The era of the single-stock ETF has arrived: What investors should know

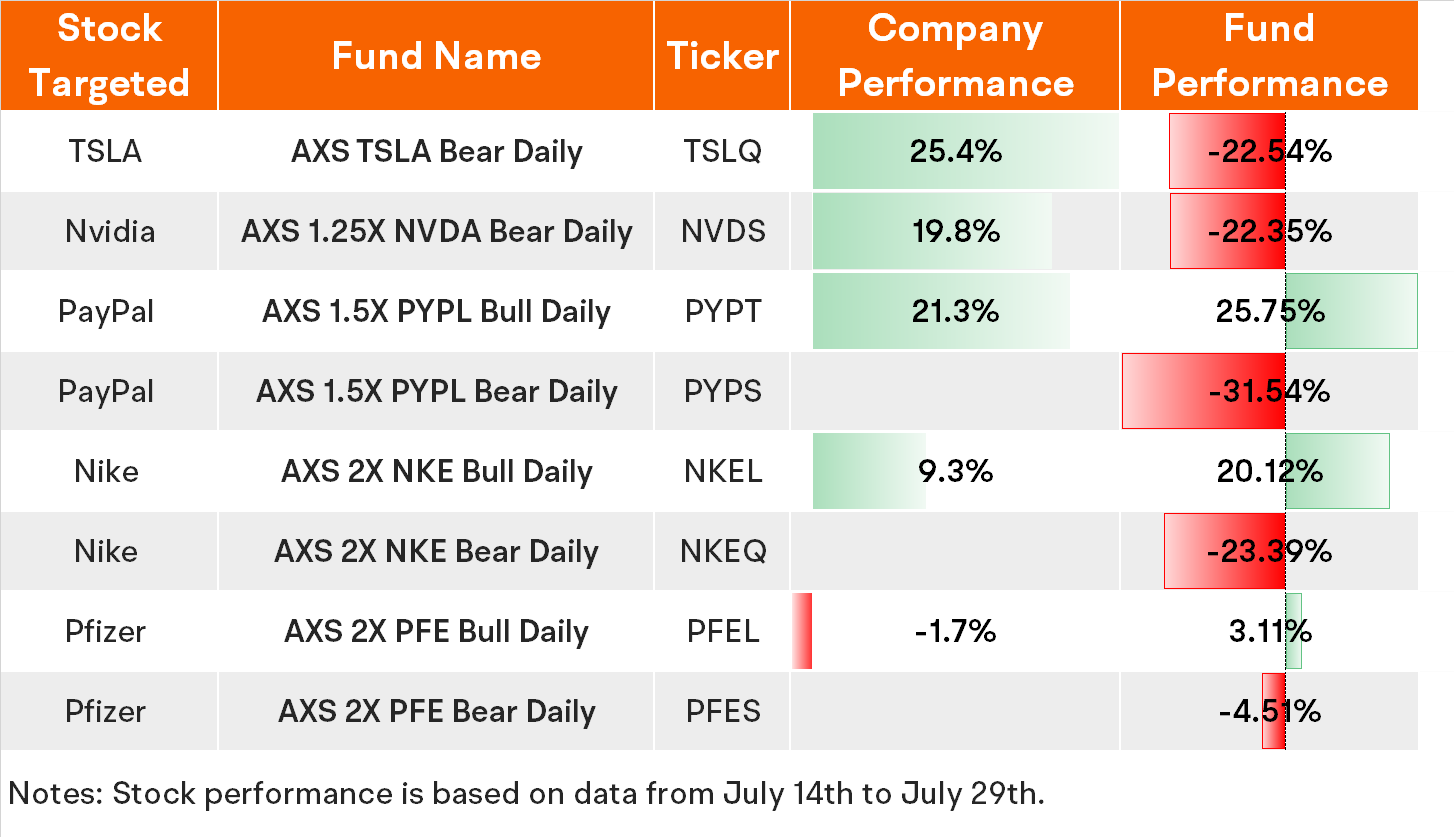

Asset management firm AXS Investments recently launched the first leveraged single-stock ETFs in US market that allow investors to make bets on or against individual stocks' daily performance.

AXS Investments launched eight exchange-traded funds that allow investors to make inverse or leveraged bets on individual companies such as $Tesla (TSLA.US)$, $NVIDIA (NVDA.US)$, and $PayPal (PYPL.US)$.

The arrival of this new breed of ETF has prompted criticism from the Securities and Exchange Commission. Although the Wall Street watchdog has not blocked the funds, several officials have warned of the threat they pose to investors and markets.

SEC Chair Gary Gensler said the products "present particular risk" in a press call this week. Commissioner Caroline Crenshaw cautioned investment advisers about recommending these products to retail traders, and the SEC's director for the Office of Investor Education and Advocacy, Lori Schock, warned investors of the volatility of these ETFs.

Greg Bassuk, chief executive officer of AXS, said the firm will focus on educating investors and that the funds are meant for "sophisticated, active traders."

"These are not products for buy-and-hold investors," he said in an interview. "They're more specific for active traders who have the ability to monitor their portfolios every day and who have the kind of the skill and education to invest in them."

There are more single-stock ETFs on their way. At least 85 more such ETFs are currently planned, according to filings tracked by Bloomberg, covering some 37 companies.

Here are some pros and cons of single-stock ETFs

Pros

· Single-stock ETFs use derivatives to deliver multiple times the performance of a company each trading day. Investorscan seize greater returns as the company shares rise.

· The performance of a single-stock ETF is related to a single company, which allows investors to bet on their company-specific event. Instead of studying the industry, a single-stock ETF enables investors to focus on a single company.

· The new products, like ETFs in general, make trading easier. Instead of having to open a margin account at a brokerage or learning the complex world of options trading, investors can express a bullish or bearish view through their normal trading account.

· Also, the maximum loss is limited to the initial investment with these products, unlike normal trading on margin.

Cons

· Single-stock leveraged ETF obviously exposes investors to greater risk since both loss and gains are amplified, while it lacks diversification. Diversification is the most well-known method to reduce volatility in one's portfolio.

· A leveraged ETF rebalances daily, so a decline one day will cause the ETF to rise off a lower base the next.It could result in a lower actual gain in these ETFs than the expectation.

· They're also more costly for investors: Each ETF carries an expense ratio of 1.15%, while the average fee for actively managed ETFs is around 0.70%.

· Leveraged ETFs have long been favorites of retail traders, but it's definitely not for buy and hold investors. AXS clearly states on its website that the ETFs "are intended to be used as short-term vehicles."

Poll: Are you interested in single-stock ETFs?![]()

![]()

![]()

Source: Bloomberg

Disclaimer: Past performance can't guarantee future results. Investing involves risk and the potential to lose principal. This article is for information and illustrative purposes only.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

steady Pom pipi :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

SpyderCall : I knew about the tslq. I did not know about the others. good article for sure. If don't feel like risking everything on an option then sometimes I'll go to leverage shares. sometimes there is no leveraged ETF for the sector or the stock I want to trade. so this is perfect.

sociable Lark_2803 : Very good I am going to try

LionsShare : sounds like another vehicle for market fuckery

Gohleng : l

Gohleng SpyderCall : 0

loving Hamster_1305 : bringing this statement into investing scared money don't make no money gotta take risks

Investing with moomoo OP SpyderCall : Glad it helps!

Investing with moomoo OP sociable Lark_2803 : Trade well trade safe

Investing with moomoo OP loving Hamster_1305 : Yup. Leveraged ETFs have long been favorites of retail traders, but it's definitely not for buy and hold investors.