Great to lock in high interest rate on long term bond

I'm doubtful that we will remain in a high interest rate environment for a very long time. Even the fed dot plot shows that interest rate will drop in the long term. So I'm eyeing out for safe long term high interest government backed bond to lock in the high yield now.

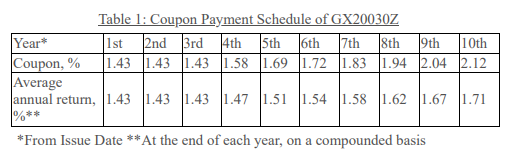

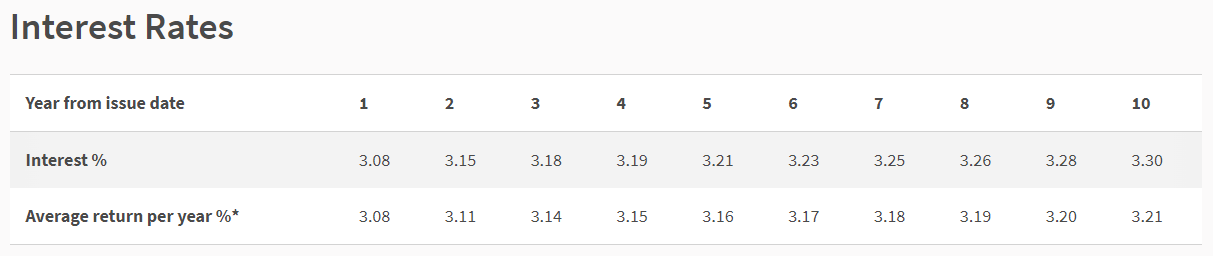

If we look at Singapore 10 years Savings Bond (SSB) that is issued by the Singapore government we can see that the yield of the bond had increased significantly. Precovid most SSB gives us 1.X% yield, but the latest SSB is giving us 3.X% yield. Almost twice as much.

One thing is for sure, when interest rate starts to drop, we will be getting back to the 1.X% yield again. So I'm interested to start buying long term government bond now, to lock in the high interest rate, for a long period of time. This way, in the future when everyone is getting 1.X% from their SSB, I'm getting 3.X% instead ![]()

![]()

Another thing to note is that existing bond price will drop when interest rate rises, but it will rise when interest rate drops. Currently, existing lower yield bond are seeing price drop, so that the net yield of the existing bond will be about the same as the newer higher yield bonds. That is because who would want to buy at 3% yield bond when they can get a better 4% yield bond, so the 3% bond will have to give discount.

For example, my $Astrea VI3%B310318# (6AZB.SG)$ bond is now priced at $0.936, a 6.4% discount ![]() So overall the yield is closer to 4% (*simplified as the yield is a step up yield). The good news is if interest rate starts to drop, then the bond price will start rising back up. So I'm kind of considering buy more.

So overall the yield is closer to 4% (*simplified as the yield is a step up yield). The good news is if interest rate starts to drop, then the bond price will start rising back up. So I'm kind of considering buy more.

Hope that there will be a release of a 50 year SGS bond with a yield greater than 4% ![]()

![]() Lock in for 50 years, is like having my own CPF SA that is paying me CPF life (coupon payment) immediately liao hahahahahaha

Lock in for 50 years, is like having my own CPF SA that is paying me CPF life (coupon payment) immediately liao hahahahahaha ![]()

![]()

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Cui Nyonya Kueh : I read some news. Fed will up the interest till 2024 if I did not read wrongly.Fed unlikely to cut interest rates until 2024, Goldman Sachs says

doctorpot1 OP Cui Nyonya Kueh : The fed do release what they expect their interst rate to look like in their report, so from the dot plot, as of now, we can see the expectation as of Sept 2022 is that they expect interest rate to start dropping from 2024 onwards. This may change, as it is just expectation.

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

so if they keep increasing, then I will buy more longer term bond so as to lock in the higher interest rate for many years again hehehe

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20220921.pdf

Captain Woon : Astrea VI is most attractive now with 0.5% bonus secured as well

doctorpot1 OP Captain Woon : based on the current price, it is giving a 4% yield too![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Captain Woon doctorpot1 OP : More than that in my calculation. Nearly 5% now excluding the 0.5% bonus, calculate till the end of the first redemption period.

doctorpot1 OP Captain Woon : then it is even better![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)