Strategies for a bear market which last on average 9.6 months, but this one may last more than 2 years

TLDR: This bear market might last more than 2 years so don't go all in to buy the dip at once, spread out your war chest as low can go lower. Selling covered CALL options at target exit price can help to reduce your cost basis too. For those who don't know how to pick stocks, dollar cost averaging on index fund such as $SPDR S&P 500 ETF (SPY.US)$, $STI ETF (ES3.SG)$ would be safer.

Story time

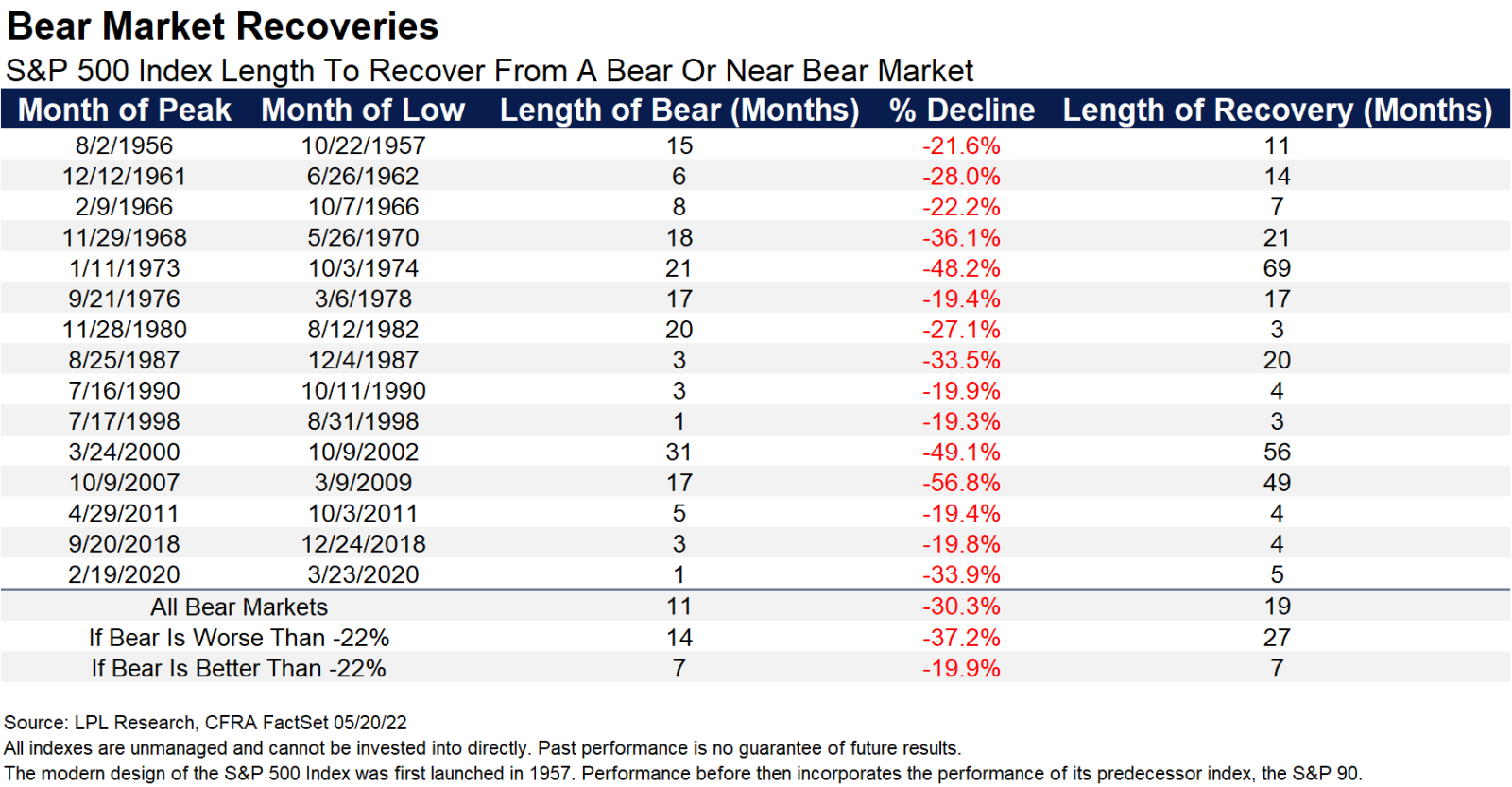

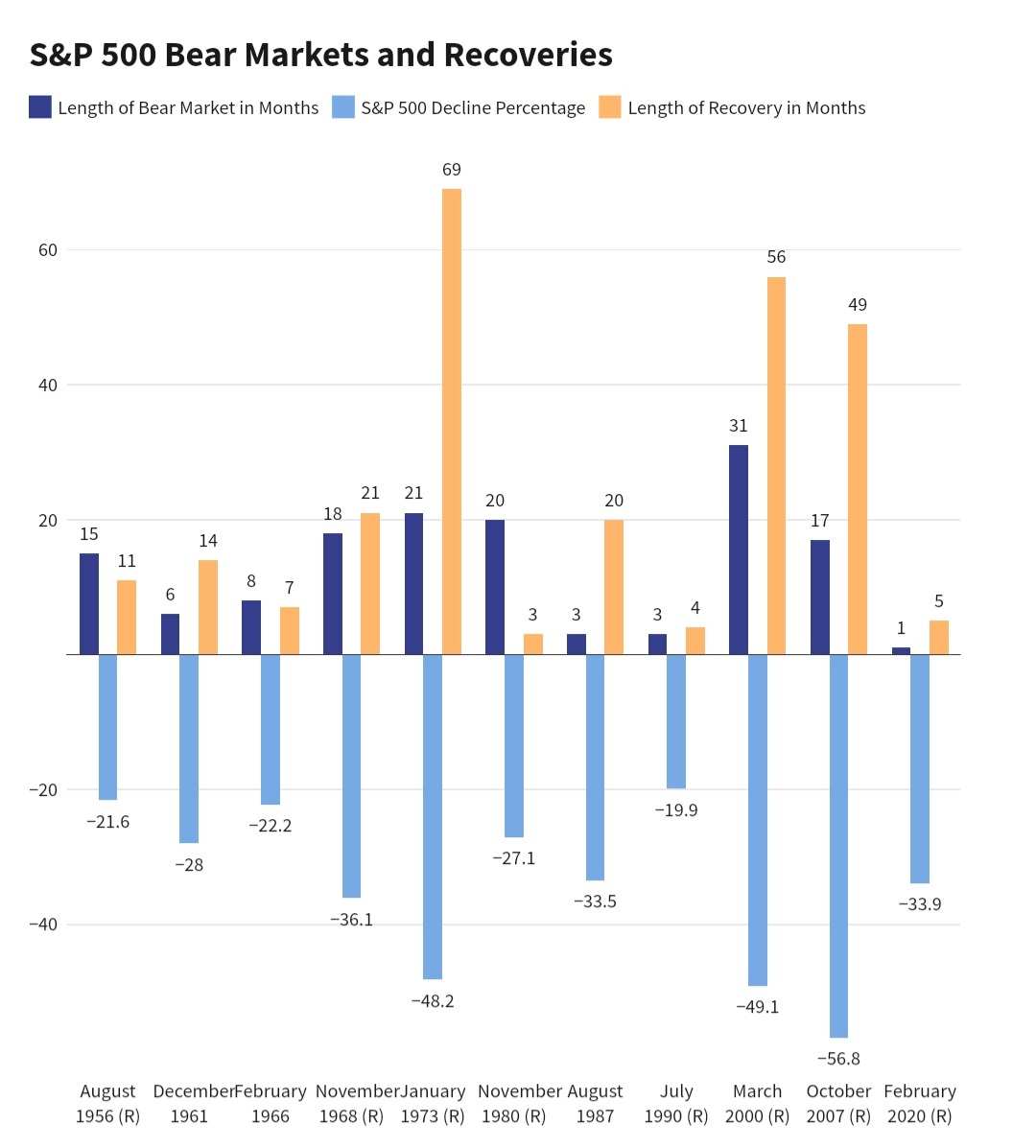

There have been 15 bear markets since April 1947. The average length of bear market is 11 month, but it range from as short as one month to as long as 2.5 years. So bear market is very common and nothing to fear about, if you know what you are doing. The worse drop in a bear market was a 56.8% drop in the S&P 500 index, $S&P 500 Index (.SPX.US)$. The mildest was a decline of 19.3%.

Story time

There have been 15 bear markets since April 1947. The average length of bear market is 11 month, but it range from as short as one month to as long as 2.5 years. So bear market is very common and nothing to fear about, if you know what you are doing. The worse drop in a bear market was a 56.8% drop in the S&P 500 index, $S&P 500 Index (.SPX.US)$. The mildest was a decline of 19.3%.

However this time round, we may have a bear market that last more 2 years, given all the crazy things that is happening. Crazy inflation, continous rate hikes, war, covid pandemic (especially poorer countries), sanctions, food and oil shortages, supply chain disruption, countries financially ruined (e.g. Sri Lanka), de-globalisation of the east and the west, potential recession, potention stagflation, potential escalation of war even going nuclear, and so on.

But one thing is for sure, after a bear market, it will be a bull market again. The only difference is, bad and weak companies may go bankrupt, but strong and resilience company will grow even stronger.

However, the time to recover back to pre-crash level could be a long journey. In the 2008 crash, the bear market lasted for 17 months, but it took 49 months to recover back to pre-crash levels. The recovery took almost 3 times the bear duration to recover. Therefore, a fundemental question when talking about navigating the bear market is, can you hold that long? Can you hold for 5.5 years and longer?

But one thing is for sure, after a bear market, it will be a bull market again. The only difference is, bad and weak companies may go bankrupt, but strong and resilience company will grow even stronger.

However, the time to recover back to pre-crash level could be a long journey. In the 2008 crash, the bear market lasted for 17 months, but it took 49 months to recover back to pre-crash levels. The recovery took almost 3 times the bear duration to recover. Therefore, a fundemental question when talking about navigating the bear market is, can you hold that long? Can you hold for 5.5 years and longer?

If we know that a bear market will eventually recover, then you can shorten the recovery duration by buying the dip. Buying the dip, lower your cost basis, which makes it much easier for it to recover, assuming the company is still good and alive that is.

Some will say buy at the bottom is the best but no one know when is the bottom in a bear market, so trying to time the market is crazy. For those that is saying I'll buy at the bottom, all we can say is good luck.

Suggestion 1: Wait it out?

Some may say that maybe we should wait until it is the bull market again before investing. That works for sure, but the trade off will be some substantial gains. But it is completely reasonable, and logical thing to do.

Why will there be a loss of substantial gain if we buy only in a bull market?

The reason is for a bull market to be certain, we have to wait until the market have a 20% gain over a long period of time. During this time, many stock would have rallied hard, especially those growth stock. 100 to 300% gains is possible.

It is very hard to buy at the beginning of a bull market because no one knows when it will begin. We have seen too many bear rally, just to see it crash harder haven't we? Just seeing a rally, doesn't mean it is a beginning of a bull market, and by the time bull market is confirmed, you are late to the party. Not too late, because there is still an amazing growth journey ahead.

Suggestion 2: stretch out your DCA

For some, the dip is the best time to buy in. As you are buying stocks at discounted price which will eventually go back up when the economic factor returns to normal. Again, assuming it is good stock that does not go bankrupt. So if you are into buying the dip, don't go all in when you are buying the dip.

No one know where is the bottom, and in a bear market, cheap can get cheaper. So space out your buy in time, spread it over a longer period of time. Slowly buying the dip brings about 2 benefits. Firstly, if the stock price keeps falling, your average buy in price is much lower then going all in. Secondly, it gives you time to constantly re-evaluate the company. So in case you made a bad bet and the company seems like it will go bankrupt, lesser of your capital is at risk.

Suggestion 3: covered CALL options strategy

On top of buying the dip, what I like to do in a bear market is to sell covered call options. This allows me to lower my average cost while riding out the bear market. Do sell the CALL option with a strike price you are willing to sell your shares at.

What is a covered call?

To understand a covered CALL strategy, we first need to understand what is a CALL option. A CALL option is just a contract that allows the buyer of the contract to buy 100 shares at a pre-determined price, anytime on or before a pre-determined date*.

A simple way to look at CALL options contract is "Seller will sell buyer 100 shares at strike price, if buyer want, anytime on or before the expiry date". The seller will get money for selling the contract, and the buyer will pay money to buy the contract. The money is known as a premium.

So a covered call is just you selling a CALL option, but because the buyer may force you to sell them the shares, you need to first have the underlying shares in case the buyer exercise the option. Thus, the word covered, which means if something happens you can fulfil your obligation.

Example

Let's take my trade in $ContextLogic (WISH.US)$ for example. So Moo Moo gave me 1 share of WISH for free for a contest that I won. Back then WISH was about $3.20. So when WISH crashed to $2, I was thinking hmmm how much lower can it go? why not buy a very small amount of it to test.

So in Feb, I bought 99 shares at $2.04. But I don't really want to keep it, so I sold a covered call immediately with a strike of $2. I gotten $28 for it thus making the average cost per share to be only $1.76. So even if I was forced to sell my stocks at $2. I still earn $24.

However low got lower, and there is almost no chance of it getting exercised. So I closed my position for $6 (by buying it back) and sold yet another covered CALL for $26. Making the new average cost to be $1.56. It goes on for a few month and the shares is still stuck with me![]()

![]() But because I sold covered CALL, the current average cost of my shares is actually $1.30 (you can see the trade record below).

But because I sold covered CALL, the current average cost of my shares is actually $1.30 (you can see the trade record below).

Some will say buy at the bottom is the best but no one know when is the bottom in a bear market, so trying to time the market is crazy. For those that is saying I'll buy at the bottom, all we can say is good luck.

Suggestion 1: Wait it out?

Some may say that maybe we should wait until it is the bull market again before investing. That works for sure, but the trade off will be some substantial gains. But it is completely reasonable, and logical thing to do.

Why will there be a loss of substantial gain if we buy only in a bull market?

The reason is for a bull market to be certain, we have to wait until the market have a 20% gain over a long period of time. During this time, many stock would have rallied hard, especially those growth stock. 100 to 300% gains is possible.

It is very hard to buy at the beginning of a bull market because no one knows when it will begin. We have seen too many bear rally, just to see it crash harder haven't we? Just seeing a rally, doesn't mean it is a beginning of a bull market, and by the time bull market is confirmed, you are late to the party. Not too late, because there is still an amazing growth journey ahead.

Suggestion 2: stretch out your DCA

For some, the dip is the best time to buy in. As you are buying stocks at discounted price which will eventually go back up when the economic factor returns to normal. Again, assuming it is good stock that does not go bankrupt. So if you are into buying the dip, don't go all in when you are buying the dip.

No one know where is the bottom, and in a bear market, cheap can get cheaper. So space out your buy in time, spread it over a longer period of time. Slowly buying the dip brings about 2 benefits. Firstly, if the stock price keeps falling, your average buy in price is much lower then going all in. Secondly, it gives you time to constantly re-evaluate the company. So in case you made a bad bet and the company seems like it will go bankrupt, lesser of your capital is at risk.

Suggestion 3: covered CALL options strategy

On top of buying the dip, what I like to do in a bear market is to sell covered call options. This allows me to lower my average cost while riding out the bear market. Do sell the CALL option with a strike price you are willing to sell your shares at.

What is a covered call?

To understand a covered CALL strategy, we first need to understand what is a CALL option. A CALL option is just a contract that allows the buyer of the contract to buy 100 shares at a pre-determined price, anytime on or before a pre-determined date*.

A simple way to look at CALL options contract is "Seller will sell buyer 100 shares at strike price, if buyer want, anytime on or before the expiry date". The seller will get money for selling the contract, and the buyer will pay money to buy the contract. The money is known as a premium.

So a covered call is just you selling a CALL option, but because the buyer may force you to sell them the shares, you need to first have the underlying shares in case the buyer exercise the option. Thus, the word covered, which means if something happens you can fulfil your obligation.

Example

Let's take my trade in $ContextLogic (WISH.US)$ for example. So Moo Moo gave me 1 share of WISH for free for a contest that I won. Back then WISH was about $3.20. So when WISH crashed to $2, I was thinking hmmm how much lower can it go? why not buy a very small amount of it to test.

So in Feb, I bought 99 shares at $2.04. But I don't really want to keep it, so I sold a covered call immediately with a strike of $2. I gotten $28 for it thus making the average cost per share to be only $1.76. So even if I was forced to sell my stocks at $2. I still earn $24.

However low got lower, and there is almost no chance of it getting exercised. So I closed my position for $6 (by buying it back) and sold yet another covered CALL for $26. Making the new average cost to be $1.56. It goes on for a few month and the shares is still stuck with me

Since WISH is now $1.815 and my average cost is $1.30. I'm technically having a profit of 40%. Over time, I'm sure the average cost will goes to $0.

Conclusion

So yea there you have it. 3 suggestions I would suggest to ride out the bear market.

Suggestion 1: Wait it out

Suggestion 2: stretch out your DCA

Suggestion 3: covered CALL options strategy

Stocks that I'm using this strategy on

These are strategies that I'm using myself on these stocks:

$Futu Holdings Ltd (FUTU.US)$ $UP Fintech (TIGR.US)$ $NIO Inc (NIO.US)$ $Palantir (PLTR.US)$ $Grab Holdings (GRAB.US)$ $Warner Bros Discovery (WBD.US)$ $StoneCo (STNE.US)$

So I really put my money where my mouth is![]()

![]()

trade safe![]()

![]()

Sources

https://www.investopedia.com/a-history-of-bear-markets-4582652

https://www.moomoo.com/community/feed/108492970000389?data_ticket=5b3500b278c1b7aa4a176e85285988a1&futusource=nnq_followtab_list

Other Notes

* only for American style option. For European style, buyer can only exercise it on the expiry date itself. Most options are American style.

Conclusion

So yea there you have it. 3 suggestions I would suggest to ride out the bear market.

Suggestion 1: Wait it out

Suggestion 2: stretch out your DCA

Suggestion 3: covered CALL options strategy

Stocks that I'm using this strategy on

These are strategies that I'm using myself on these stocks:

$Futu Holdings Ltd (FUTU.US)$ $UP Fintech (TIGR.US)$ $NIO Inc (NIO.US)$ $Palantir (PLTR.US)$ $Grab Holdings (GRAB.US)$ $Warner Bros Discovery (WBD.US)$ $StoneCo (STNE.US)$

So I really put my money where my mouth is

trade safe

Sources

https://www.investopedia.com/a-history-of-bear-markets-4582652

https://www.moomoo.com/community/feed/108492970000389?data_ticket=5b3500b278c1b7aa4a176e85285988a1&futusource=nnq_followtab_list

Other Notes

* only for American style option. For European style, buyer can only exercise it on the expiry date itself. Most options are American style.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

SANDRO 善子 : Great analysis, thanks

SANDRO 善子 : Great analysis, thanks

ATS A trade sniper : trade it la la la

Milk The Cow : Cool![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) , that is a nice read

, that is a nice read ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) .

.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) .

.

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) . Will check it out

. Will check it out ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) .

.

I agreed to all ur points

By the way, I did not know there a stock call "WISH"

doctorpot1 OP SANDRO 善子 :

doctorpot1 OP ATS A trade sniper : hahahahaha![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) I investor leh, not trader. no time to always look at charts and daily movement

I investor leh, not trader. no time to always look at charts and daily movement ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

doctorpot1 OP Milk The Cow : it is kindda a meme stock hahahaha that's why I only put a tiny amount. It is just for playing around and testing the strategy. But wasted, should have put more if I knew it work quite well![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

ATS A trade sniper doctorpot1 OP : hohoho i m jus a trader![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

doctorpot1 OP ATS A trade sniper : This market super volatile, I'm sure you can make many great trades![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

ATS A trade sniper doctorpot1 OP : some loss trade n drink red wine hohoho

View more comments...