Weekly Buzz: Stocks slid as inflation worries rise again

Spoiler:

At the end of this post, there is a chance for you to win points!

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Make Your Choices

Buzzing Stocks List & Mooers Comments

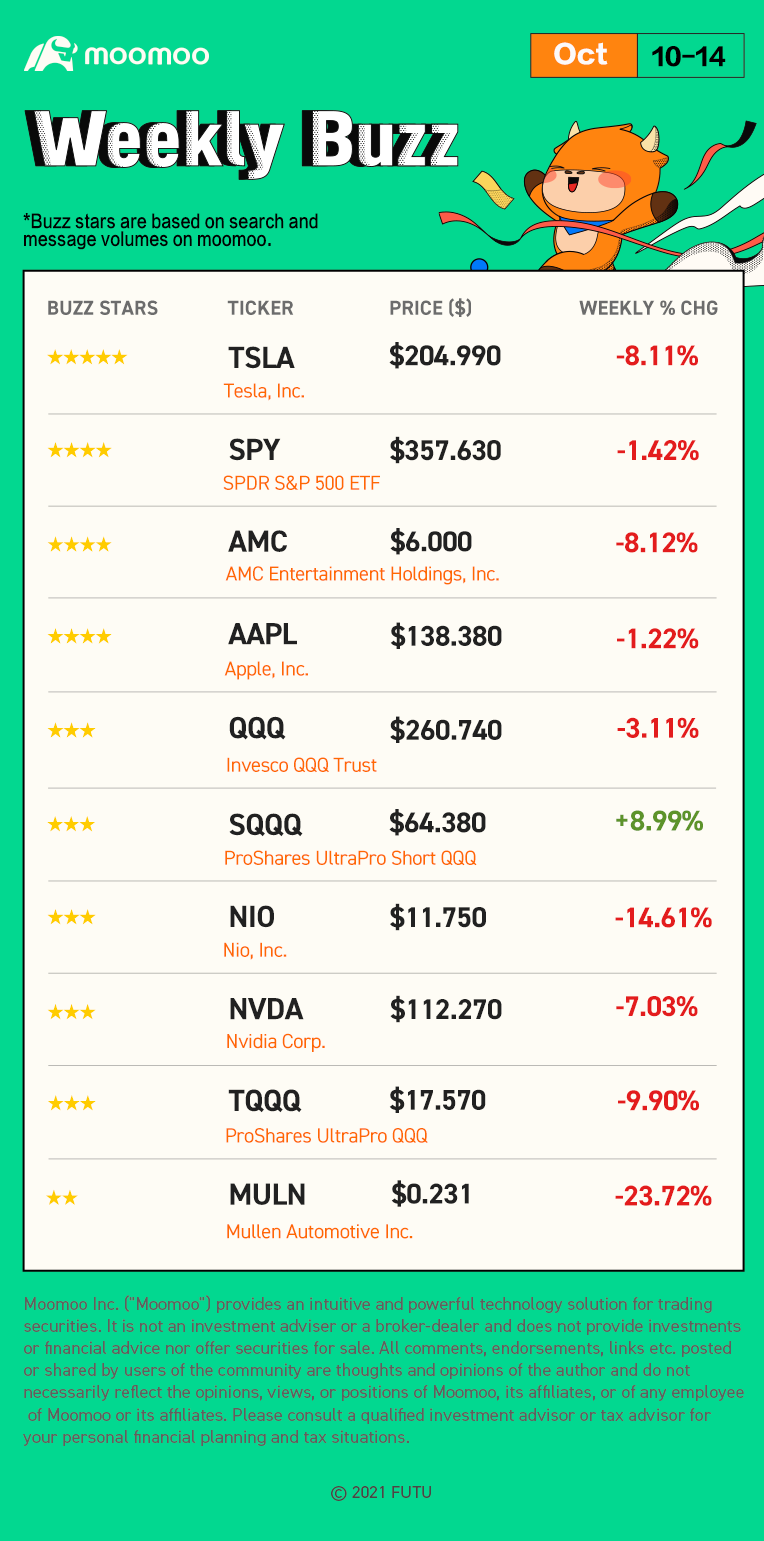

What a volatile week we had! Inflation jumped by 8.2% in September versus a year earlier, hotter than expected though a slight decline from August. Most sectors closed in the red last week, with the S&P 500 and the Nasdaq ending the week 1.55% and 3.18% lower, respectively (as of Oct 14, 2022).

Without further ado, let's dive into the weekly buzzing stock list of last week:

1. TSLA - Buzzing Stars: ⭐⭐⭐⭐⭐

Tesla shares were trading 8.11% lower last week amid over-market weakness. Its stocks dipped 44% this year and were heading toward a new 52-week low. Additionally, reports suggested the company is facing production issues at Gigafactory Berlin (As of Oct 14, 2022).

@Asphen:

- Fail to break 225 (tried but got rejected immediately)

- Everyone will probably see clearly a bearish engulfing candle formed last night which means bearish

- Look for any reversal price action at 190 as next level of support.

Read more >>

Upcoming Live: Tesla Q3 2022 earnings conference call

2. SPY - Buzzing Stars: ⭐⭐⭐⭐

The S&P 500 ended the week lower, erasing a short-lived rally. The price of SPY closed at $357.630, with a weekly decline of 1.42% (As of Oct 14, 2022).

@MarketMatt Channel:

In my opinion, I expect consolidation, my trading strategy, trade the spy levels, current support, $359, currently supported $363, current rejection $367

Read more >>

3. AMC - Buzzing Stars: ⭐⭐⭐⭐

Shares of AMC plunged 8.12% last week as equities research analysts reduced its target price at B Riley from $11.00 to $7.50 in a research report (as of Oct 14, 2022).

@TheApeInvestor:

$AMC Entertainment (AMC.US)$ looking like the shorts are exhausted here. apparently they are buying expensive ITM shorts to suppress the price and theres no shares to borrow. I think I‘ll HODL.

Read more >>

4. AAPL - Buzzing Stars:⭐⭐⭐⭐

Shares of AAPL slid 1.22% toward a 4-month low amid a rise in treasury yields, which has pressured growth stocks (as of Oct 14, 2022).

@Asphen:

Current level is near the key support level of 135

- 135 has bounced once on 13 Oct, and a 2nd test will likely break through

- Breaking 135 would then mean 123 is very much in play (possibly finding minor support at 126 and 131)

Read more >>

5. QQQ - Buzzing Stars: ⭐⭐⭐

The tech-heavy Nasdaq 100-tracking Invesco QQQ Trust ETF dropped 3.11% over last week (as of Oct 14, 2022).

@Gilley:

bad news creates massive rally yeah the public needs to look into the stock market its a total scam it dropped bad asf on good news to the other day on jobs data now probably more bad news tomorrow let's see the magic jump

6. SQQQ - Buzzing Stars:⭐⭐⭐

Congrats in the only green baby we got last week! SQQQ has been trading in a consistent uptrend since Aug 16, when the S&P 500 and the Nasdaq 100 reversed into downtrends. The SQQQ showed signs of strength with a weekly growth of 8.99% (as of Oct 14, 2022).

@Dodgers for life:

It is estimated that the opening of trading next week will still fluctuate the downward trend, but after selling 40% of the position over the weekend, it will continue to fall, rising and falling for three days.

Read more >>

7. NIO - Buzzing Stars:⭐⭐⭐

With the US inflation data worse than expected and CPI rising 0.4% in September, NIO's shares plummeted 14.61% over last week (as of Oct 14, 2022).

@IVY CHEW:

I used to buy 15 and sell 17. Some people say that you can no longer get the price of 15. Today, is under 13. So I still insist on selling as much as I can in the stock market. Be sure to release stop point. Don't be greedy.

8. NVDA - Buzzing Stars:⭐⭐⭐

NVDA slipped 7.03% last week as the all-around dismal trading session for the stock market. Besides, a weak PC (personal computer) demand and restrictions on data center chips' sales to China could also wreck its financial performance (Oct 14, 2022).

9. TQQQ - Buzzing Stars:⭐⭐⭐

According to Nasdaq, TQQQ has detected $236.9 million outflow, and its price fell 9.90% over last week (as of Oct 14, 2022).

@101573075:

If CPI exceed expectation then it would mean good news for Sqqq, if however CPI falls below expectations and meet expectation it would be bad news for Sqqq but good news for Tqqq

Read More >>

10. MULN - Buzzing Stars:⭐⭐

MULN stock slid 23.72% lower last week after Mullen won the ELMS bankruptcy auction. The stock price of MULN also touched a new 52-week low of 24 cents (as of Oct 14, 2022).

@itsmehello:

$Mullen Automotive (MULN.US)$ again added at 0.23 and bow holding 45 k shares at 0.3745.. market will recover. Now all EV stock down. so nothing to conplain on mullen

$Mullen Automotive (MULN.US)$ again added at 0.23 and bow holding 45 k shares at 0.3745.. market will recover. Now all EV stock down. so nothing to conplain on mullen

Thanks for your reading!![]()

Before moving on to part three, congrats to the following mooers whose comments were selected as the top comments last week!

Notice: Reward will be sent to you this week. Please feel free to contact us if there is any problem.

Weekly Topic

Time to be rewarded for your great insights and knowledge!

What is your investment objective?

e.g. To achieve FIRE? To get rich? To be happy? To travel around the world?

e.g. To achieve FIRE? To get rich? To be happy? To travel around the world?

Comment below and share your ideas!

We will select 15 TOP COMMENTS by next Monday.

Winners will get 200 points by next week, with which you can exchange gifts at Reward Club.

*Comments within this week will be counted.

We will select 15 TOP COMMENTS by next Monday.

Winners will get 200 points by next week, with which you can exchange gifts at Reward Club.

*Comments within this week will be counted.

Previous of Weekly Buzz

Disclaimer: Comments above are made available for informational purposes only. Before investing, please consult a licensed professional.

This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Tap for more details.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Milk The Cow :

HopeAlways : My investment objective is primarily capital appreciation which emphasises on long-term growth. This involves holding stocks for many years and letting them grow within my portfolio. At the same time, I will be reinvesting dividends to purchase more shares. Compound returns are the greatest force for those who focused on capital appreciation. As I am using capital appreciation strategy, I am not too concerned with day-to-day price fluctuations. However, I would keep a close eye on the fundamentals of the company for changes that could affect long-term growth. Making regular purchase for quality stocks will also help to build up my portfolio over time.

Milk The Cow : My investing objective is to get rich all along .

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) to help me solve most of my problems that has been for decades, that's all. It's not really to be happy or to travel.

to help me solve most of my problems that has been for decades, that's all. It's not really to be happy or to travel.

It because I need

After my life problems are solved, I will then decide what I wanna do with my remain life, provided I'm able to.

Two words "Financial Independent" come first.

Syuee : My investment objective is to be financially independent and my real goal is early retirement.

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) I shall end with a quote from the Bible :

I shall end with a quote from the Bible :

My plan is to maximize income first and savings second.

As my income increases, I also saved more ( both dollar amounts and percentage ).

Best to focus on two things :

1 ) Living way below our means

2 ) Investing on the side for long-term growth.

The secret is to start early !

Financial Independence, Retire Early ( FIRE ) movement, literally means exchanging money for time.

By retiring early, one gives up the opportunity to earn more money by working, but in return, get a lot more free time to do whatever one desires.

Of course, most people can make more money by continuing to work, even after they have reached financial independence.

But, the utility derived from additional units of money diminishes, as the amount of wealth increases.

Time, on the other hand, gains in value over time, as every second that passes away brings a man that much closer to death.

It is all about trade-off.

Those who adopt FIRE movement, simply value TIME more than money .

Life is short.

Everyone is allotted the same amount of time, which, once lost, can never be gained back.

“ What shall it profit a man, if he shall gain the whole world, and lose his own soul … ? "

Financial Independence isn’t all about making more money.

The ultimate goal is living life, on our own terms.

#WhatIsTheSweetestScent

#Freedom

HopeAlways Syuee : When it comes to investing, our investment objectives can help us achieve our financial goals. While certain methods may work for one objective, they may produce poor results for others.

Syuee HopeAlways : To be in a position to reap the rewards of capital appreciation, one have to first be able to spot a good investment portfolio proposition.

Capital appreciation is certainly one part of a long-term wealth-building strategy.

Popular on moomoo OP :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) Time to be rewarded for your great insights and knowledge!

Time to be rewarded for your great insights and knowledge!

What is your investment objective? e.g. To achieve FIRE? To get rich? To be happy? To travel around the world?

ZnWC : What is your investment objective?

, eat healthy meal

, eat healthy meal  , manage mental well-being

, manage mental well-being  ). You need to work hard to stay healthy and I don't want to work til I die.

). You need to work hard to stay healthy and I don't want to work til I die.

, you will work until you die. - Warren Buffett

, you will work until you die. - Warren Buffett

e.g. To achieve FIRE? To get rich? To be happy? To travel around the world?

What's my investment goal:?

To be build wealth by achieving financial independence.

I invest to make time to do things that I like to do (such as help people, travel the world, spend time with love one etc).

Being rich is having money; being wealthy is having time - Margaret Bonnano

How to achieve? Through FIRE (Financial Independence Retire Early)

FIRE is easier said than done as you need to increase income and reduce expenses at the same time.

Getting wealthy vs Staying wealthy. There's only one way to stay healthy; a combination of frugality and paranoid. - Psychology of Money

Why I invest?

To make time to maintain a healthy lifestyle (exercise daily

If you don't find a way to make money while you sleep

ZnWC Syuee : @Syuee@HopeAlways

Someone told me that capital appreciation is the most effective way to fight inflation. I have always wanted to learn more about this topic, thanks for bring it up

Syuee ZnWC : Always happy to share ideas and insights !

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Thank you for sharing yours too .

View more comments...