Broader market recap: New highs with 4400 in sight

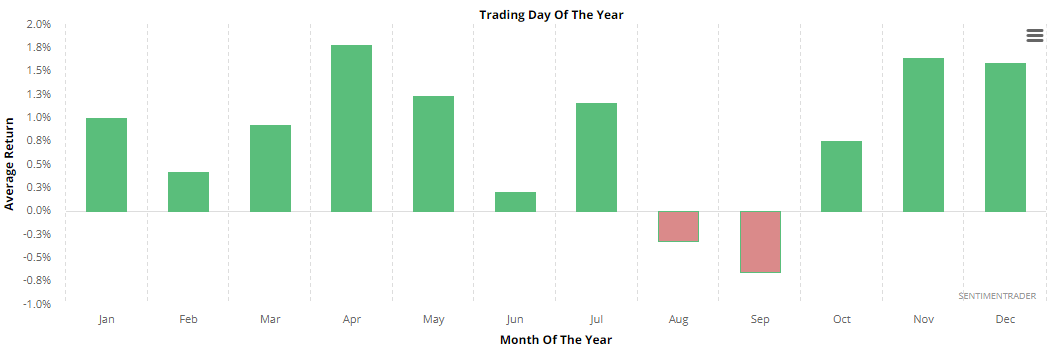

The S&P 500 shrugged off weaker Jun seasonality and scored another new all-time high last trading session.

This cleared 4238-4257 resistance to confirm a bullish cup and handle that sets up bullish summer seasonality with upside potential to 4400-4420.

This cleared 4238-4257 resistance to confirm a bullish cup and handle that sets up bullish summer seasonality with upside potential to 4400-4420.

This means that the $S&P 500 Index (.SPX.US)$has an upside beyond the 2020 cup and handle count at 4250, which the SPX achieved last week. Supports are 4257-4238 and 4193 to 4168-4164(June lows).

1. On the $SPDR S&P 500 ETF (SPY.US)$options front

For any financial instrument,be it a stock or an option,there is a bid price and an ask price. A transaction takes place when either a potential buyer is willing to pay the asking price,or a potential seller is willing to accept the bid price, or else they meet in the middle if both buyers and sellers change their orders.

Since that, for specific accumulated contracts on the left column as the chart shown below,they could be considered mainly executed on the bid side (sell put in this case) if the percentage of transactions leaning on the bid side. And for those contracts with a large portion leaning on the ask side could be considered as long-side transactions(long call in this case).

1. On the $SPDR S&P 500 ETF (SPY.US)$options front

For any financial instrument,be it a stock or an option,there is a bid price and an ask price. A transaction takes place when either a potential buyer is willing to pay the asking price,or a potential seller is willing to accept the bid price, or else they meet in the middle if both buyers and sellers change their orders.

Since that, for specific accumulated contracts on the left column as the chart shown below,they could be considered mainly executed on the bid side (sell put in this case) if the percentage of transactions leaning on the bid side. And for those contracts with a large portion leaning on the ask side could be considered as long-side transactions(long call in this case).

Open interest is the total number of outstanding derivative contracts,such as options or futures that have not been settled for an asset.

To simply put,open interest is a number that tells you how many options contracts are currently outstanding(open) in the market, which means market participants will be watching that market closely.We usually use them as an indicator of trend strength.

As we can see from the chart above, different SPY options trade setups have been initiated but yet to be closed and the majority of them executed on the mid side, usually, they are less indicative for gauging the market participants' sentiment upon the future price action.

Professional participants tend to trade on the put side during the uptrend market atmosphere to protect theirdownside risk and prefer to trade on the mid price for convenience trade purposes since there is less willingness to get the trade done.

So what we are looking into here is the transactions with a tendency as mentioned above that either leaningon the long or short side to determine professional participants' actual sentiment for the future market movement.

Sell put and the long call stood out here in this case,put sellers and call buyers lose money if the stock price falls and therefore the current SPY options chain sentiment from a technical point of view is also a bullish.

2. Notes

For more details, you can check out moomoo's most latest features that will be launched soon so-called "options Xray" icon in the toolbox(upper left corner) under the 'trade' column. By monitoring this market data,traders can create strategies that capitalize on this often over looked information.

To simply put,open interest is a number that tells you how many options contracts are currently outstanding(open) in the market, which means market participants will be watching that market closely.We usually use them as an indicator of trend strength.

As we can see from the chart above, different SPY options trade setups have been initiated but yet to be closed and the majority of them executed on the mid side, usually, they are less indicative for gauging the market participants' sentiment upon the future price action.

Professional participants tend to trade on the put side during the uptrend market atmosphere to protect theirdownside risk and prefer to trade on the mid price for convenience trade purposes since there is less willingness to get the trade done.

So what we are looking into here is the transactions with a tendency as mentioned above that either leaningon the long or short side to determine professional participants' actual sentiment for the future market movement.

Sell put and the long call stood out here in this case,put sellers and call buyers lose money if the stock price falls and therefore the current SPY options chain sentiment from a technical point of view is also a bullish.

2. Notes

For more details, you can check out moomoo's most latest features that will be launched soon so-called "options Xray" icon in the toolbox(upper left corner) under the 'trade' column. By monitoring this market data,traders can create strategies that capitalize on this often over looked information.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment