Will Buffett's secret positions be disclosed in the 13F filings? Get to know Berkshire's investment activities in the first quarter of 2024 in one article!

This article uses automatic translation in some parts.

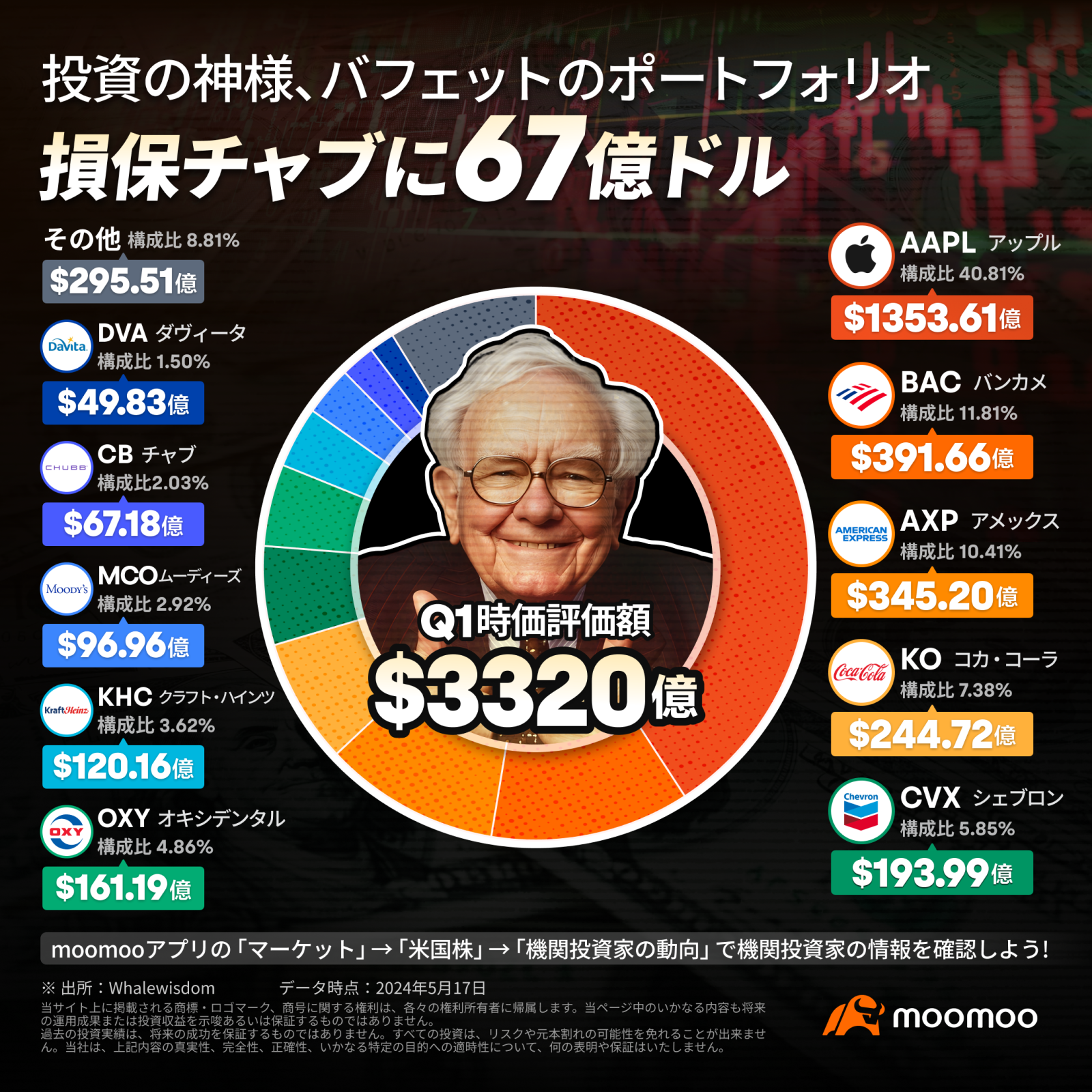

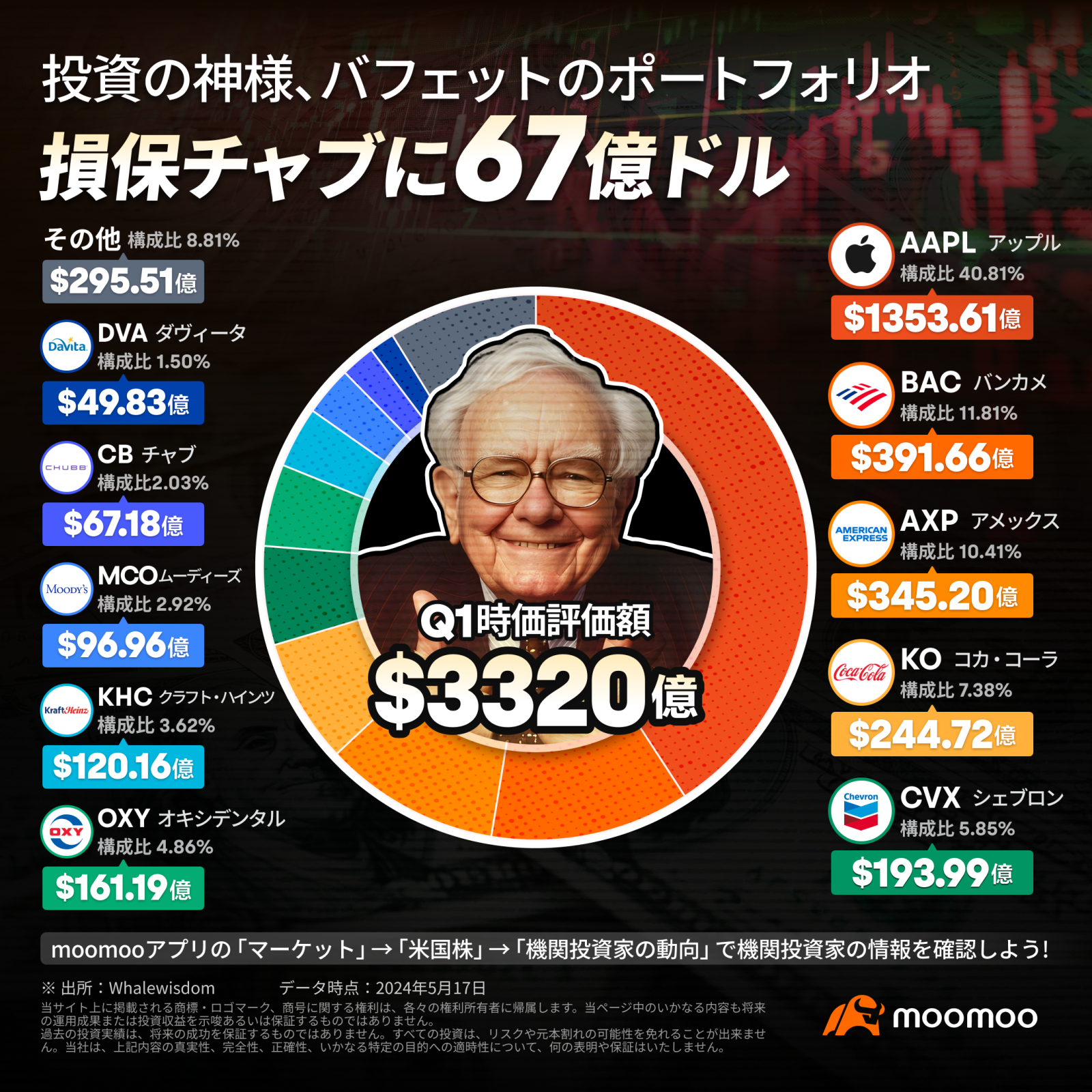

According to the 13F filing documents, $Berkshire Hathaway-A (BRK.A.US)$ The top 5 holdings are: $Apple (AAPL.US)$(135.4 billion dollars), $Bank of America (BAC.US)$ (39.2 billion dollars), $American Express (AXP.US)$ (34.5 billion dollars), $Coca-Cola (KO.US)$ (24.5 billion dollars), $Chevron (CVX.US)$and (19.4 billion dollars), respectively, and they account for approximately 75% of the portfolio.

"Stock God" Warren Buffett's Berkshire Hathaway revealed changes in its holdings in the 13F filing submitted to the U.S. Securities and Exchange Commission (SEC) after the close of the U.S. stock market on the 15th. Berkshire started purchasing a mysterious stock that had aroused great interest among outsiders through secret filings starting from the third quarter of 2023.

Its true identity is the world's largest publicly traded property and casualty insurance company, $Chubb Ltd (CB.US)$ Chubb Insurance Group is the world's largest property and casualty insurance company that provides insurance and services in 54 countries and regions. Berkshire purchased approximately 26 million shares, totaling approximately $6.7 billion, of the company's stock in the previous period and jumped to the 9th position in Berkshire's holdings. The company's stock price rose more than 8% in after-hours trading and has risen approximately 12% year-to-date (as of the closing price on the 15th), reaching $252.97.

In response, Cathy Seifert, an analyst at CFRA Research, stated, "Chubb is an attractive stock investment for Berkshire because it operates in the property and casualty insurance business that Berkshire excels in."

Increase in Ocxy Holdings, HP to be fully sold

According to Berkshire's 13F filing, the additional holdings include $Under Armour-C (UA.US)$ , $Occidental Petroleum (OXY.US)$ ・ $Empire Petroleum (EP.US)$ telecom services and satellite communication services $Liberty SiriusXM Series A (LSXMA.US)$, $Liberty SiriusXM Series C (LSXMK.US)$ etc.

According to Berkshire's 13F filing, the additional holdings include $Under Armour-C (UA.US)$ , $Occidental Petroleum (OXY.US)$ ・ $Empire Petroleum (EP.US)$ telecom services and satellite communication services $Liberty SiriusXM Series A (LSXMA.US)$, $Liberty SiriusXM Series C (LSXMK.US)$ etc.

In the previous period, Berkshire increased its shareholding by nearly 2%, holding more than 48 million shares, with a total value of about 16.1 billion dollars. On the other hand, the stocks that decreased their holdings were $Occidental Petroleum (OXY.US)$et $Apple (AAPL.US)$ , $Paramount Global-A (PARAA.US)$ , $Chevron (CVX.US)$ , $Sirius XM (SIRI.US)$ , is a building materials manufacturer. $Louisiana-Pacific (LPX.US)$ etc.

What is noteworthy is $Helmerich & Payne (HP.US)$was sold to Berkshire in full in the previous period, and at Berkshire's annual meeting, Mr. Buffett reduced his holding by 13% due to tax reasons $Apple (AAPL.US)$. In addition, at the annual meeting, Mr. Buffett acknowledged that the investment in Paramount was a mistake and sold all the shares.

- Moomoo News Zeber

Source: Bloomberg, Berkshire Hathaway official website

This article uses automatic translation in some parts.

Source: Bloomberg, Berkshire Hathaway official website

This article uses automatic translation in some parts.

Please check the details of the 13F in the "Market - US stocks - Institutional tracking" section of the app~

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

やふ : I was wondering if it was Japanese bank stocks or non-life insurance stocks, but was that so? Too bad!

二日酔 : Keep talking about the same topics over and over again.

moomooニュース奈々 二日酔 : Hangover samaThank you for using moomoo every time. Thanks for pointing that out.Moomoo News will strive to provide the best news service and a good user experience to all users. We look forward to working with you in the future.

生活保護投資 : Wouldn't it be better to buy Buffett's company rather than buy Buffett shares?

浮世草子 生活保護投資 : I wonder if 1 unit is tens of millions of yen

182208701 moomooニュース奈々 : El

生活保護投資 浮世草子 : There is BTK.B

syo998 : Japanese investment is really boring... as conservative and boring as the economy that has been suspended for the past 30 years; they actually value corporate dividends rather than corporate growth...![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)