What did I notice from NFLX's web traffic

$Netflix(NFLX.US$ Prior to the third-quarter Netflix earnings report, analyst Mark has reiterated a Buy rating and a price target of $695 (10.62% upside potential) on the stock.

While we view the likelihood of significant price appreciation on the print to be relatively low, we believe that given the continued content slate strength heading into 2022, the risk-reward favors the upside and any potential weakness to share prices on the print would be short-lived.

Markedly, the analyst expects 25 million net additions in 2022, with the belief that mainly Europe and Asia will show strength.

Overall, the stock has a Moderate Buy consensus rating, based on 24 Buys, 5 Holds, and 3 Sells. The average Netflix price target of $648.90 implies 3.28% upside potential from current levels.

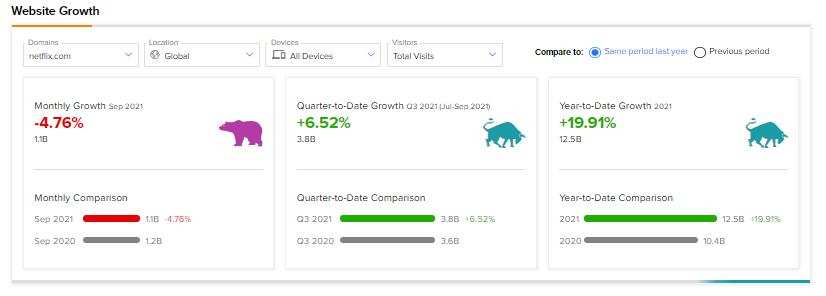

According to SEMrush Holdings, the world’s biggest website usage monitoring service, globally, Netflix’s website recorded a 4.76% monthly decline, year-over-year, in visits in September, while Q3 depicted a 6.52% quarter-to-date growth. Markedly, year-to-date website growth, compared to year-to-date website growth in the previous year, came in at 19.91%. See the following screenshot.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment