Elon's data scientist reported estimated bot count to be 5% to 11%, but he allegedly hid this data

$Twitter (Delisted) (TWTR.US)$'s lawyers mentioned that Elon Musk's own data scientists failed to find "a lot of bots" on Twitter. Musk hired 2 firms to analyze Twitter's data to estimate the number of bots. One of the firm CounterAction's analysis estimated the number to be around 5.3% whereas the other firm Cyabra estimated the number to be 11%. Both are well short of the "at least 20%" mark.

Twitter's lawyer accused Musk's legal team of intentionally withholding the data, saying they had only just been able to view the documents as of Tuesday, despite seeking them since the early days of the lawsuit.

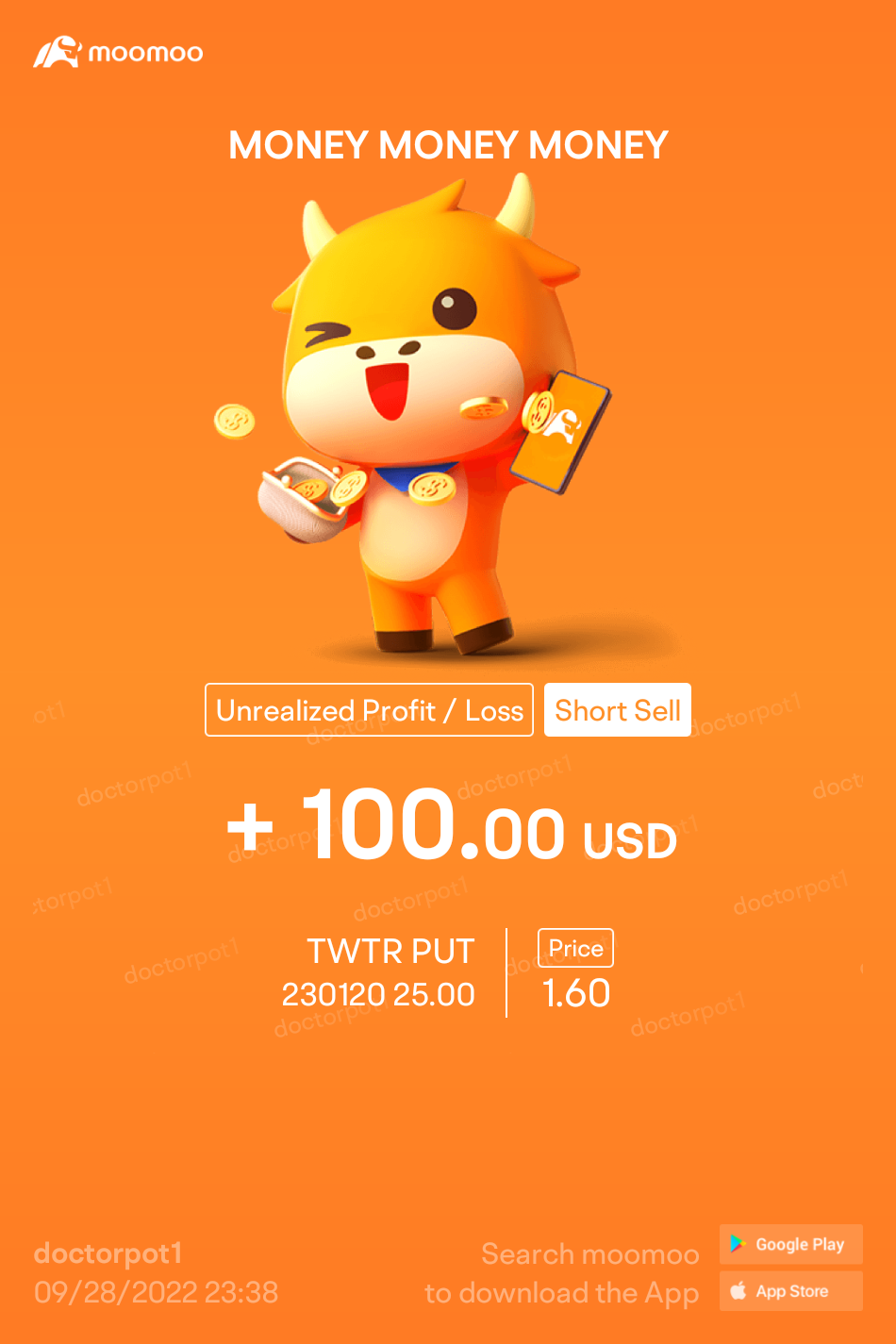

Still hopeful that Twitter will win!! Had earn $170 from trading PUT option, and will be selling $25 PUT again when the price goes back up to $2.00 and probably will hold till the case is settled.

Twitter's lawyer accused Musk's legal team of intentionally withholding the data, saying they had only just been able to view the documents as of Tuesday, despite seeking them since the early days of the lawsuit.

Still hopeful that Twitter will win!! Had earn $170 from trading PUT option, and will be selling $25 PUT again when the price goes back up to $2.00 and probably will hold till the case is settled.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

s ong : hi @doctorpot1could you explain to me why you buy and sell put at the same strike price and expiry? I am a little confused how it works as I am still learning. many thanks

doctorpot1 OP s ong : I first sold 2x PUT option with the strike of $25 for $205 per contract. Which means the buyer of the option can force me to buy 2x100 Twitter shares at $25 per share, but the buyer paid me 2x$205 in premium.

when the price drop to $170 a contract, I "bought back" the contract I sold for $170 each. This way the position is closed. meaning the buyer now cannot force me to buy 2x100 Twitter shares at $25 per share anymore.

Then when the price of the same contract goes back up to $210, I sold 2 more contracts again. which means the buyer of the option can force me to buy 2x100 Twitter shares at $25 per share, but the buyer paid me 2x$210 in premium.

then again when the price drop to $160 a contract, I "bought back" the contract I sold for $160 each. This way the position is closed. meaning the buyer now cannot force me to buy 2x100 Twitter shares at $25 per share anymore.

so currently, I'm not holding any position anymore, but I want to sell the contract again when the price goes back up to $200 a contract.

Why did I choose this PUT instead? here is a post with more detailed explaination on why I choose this instead of buying CALL option or the shares.

doctorpot1 :Lawyer's take on the Twitter v Elon Musk case, and strategies to take position

https://www.moomoo.com/community/feed/108679962361862?data_ticket=5b3500b278c1b7aa4a176e85285988a1&content_type=feeddetail

s ong doctorpot1 OP : wow. thank you very much for such detail explanation. it is very informative and I learned it![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

doctorpot1 OP s ong : no problem![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) there are some options chat room now in moo moo. you can search option then choose groups and join them, we answer questions and discuss about options there so can learn from many many people

there are some options chat room now in moo moo. you can search option then choose groups and join them, we answer questions and discuss about options there so can learn from many many people ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)