This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this video is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

Milk The Cow : Cool![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) , u learned something new.

, u learned something new.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) .

.

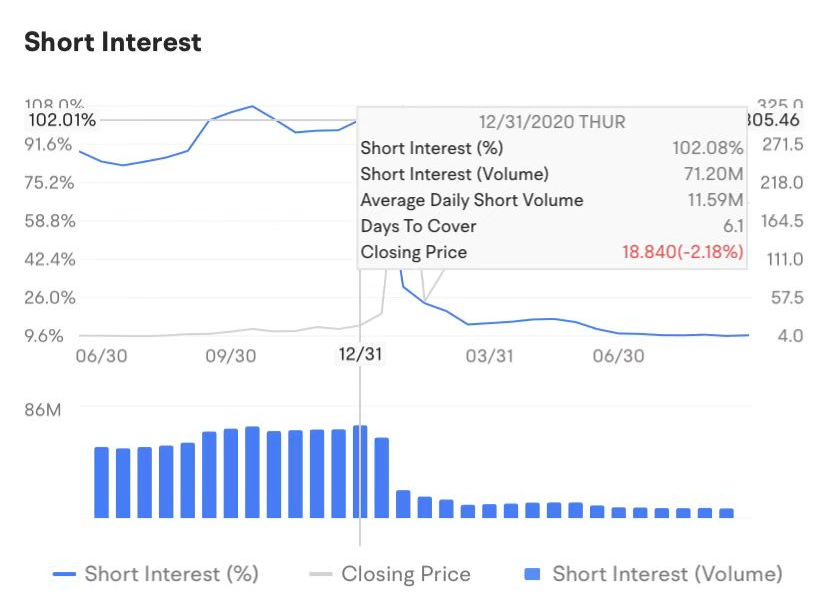

So it's all about short-interest % to look out for short squeeze

102935791 Milk The Cow : hhhhh

ur wifes boyfriend : the sec report to Congress and the report released by Congresswoman Walters are two different reports. The Short interest that was available to retail at the time was not even close it was over 100%.

I'm also very positive that the short interest is nowhere near what it is when it is known to the public.

and when the price starts to go up on a short squeeze that was going on with AMC and GameStop plus bby etc. there was a buy button removal. not too long ago the same thing happened in London for a metal material and the buy button was removed.

hdk which was running up in the market was not halted or button removed because the retailers were not the ones buying the stock as much as compared to institutions. GameStop and AMC were halted earlier this week and the price went down and it was suppressed I'm going up.

I ask myself is there going to be a short squeeze ever again for retail investors or will the market makers stop it in its tracks by halting or removing the buy button. sending orders to the dark pools over 50 sometimes 60% of the day's volume so it doesn't have any impact on the price upward movement. and the short volume is constant and usually rising while the shorts available to land land out magically appear everyday at different times in the day and night.

There is obviously something not being disclosed and being purposely hidden from the public. The DOJ have been busy prosecuting the securities fraud in the market as of late. so just because the ones in charge of all this are not getting in trouble now does that mean they will not be in a few years. your past will come and haunt you and you will pay for your crimes eventually. the way the market is set up and rigged against the retail investor has run its course and has caused financial destruction in our world economy. The blame should be worldwide in China ,London and here.

so any public information that is allowed from the sho is not to be trusted or considered reliable.

HengOngHuat888 : Short selling is so cool and unusual. The first time I witness is with GME and AMC. What a meme! Glad to witness such happenings in my life.

Alvinnnnnnngenius : Where can I get info of short interest in moomoo?

J Tan88 : When does short position need to close to cover ? Three months after short position was opened ?

If not short positions can continue to hold , until the next margin call ?

ankykong : it's interesting to see the charts and see exactly the impact we as retail investors have.

DarhamadAbedelrhaman :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Weicl : The first time I saw it was AMC.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

101494038 (佩施) : good

View more comments...