Will Tesla's upward momentum continue?

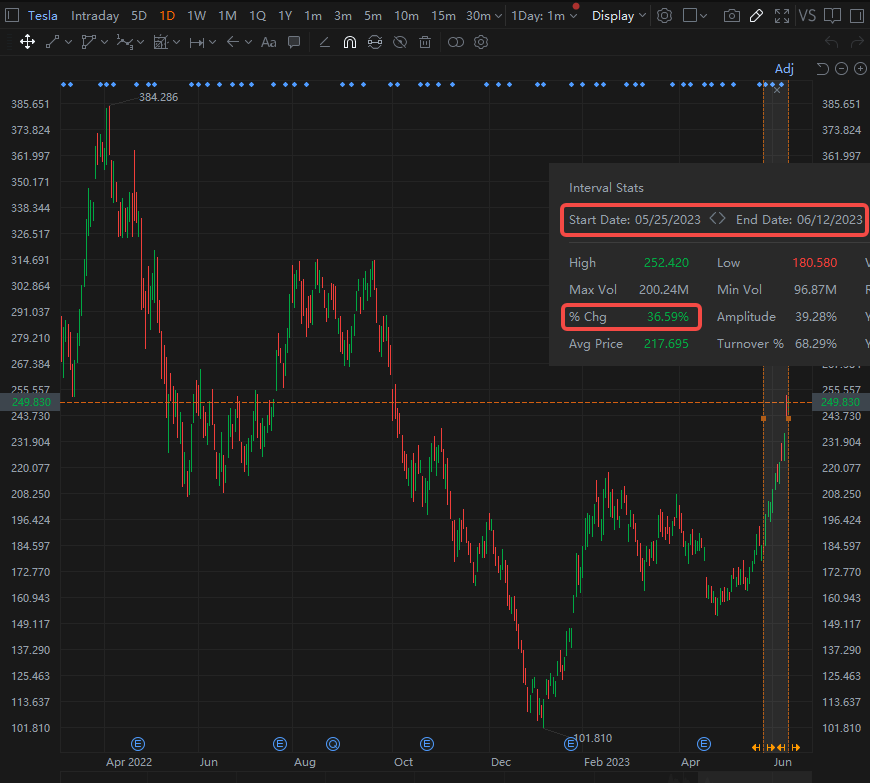

$Tesla (TSLA.US)$ have been soaring recently, rising for the 12th consecutive trading day as of June 12, accumulating a 36% gain, while the S&P 500 and Nasdaq Composite Index rose 5% and 7%, respectively, during the period.

The company's shares have gained a cumulative 102% so far this year. Nonetheless, its shares are still down about 39% from the all-time high of nearly $410 per share set in November 2021 .![]()

Traders shorting Tesla shares have accumulated losses of about $6.08 billion during the 11th straight session of gains, according to the latest data from S3 Partners.

Musk also took the opportunity to poke fun at legendary investor Bill Miller on Saturday, responding to an interview Miller gave earlier in January in which he said he was shorting the electric car maker because of increased competition in the industry.![]()

What is driving this trend?

Why is it rising now? Earnings season is long past and second quarter delivery figures are weeks away, so is it because of the Fed's pause in rate hikes, the rising tide in artificial intelligence, or Twitter's new CEO?

Gary Black, co-founder of Future Fund Active ETF (FFND), took to Twitter last Thursday to conduct a poll asking why the stock was rising. The results showed that the top ranking was the restoration of the full $7,500 tax credit for Model 3 sedans, something that had already happened earlier last week.![]()

But as the stock price continues to rise, there is more good news being digested by investors. This includes:

1. Cybertruck production exceeds expectations

As previously reported by Electrrek, Tesla plans to produce 375,000 Cybertruck per year, which far exceeds Wall Street's expectations. Previously analysts expected the number to be below 100,000 by 2024 and about 240,000 by 2027. So, the 375,000 figure is very striking.

Sources from Tesla's suppliers say that production of the Cybertruck is expected to officially begin in early October and that pre-orders for the Cybertruck have already reached 1.5 million units. Last December, Tesla took delivery of its first electric truck, the Semi, which is now aimed at corporate customers, with PepsiCo as one of the first customers.![]()

The Cybertruck's aggressive sales targets will challenge the U.S. pickup market landscape, as the top three U.S. car sellers in 2022 are all pickups: Ford F-Series (650,000), Chevrolet Silverado (510,000), and Dodge Ram RAM (470,000).

2, Tesla charging standard is expected to go to the global market

Following the announcement by Ford and GM that the next generation of electric cars will adopt Tesla's charging standard NACS, Tesla, the biggest winner, has already welcomed a rise in its share price.

First, this move will add millions of users to Tesla's existing charging network. General Motors plans to reach 1 million U.S. electric car production capacity by 2025, while Ford expects to break 2 million electric vehicles by 2026. Tesla will certainly receive additional revenue from Ford and GM EV owners and its charging network will be more fully utilized.

Second, the charging technology is being used by older competitors, signaling peer recognition of its technology, and the market expects Tesla's charging standards to "unify North America," paving the way for a unified, open U.S. electric vehicle charging standard.

But the benefits don't stop there. On Monday, June 12, local time, four Western companies announced their acceptance of Tesla's charging standards.![]()

ChargePoint Holdings Inc., which claims to operate the largest network of electric vehicle (EV) charging stations in North America and Europe; Blink Charging Co., which operates EV charging stations in the U.S.; and Wallbox NV, a Spanish provider of smart EV charging and energy management services, all said they will have chargers adapted to Tesla's NACS. Australia-based EV charger hardware and software maker Tritium DCFC Ltd. also said it will offer a NACS connector option for its charger products.

Shares of all four of these companies jumped in Monday's session. $Blink Charging (BLNK.US)$ rose more than 10% at one point to close up 9.4%; $Wallbox (WBX.US)$ rose nearly 9% at one point to close up 5.96%; $Tritium DCFC (DCFC.US)$ closed up 5.61%; $ChargePoint (CHPT.US)$ closed up over 6%.

The market now expects the Tesla charging standard to move to a wider global market.![]()

With the charging pile, will the next step of driverless technology, FSD, also be more widely promoted?

What does Wall Street think?

There is no doubt that Tesla has recently received a lot of bullishness from Wall Street banks, with investment bank Wedbush putting Tesla on its "Best Ideas" list and raising its price target to $300.

Analyst Dan Ives and his team believe that Tesla is on track to meet its delivery target of 1.8 million vehicles this year, and that profit margins should pick up in fiscal 2024. The bank estimates that new electric vehicle battery charging agreements with Ford and GM could add another $3 billion to Tesla's electric vehicle charging service revenue in the next few years, another move that will be a value-added card for Tesla.

Investment bank Evercore ISI estimates that Tesla's Supercharger network will generate $4 billion to $6 billion in total revenue by 2030, with about $1.1 billion coming from non-Tesla customers.

Analyst Doron Levin said Tesla's opening up of its charging network creates a potential new source of revenue - vehicle power sales. He noted that "the chargers also have marketing value for Tesla vehicles, serving as stand-alone advertising to some extent."

However, Wells Fargo analyst Colin Langan believes that the economic benefits of the deal may not be as great as some investors expect. The analysts and their team estimate that the annual charging revenue opportunity is only about $150 per car, and if 70% of the charging is done at Tesla's network of charging stations, then the charging revenue would be $400 million per year, compared to Tesla's total revenue of $81.5 billion in 2022. Analysts also say that Tesla's charging station network is a competitive advantage today, but that this advantage will be diluted as the deal proceeds.

It's worth noting that with $Tesla (TSLA.US)$ rising continuously, it's looking a little dangerous. The company's current stock price is well above its 200-day moving average of about $200 per share and is considered to be "overbought," a technical term that basically means a stock is rising too fast.![]()

In fact, "overbought" reflects a lot of good news, which is a short-term risk for any stock. Investors aren't thinking too much about risk right now, they're just focused on the returns of a new model that could become a breakout hit.

All of this could be a sign of a pause, but Tesla is a stock that can never be predicted.

what do Mooers think?

Musk recently reiterated that Tesla's market capitalization could one day exceed the sum of Apple and Saudi Aramco. Saudi Aramco currently has a market cap of 7.85 trillion riyals (about $2.09 trillion), while Apple's market cap is a whopping $2.89 trillion. On the other hand, Tesla's market capitalization stood at $791.79 billion as of Monday's close.![]()

You are also welcome to tell us in the comments section your specific reasons for being optimistic or bearish about Tesla's future stock price ~

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

DukeSteven : Yes. All the way to 300 follow by 400 then 1k

The Cow King : $NVIDIA (NVDA.US)$ and $Netflix (NFLX.US)$ stock price already hit 400+. There is no reason why Tesla couldn't

Fire Cat DukeSteven : I totally agree.

Fire Cat : Time and time Tesla has proven people wrong. $160 becomes thousands and split and went up again. Time will tell again.

102647062 : tesla is a hot stock

Xiao Siow : All the way up

CPN fen : Up up up

Koolgal : $Tesla (TSLA.US)$ share price has been sizzling hot and I believe it still has lots of exponential growth ahead.

ZnWC : You can read the following posts about why Tesla's momentum will continue:

Tesla's current valuation is cheap in hindsight if the company successfully applies AI

Artificial Intelligence Will Be the Primary Growth Driver for Tesla Stock

73236942 102647062 : Yes, it's also the technology stock sector

View more comments...