What sectors are investors buying in?

Hey mooers![]()

![]()

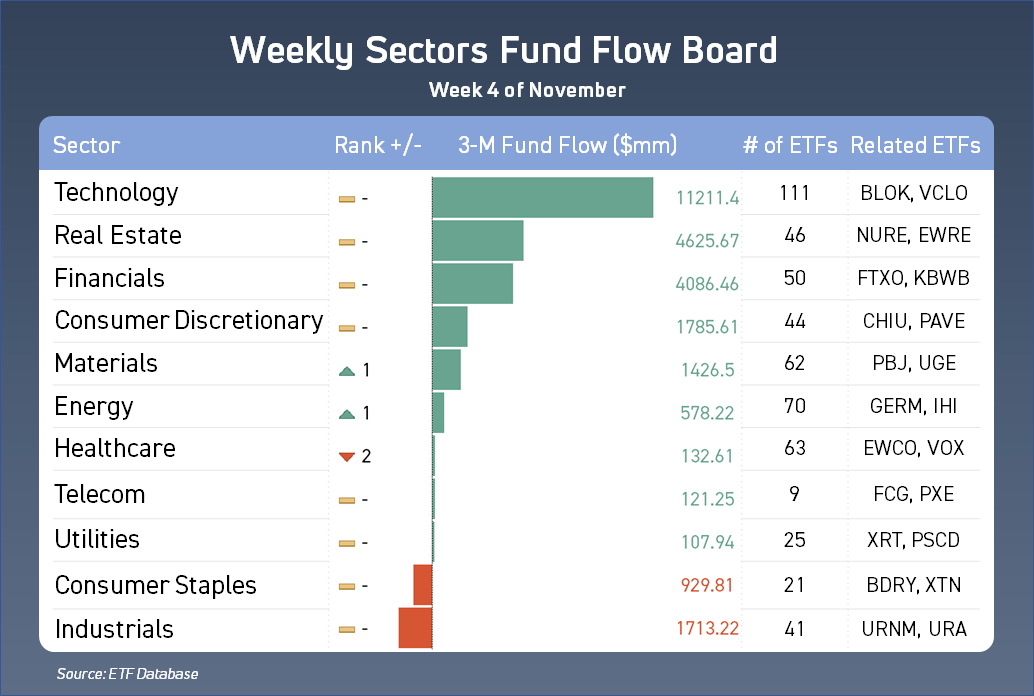

From this chart, you will be able to find out what sector ETFs have most fund inflow. Fund inflow is often considered as a bullish sign of the sector and related ETFs!

^Weekly Sectors Fund Flow Board: a sector ranking based on sector ETFs aggregate 3-month fund flows.

^3-month fund flows: a metric that can be used to gauge the perceived popularity amongst investors of different sectors.

^The board includes the following information: change of rankings, 3-month fund flows, how many ETFs are in the sectors, and the related ETFs.

For this week, I covered thetop two YTDsector-related ETFs(non-leveraged)! Now, let's take a look at the board~You may find something todiversify your porfolio![]()

![]()

* Follow me to know what is hot on the market![]()

![]()

![]()

Latest Updates:

Headline market tracking exchange traded funds start Black Friday's trading session deep into the red as a new COVID variant strain is discovered in South Africa.

Market tracking funds such as $SPDR S&P 500 ETF (SPY.US)$, $SPDR Dow Jones Industrial Average Trust (DIA.US)$, and $Invesco QQQ Trust (QQQ.US)$have all have slipped to the downside as all three major indices are falling.

SPY, DIA, and QQQ are three of the market's most prominent ETFs with $423B AUM, $30B AUM, and $209B AUM, respectively.

Early into trading, SPY is -1.8%, as the S&P 500 has dipped 88 points. DIA is -2.5%, and the $Dow Jones Industrial Average (.DJI.US)$ has found itself plummeting 900 points so far. $Invesco QQQ Trust (QQQ.US)$ is -1.4%, as the Nasdaq is down 280 points.

Source: Seeking Alpha

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

101621268 :

102351577 :

Winner01 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Accelerate : a

Ginvest :

Tiff Lim :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

102585578 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

RAAW : 112114

iPhoneK : That’s good investment advice. Thanks!

Ksy88 :

View more comments...