Part Two: Find the bull & bear with dots & lines

Hi, mooers!![]()

There is no way you can use only one indicator to predict a bullish or bearish trend. If we only use the SAR indicator to analyze a stock, the risk of losing is fairly high. That's why we need to use technical indicator combinations to help us better assess the stock.![]()

![]()

There is no way you can use only one indicator to predict a bullish or bearish trend. If we only use the SAR indicator to analyze a stock, the risk of losing is fairly high. That's why we need to use technical indicator combinations to help us better assess the stock.

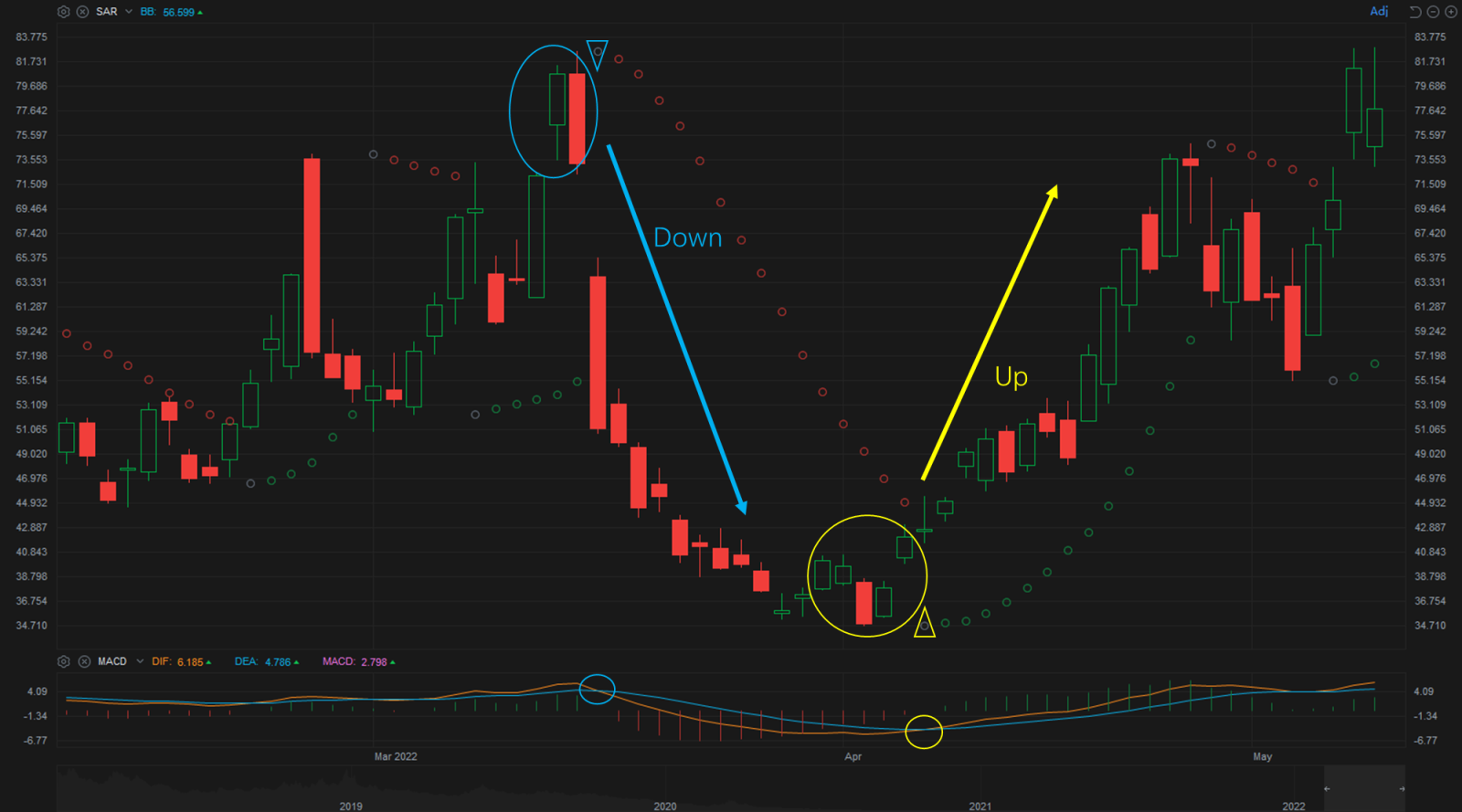

1. SAR+MACD (Moving Average Convergence Divergence)

In this case, the DIF line is moving close to the DEA line, signaling a bearish trend may appear. Then we look at the SAR indicator. It doesn't suggest the same. At that moment, you should consider placing a stop to keep most of your profits. Then, the stock price falls when the two indicators signal a bearish trend.

Later, when both the SAR and the MACD indicate a bullish trend, the stock price rises. It may be good timing to open a position and see how it goes. If the bullish trend is confirmed (the DIF is moving further away from the DEA and the SAR shows a green dot), increasing positions could be an option.

Tip: In a ranging (sideways) market, you will get too many false signals which will cause you to get stopped out frequently. We should consider using the MACD as our primary indicator because it is more sensitive to the market capital than the SAR.

2. SAR+RSI (Relative Strength Index)

The SAR works well with the RSI. Usually, the RSI will fall into the oversold area before the SAR shows a bullish trend. If the RSI value of the stocks on your watchlist reaches the oversold zone, it may be worth your time to watch their price patterns and wait for the SAR bullish signal to open positions.

When the RSI hits the overbought zone, but the SAR doesn't respond the same, you should be careful and consider setting your exit point to protect your profit.

After learning how to use the combinations, it's time to put them into practice. If you have any questions, leave a comment below, and our mooers will help you find the answers. Investing doesn't have to be lonely and tedious!![]()

![]()

Post your learning results by taping the discussion:TA Challenge: How to use the SAR to spot reversal signals?

Check the previous TA topics:

Disclaimer:This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.Tap for more details.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Milk The Cow :

Milk The Cow :

whqqq : wow! This is what I didn't expect. What you said is very comprehensive![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

toomanyscammers : what is dif line

ninor toomanyscammers : The Divergence is an indicator in technical stock market analysis, abbreviated as DIF, which is the 12-day EMA value minus the 26-day EMA value. In a sustained upward trend, the 12-day EMA is above the 26-day EMA.

ROM-STAR whqqq : Learn something new every time

Milk The Cow : This is my idea, slightly different![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) :

:

Milk The Cow :How to use SAR to spot reversal signals, 6th indicator challenge

https://www.moomoo.com/community/feed/108587929370630?data_ticket=e577728400cbeaa02d8a4acaaf3a354d&futusource=nnq_noticetab

富贵健康 : Learn more and participate more

Alexle0 Milk The Cow : So detailed! Thanks for sharing!

Milk The Cow Alexle0 : Np![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...