My Options Trading Experience - Keep it Simple, Know your Risk (KSKR)

I use options trading for 3 purposes:

1. Buy value stock at cheap price

1. Buy value stock at cheap price

This is done by selling put options (covered) at a price you can afford. For example, if I want to buy 100 Apple share at USD 160 (currently is USD 180), it can be done by selling a put options at strike price USD 170. I can earn a premium while waiting for the price to drop (if the price drops).

2. Sell stock at a higher price

This is done by selling call options (covered) at a price you see reasonable. For example, if I want to sell 100 Apple share at USD 190 (currently is USD 180), it can be done by selling a call options at strike price USD 190. I can earn a premium while waiting for the price to rise (if the price rises).

3. I can protect my stock from losing money

After buying a stock, I can protect the value by buying a put options. For example, if I own 100 Apple share at USD 170 (currently is USD 180). I can buy a put options at strike price USD 175. If the share price fall below USD 175, I can exercise the put option to sell 100 Apple share at a higher price than what I initially bought.

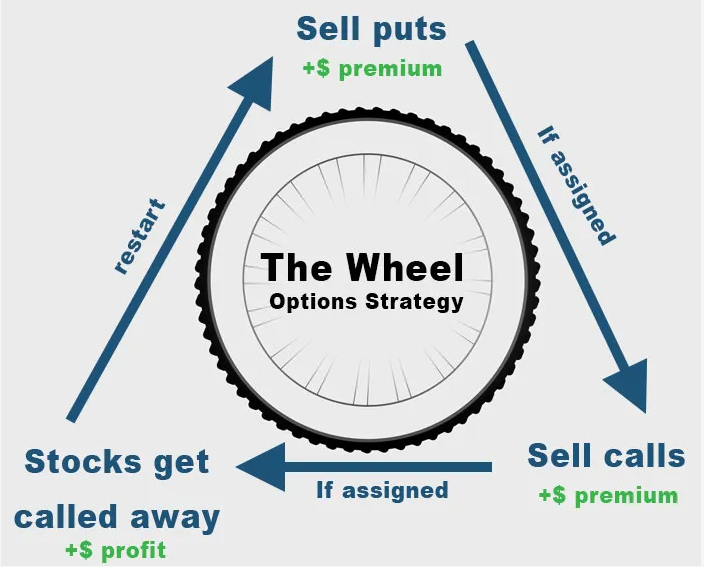

Methods 1 and 2 are what some people call Wheels Option Strategy (WOS) and Method 3 is also known as Long Put Spread.

2. Sell stock at a higher price

This is done by selling call options (covered) at a price you see reasonable. For example, if I want to sell 100 Apple share at USD 190 (currently is USD 180), it can be done by selling a call options at strike price USD 190. I can earn a premium while waiting for the price to rise (if the price rises).

3. I can protect my stock from losing money

After buying a stock, I can protect the value by buying a put options. For example, if I own 100 Apple share at USD 170 (currently is USD 180). I can buy a put options at strike price USD 175. If the share price fall below USD 175, I can exercise the put option to sell 100 Apple share at a higher price than what I initially bought.

Methods 1 and 2 are what some people call Wheels Option Strategy (WOS) and Method 3 is also known as Long Put Spread.

Bottom line

For the above to work, predicting the price trend accurately is important to maximise profit (or premium). You need fundamental analysis (valuation) and technical analysis (price trending) to accurately find the best time to enter a options trade. You are gambling if you trade options by following other recommendations blindly or just based on on luck.

I don't sell naked put or call options (short put or short call) which is very risky. Ensure you have sufficient cash before you sell any put options because you can be forced to buy 100 shares if it is ITM (in the money). Understand the risk before you try options trading. Beware of greed or exceed your risk level.

I don't sell naked put or call options (short put or short call) which is very risky. Ensure you have sufficient cash before you sell any put options because you can be forced to buy 100 shares if it is ITM (in the money). Understand the risk before you try options trading. Beware of greed or exceed your risk level.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

ZnWC OP : I don't trade options frequently because of expensive options fee which is something you've to consider when trading options.