Fed Set to Release Hawkish Messages While Slowing Rate Hikes

The Federal Reserve is set to slow its inflation-fighting campaign without signaling a readiness to stop as inflation is fading.

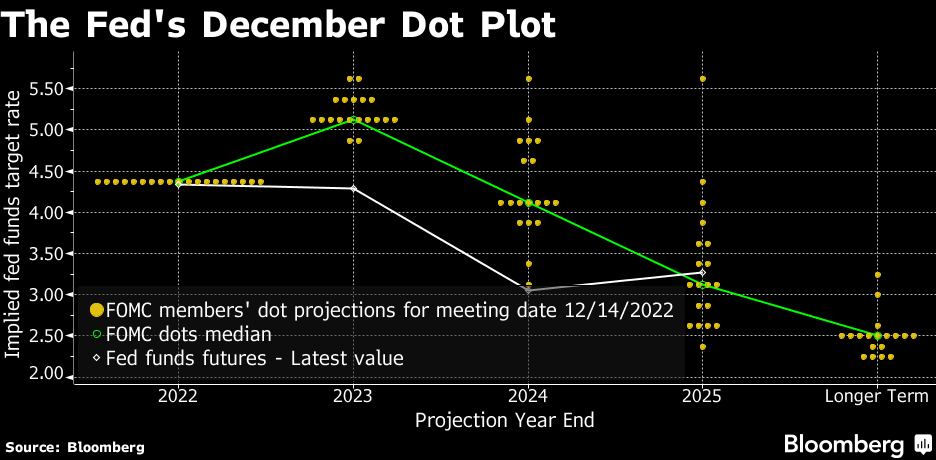

A slower pace of a quarter-point rate hike is priced in on Feb. 1. Traders expect a peak policy rate of around 4.9% by May and June, falling to less than 4.5% by the December meeting, and further cuts in 2024.

By contrast, 17 of 19 central bank officials saw rates would be above 5% this year, with two of them seeing rates above 5.5%, according to the central bank's December forecasts.

Notice that rising stock and bond prices might fuel the pressures that Chair Powell wants to restrain. Given this backdrop, Powell is also expected to balance a potential 25 basis-point rate hike with a stern message – his commitment to bring down inflation to 2% will remain unchanged.

"The goal now is to keep the financial markets from pricing in a premature pause and lean against the bond market's expectation of rate cuts in the second half of 2023, which would lead to further unwanted easing in financial conditions," said Kathy Bostjancic, chief economist at Nationwide.

Source: Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

RDK79 : Who are these ‘traders’??? that expect about 5% by May / June…

Ixy The Cat : Where did anyone get the idea that inflation is fading?

72754563 : this democrat economy is killing everyone