Singapore REITs may benefit from haven status amid market volatility

Singapore real estate investment trusts can benefit from their safe-haven status during a time of market volatility as the U.S. Fed raises interest rates, analysts from DBS say in a research note.

The Fed's clarity on its rate-rise trajectory will likely lead to more price stability for Singapore REITs, they say.

What are Real Estate Investment Trusts (REITs)?

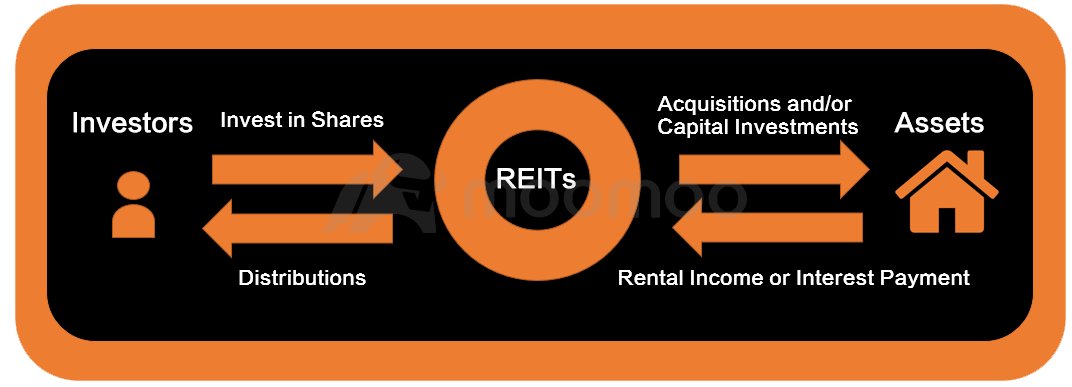

Real Estate Investment Trusts (REITs) are funds that invest in a portfolio of income generating real estate assets such as shopping malls, offices or hotels, usually with a view to generating income for unit holders of the fund (i.e. investors of the REITs).

Assets of REITs are professionally managed and revenues generated from assets (primarily rental income) are normally distributed at regular intervals to investors. REITs allow investors to access real property assets, and share the benefits and risks of owning a portfolio of properties.

Units of REITs are bought and sold like other securities listed on SGX at market driven prices.

Why invest in Real Estate Investment Trusts (REITs)?

- Portfolio Diversification: REITs typically own multi-property portfolios with diversified tenant pools.

- Income Distribution: REITs typically have regular cash flows since most of the revenues are derived from rental payments under lease agreements with specific tenure. REITs are required to distribute at least 90% of taxable income each year to enjoy tax exempt status by IRAS (subject to certain conditions).

- Tax Benefits: Individual investors enjoy a tax-exempt distribution which comes in the form of dividends in the REITs structure.

Why Trade REITs & Property Trusts on SGX?

- Singapore has 44 REITs & Property Trusts with a combined market capitalisation of S$116B, representing c.13% of Singapore's overall listed stocks

- The REITs & Property Trusts offer wide diversity across property sub-segments

- Average dividend yield of 6.1%

- FTSE ST REIT Index 10-year total return of 142.8%

- Average gearing ratio of 37%*, lower than the regulatory limit of 50%

- 10 year market cap CAGR of 13%

What are the risks to consider?

What are the risks to consider?

The risks associated with a REIT investment vary and depend on the unique characteristics of each REIT (e.g. leverage ratio, cost of refinancing, management fees paid to REIT managers), as well as the geographical location, quality of the underlying property investments (e.g. concentration of properties, length of lease), and land tenure of properties (leasehold or freehold). Other risks associated with stock investing (e.g. price risk, volatility and liquidity risks) also apply.

Investors should study the specific REIT prospectus to understand its investment objective and details of the properties to be acquired before making an investment decision.

SG REITs Movers for Friday (5/13)

SG REITs Movers for Friday (5/13)

$REITs (LIST3047.SG)$ $FTSE Singapore Straits Time Index (.STI.SG)$ $SGX (S68.SG)$

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Rookie22 : Interesting. Always thought increase interest rate and reit price still stable

Chinese Bagus : Tax Benefits: Individual investors enjoy a tax-exempt distribution which comes in the form of dividends in the REITs structure. .... Partially true unless your personal tax rate is above 17%

Lcc888 : Like

ccl2 : Like

Luck66Luck Lcc888 :

SimplyDeep :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Jadon Yeo : Like

靓啊 : jzjsjd

AhOngOng :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Fortune Cat Huatsss : Like

View more comments...