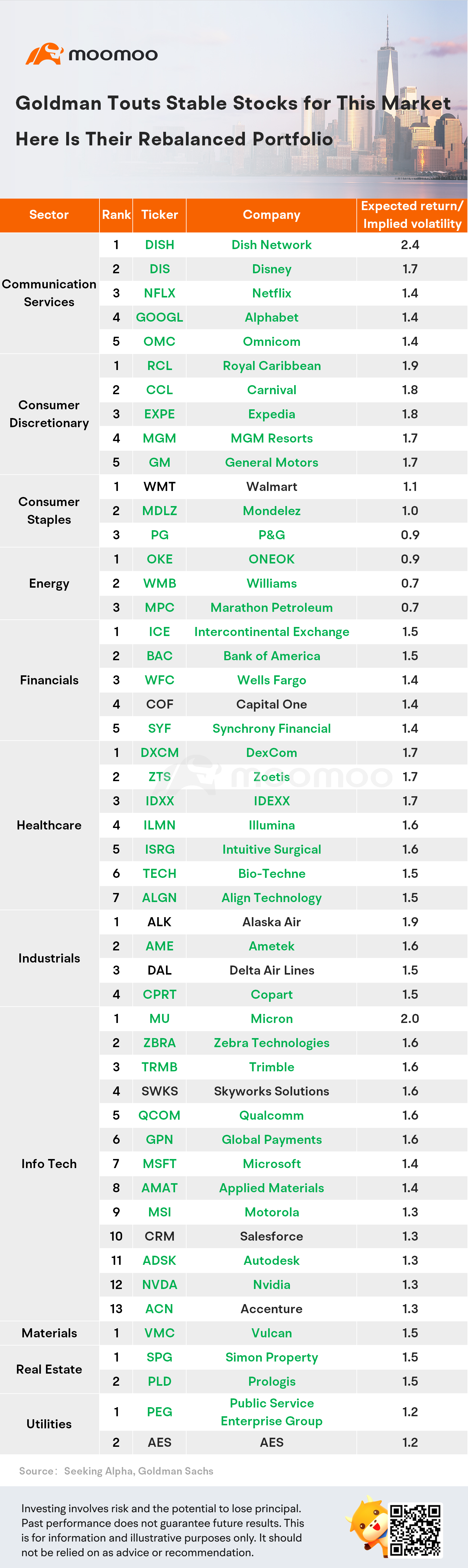

Goldman touts stable stocks for this market; here is their rebalanced portfolio

According to Goldman Sachs, investors should own stable stocks as they grapple with tighter monetary policy and slowing growth.

"Firms with low share price volatility and stable earnings growth should outperform in the uncertain macro environment," Goldman Sachs strategist David Kostin wrote in a note. "Our High Sharpe Ratio basket, which we rebalance in this report, also takes volatility into account, but maximizes prospective risk-adjusted returns."

The prospective Sharpe Ratio is the return on the consensus 12-month price target divided by 6-month option-implied volatility.

The median stock of this basket is expected to generate 2x the return of the median $SPDR S&P 500 ETF (SPY.US)$ stock with only slightly higher implied volatility. At the sector level, the median Communication Services stock has the highest prospective Sharpe Ratio (1.2) while the median Energy stock has the lowest (0.6), Goldman Sachs said.

The basket was down 18% this year, while the median large-cap mutual fund declined 22%. The basket saw nearly a complete overhaul, with 42 new entrants. The stocks by sector with new entrants denoted in green are:

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Law Yong Fatt : ok

70832332 : lets see

Iwnl : Useful

WaitForDrop : No JPM?

FearGreed : I wouldn’t think CCL RCL as stable stocks, but it is nice to know that they have big sponsorship.