdings (D05.SG)$ $OCBC Bank (O39.SG)$ $UOB (U11.SG)$ $Signature Bank (SBNY.US)$

The Singapore banking system remains “sound and resilient” amid the recent collapse of Silicon Valley Bank (SVB) and a couple of other small banks, said the Monetary Authority of Singapore (MAS) on Monday.

Analysts also expect SVB’s fallout to have limited impact on Singapore’s banks, given fundamental dif...

The Singapore banking system remains “sound and resilient” amid the recent collapse of Silicon Valley Bank (SVB) and a couple of other small banks, said the Monetary Authority of Singapore (MAS) on Monday.

Analysts also expect SVB’s fallout to have limited impact on Singapore’s banks, given fundamental dif...

1

I don’t think SVB will be the end of troublesome signs coming from banks. The fractional reserve system of the banks is going to reveal how fragile and how thin of a line the banks walk on.

2

$DBS Group Holdings (D05.SG)$ $OCBC Bank (O39.SG)$ $UOB (U11.SG)$ $SVB Financial (SIVB.US)$

“Our Singapore banks today are well capitalised and have ample provisions to weather any need for write-downs, and are ranked amongst the strongest and safest in world rankings and benchmarks.”

“We see any share price decline in the Singapore banks today as an opportunity to ‘accumulate’ as:

![]() The contagion effect of a bank run should not spread to Singapore due to...

The contagion effect of a bank run should not spread to Singapore due to...

“Our Singapore banks today are well capitalised and have ample provisions to weather any need for write-downs, and are ranked amongst the strongest and safest in world rankings and benchmarks.”

“We see any share price decline in the Singapore banks today as an opportunity to ‘accumulate’ as:

1

Warren Buffett's Berkshire Hathaway has likely seen around $8 billion wiped off the value of its financial stocks in just three trading days, after Silicon Valley Bank's collapse sparked a firesale in the sector.

The famed investor's company owned about $74 billion of banking, insurance, and financial-services stocks at the end of December, its latest portf...

The famed investor's company owned about $74 billion of banking, insurance, and financial-services stocks at the end of December, its latest portf...

$SVB Financial (SIVB.US)$ $DBS Group Holdings (D05.SG)$ $OCBC Bank (O39.SG)$ $UOB (U11.SG)$

Analysts remained sanguine on the outlook of Singapore’s banks, arguing that there are several fundamental differences which set local lenders significantly apart from SVB:

Maybank Securities Singapore head of research, Thilan Wickramasinghe:

![]() “(SVB’s collapse) was more of an old-fashioned liquidity crisis than really a solv...

“(SVB’s collapse) was more of an old-fashioned liquidity crisis than really a solv...

Analysts remained sanguine on the outlook of Singapore’s banks, arguing that there are several fundamental differences which set local lenders significantly apart from SVB:

Maybank Securities Singapore head of research, Thilan Wickramasinghe:

1

$SVB Financial (SIVB.US)$ $DBS Group Holdings (D05.SG)$ $OCBC Bank (O39.SG)$ $UOB (U11.SG)$

SVB became the largest US bank to fail since the 2008 global financial crisis (GFC), with a rout in the lender’s stock that began last Thursday (March 9), spreading over into other US and European banks.

Less than 48 hours after the bank announced that it was planning to conduct a capital raise, the bank experienced a wave of withdrawals tha...

SVB became the largest US bank to fail since the 2008 global financial crisis (GFC), with a rout in the lender’s stock that began last Thursday (March 9), spreading over into other US and European banks.

Less than 48 hours after the bank announced that it was planning to conduct a capital raise, the bank experienced a wave of withdrawals tha...

2

Over the last week, the entire financial system in Us is thrown in doubt. We have the 16th largest bank in US called silicon valley bank under receivership and many startups are going concern as their funds are tied up.

This seriously put a dent on Us' innovation if these startups and depositors fail to recover their uninsured deposits. I am not surprised that Some regulatory parties will eventually do something for the system. It may not be for silicon valley bank but fo...

This seriously put a dent on Us' innovation if these startups and depositors fail to recover their uninsured deposits. I am not surprised that Some regulatory parties will eventually do something for the system. It may not be for silicon valley bank but fo...

Silicon Valley Bank (SVB)'s new CEO Tim Mayopoulos sent an email to customers that the bank has reopened and is open for business as usual, with new deposits as well as existing deposits protected by the Federal Deposit Insurance Corporation (FDIC) in the new bank.

The email mentioned that FDIC has transferred SVB's saving and assets to a new interim bank. All wire transfers placed on March 9 or 10 but not yet processed have been cancelled and wil...

The email mentioned that FDIC has transferred SVB's saving and assets to a new interim bank. All wire transfers placed on March 9 or 10 but not yet processed have been cancelled and wil...

3

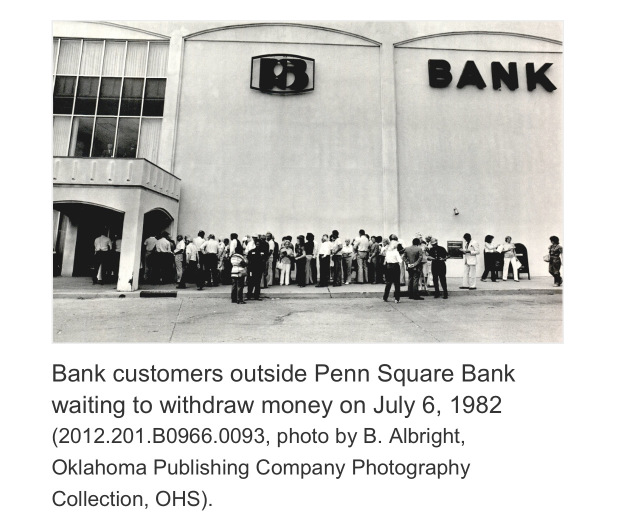

When Penn Square Bank was shut down by the Feds in ‘81 depositors lost 163 million dollars in uninsured accounts.

Seattle First National Bank (Seafirst) in Washington was one of the first failures to result from losses on the participations. Soon after, Continental Illinois National Bank and Trust Company in Chicago, which had participated in the loans in the amount of almost $1 billion, became the largest bank failure in U.S. history up to that time.

By the late 1...

Seattle First National Bank (Seafirst) in Washington was one of the first failures to result from losses on the participations. Soon after, Continental Illinois National Bank and Trust Company in Chicago, which had participated in the loans in the amount of almost $1 billion, became the largest bank failure in U.S. history up to that time.

By the late 1...