Chip: How to Invest nearing a turning point?

After largest sell-offs since 2008, the $PHLX Semiconductor Index (.SOX.US)$ has dropped 35.83% in a year, and many leading chip companies' share prices were cut in half.

An industry with a long runway

A recent Invesco report shows global semiconductor sales expend 50x in 40 years, twice the growth of global GDP. However, the semiconductor cycle occurs every 3-4 years, due to supply-demand mismatch.

How to find the turning point?

How to navigate the cycle? Analysts revealed two hints:

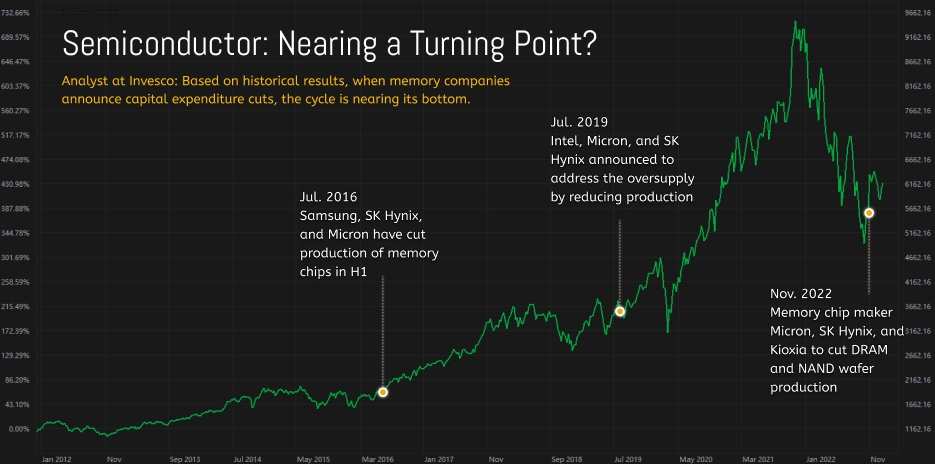

-Invesco: Based on historical results, when memory companies announce capital expenditure cuts, the cycle is nearing its bottom.

-Jeffries: the U.S. The semiconductor sector tops six months before the order cuts. After the news came out, the semiconductor stocks basically found their bottom.

Leave your comment to win

How to invest in chip stocks during the cycle?

Which stocks do you currently hold or plan to trade?

Reward: 6 users sharing the best investment idea, orders, or positions will win 1,000 points!

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

khalifa marzouq : $Tesla (TSLA.US)$ 100000

tony123456 khalifa marzouq : 100

LH_XY_C_L : invested in index stock such as TQQQ.

Always stay in the market but rebalancing with the percentage of stock holding and percentage of money holding

Johnnie Worker : Good to know! I’m sure my micron $Micron Technology (MU.US)$ is bouncing back to a new bull rally

RyanT2021 : My investment strategy during this cycle is to DCA on my highest conviction stocks like $Tesla (TSLA.US)$ $Tencent (TCEHY.US)$ $Apple (AAPL.US)$ $AMC Entertainment (AMC.US)$ $Palantir (PLTR.US)$ so that I have enough fuel to reach the moon when the bull market inevitably comes.

Biggy168 : Hv been waiting for this moment, Telsa, Apple, nividia, amd, li motor, nio n not forgetting to buy HK tech stock, like Q tech, byd n their battery stk too,

xiaomitu : Ai demand will drink chips stock. Crypto demand less. DCA. $NVIDIA (NVDA.US)$ $Advanced Micro Devices (AMD.US)$ $Taiwan Semiconductor (TSM.US)$ Drop $Intel (INTC.US)$ hold long term at least 3 years.

102131952 : $ASML Holding (ASML.US)$ go go go

Fundamentalist :

Fundamentalist Fundamentalist : After getting a beatdown from the bear market, many chip stocks trade at a value price. It will take a long term approach in investing and holding power is essential. I think these stocks will do well in 2023. What do you think?

View more comments...