Bull Session | Money managers believe stocks aren't far from bottoming out. What do you think?

After $S&P 500 Index (.SPX.US)$ succumbed to a bear market in June, money managers participating in the latest Bloomberg MLIV Pulse survey believe the market is not far from bottoming out.

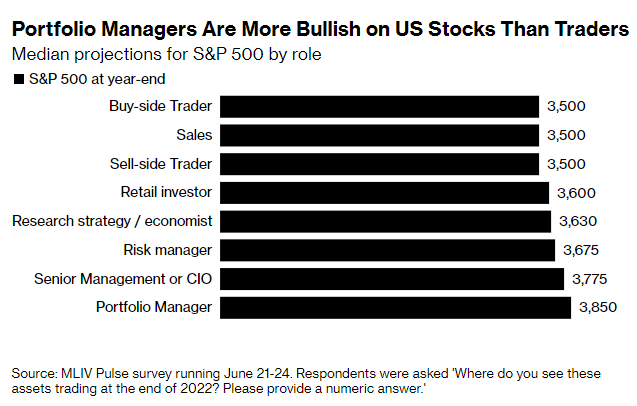

The more than 1,700 respondents see S&P 500 Index closing at 3,700 at the end of 2022. While that's far lower than the Wall Street consensus, it's a modest 3% decline from Tuesday's close -- and above the lows already notched this year.

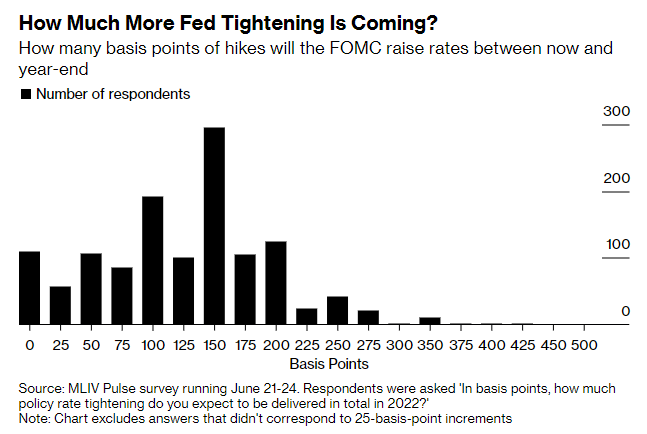

In terms of Fed tightening, the median view of respondents suggests a further 125 basis points of Fed rate hikes is in the cards this year, a full 50 basis points less than market-implied odds last week.

With the monetary and economic outlook shrouded in doubt across the world, respondents are divided on the trading road map. Asked to rank their five favorite asset classes for the rest of this year, more than a quarter put commodities dead last, while 29% ranked it first. Developed-market stocks received more love than government bonds.

So mooers, What do you think? What is your year-end prediction for the S&P 500 Index? Leave your comments below![]()

![]()

Source: Bloomberg

Disclaimer: The content should not be relied on as advice or recommendation.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

itsaplant : I think big money and market makers are saying we are bottoming so people put money back in the market

Tiggerpepper : Lots of more bottoming can happen.

JBJBA : I would guess we are closer to the bottom than we were 6 months ago

lightfoot : I have Ford, it is down over 50%. I have never been an investor of ford but at this price I can't say no. with ev on the horizon this stock will do ok.

lightfoot : I think soon we will have another pull out. I want to have cash available. good hunting investors.

50 cent : I think we see some more downside, probably until October when the buying season picks up!

71175525 : it's not looking good

Giovanni Ayala : GoodMorning Sue

71750344 : It depends on summer activities like the movies, cruises and vacations that generate revenue. If people start spending, we could see a trend upwards. But, if doubts of any kind like gas prices, food prices, rent, electric, water, gas, and sewer go up, people will cut way back for survival. What little people have been able to accumulate for a rainy day, being locked up for Covid not spending, can get wiped out with fear of the unknown, with government control!