[13F] Mr. Buffett, the god of investment,'s secret portfolio revealed?! Apple stock holdings were cut in half and new cosmetics retail stocks were acquired

Rice led by Mr. Buffett, the “god of investment” $Berkshire Hathaway-A (BRK.A.US)$On the 14th, a list of stocks held as of the end of 2024/6 was disclosed.

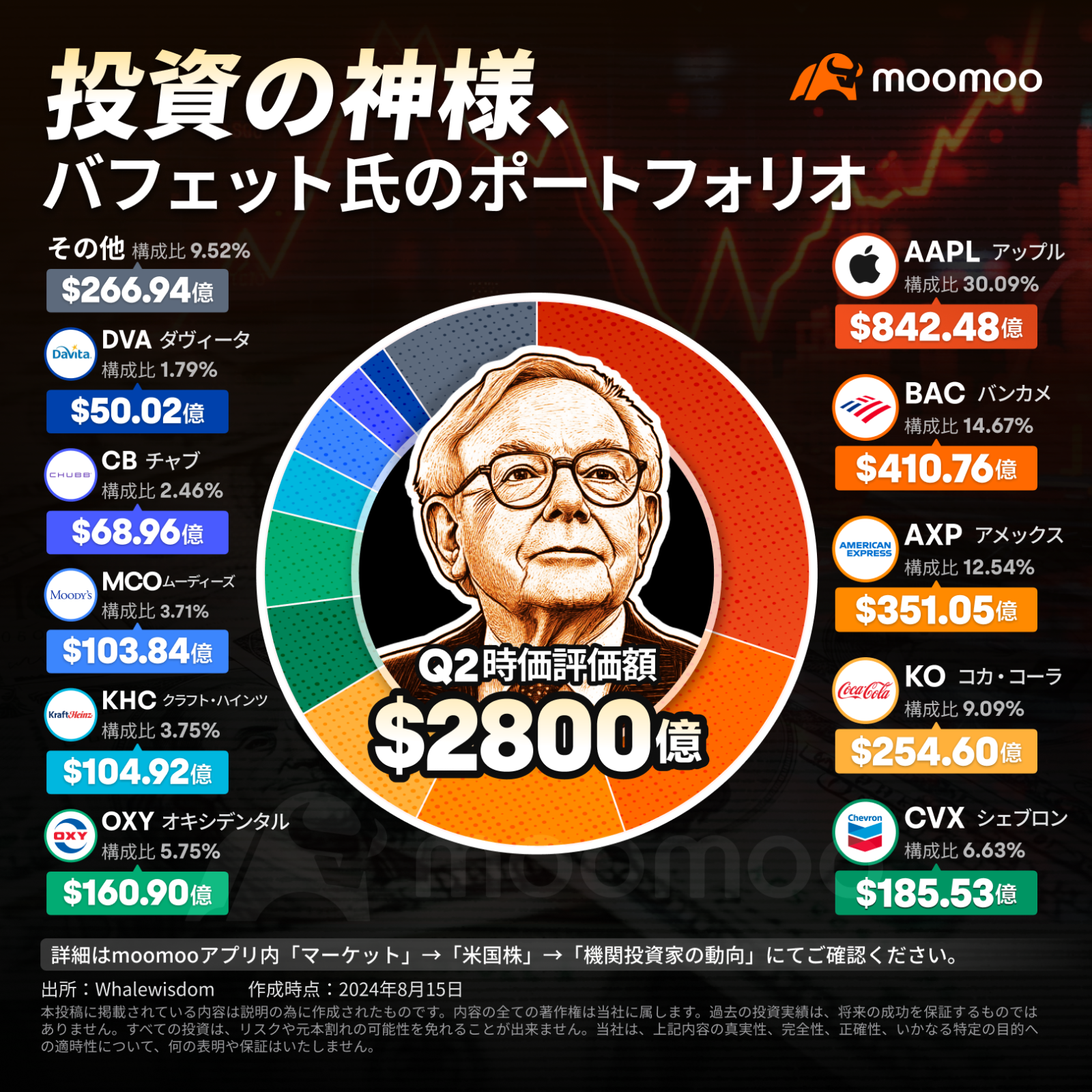

![[13F] Mr. Buffett, the god of investment,'s secret portfolio revealed?! Apple stock holdings were cut in half and new cosmetics retail stocks were acquired](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240815/ed32bfcb96abe485c8e8dc228b1a096f.png/big?area=105&is_public=true)

$Apple (AAPL.US)$What is the number of shares held byDecreased from 0.7 billion 89 million shares in the first quarter to approximately 0.4 billion sharesThen,A decrease of almost 50%It became.

Mr. Buffett suggested at the Berkshire general shareholders' meeting held in May that Apple's ownership ratio would be lowered for tax reasons. He pointed out that if the US government wants to fill in the widening budget deficit and raise capital gains taxes, this year's “small sale of Apple” will benefit Berkshire shareholders in the long run.

Meanwhile, cosmetics retail stocks have plummeted this year $Ulta Beauty (ULTA.US)$を0.69 million new shares were acquiredI made that clear. In the second quarter, Alta Beauty shares held by Berkshire had a market value equivalent to 0.2 billion66 million dollars. The company's stock price is on the 14th10% or more increase from the closing price on the same day due to overtime tradingI did it.

Alta Beauty's unique market position, which spans popular cosmetics and luxury brands, may also be one of the reasons why Mr. Buffett is bullish. DA Davidson analyst Michael Baker points out that the reason Alta's stock price is under pressure is partly due to new competitiveness with rival Sephora. In the luxury cosmetics category, Alta Beauty's market share is being squeezed, and although the company's market share momentum is weakening, it is still growing in the popular cosmetics category.

Aerospace and electronics companies $Heico (HEI.US)$It was also newly acquired.

Furthermore, Berkshire held a total of 6.12 million shares in US cloud computing companies at the end of the first quarter $Snowflake (SNOW.US)$Shares held byFull saleI did it. It is the second sale after Apple in the second quarter, but the ratio of Berkshire's portfolio to 0.03% is relatively small.

Not limited to Snowflake, Berkshire is a media group during the second quarter $Paramount Global-A (PARAA.US)$All 7.53 million shares held by were sold.

Also a retailer of hard flooring and related accessories $Floor & Decor (FND.US)$, major oil and gas companies $Chevron (CVX.US)$, the telecommunications giant's $T-Mobile US (TMUS.US)$etc. also reduced the number of shares held.

When viewed from the total market value of stocks bought and increased, Berkshire is in the second quarter $Occidental Petroleum (OXY.US)$Shares held byIncreased the most. 7.26 million shares were bought up, and the total market value reached 0.4 billion 58 million dollars. The number of shares heldUp nearly 70% from 4.3 million shares in the first quarterI did it. In June, which is the first month of the second quarter, Berkshire held a total of approximately 7.3 million shares of Occidental Petroleum in a nine-day transaction until 6/17, and purchased it at a price close to 60 dollars per share.

Major non-life insurance company that first disclosed in the previous quarter $Chubb Ltd (CB.US)$I bought more. Arbitrage transactions have been reported many times until now $Sirius XM (SIRI.US)$It also continued to increase the number of shares held.

After intense overselling, there was no change in Berkshire's major holdings. apple, $Bank of America (BAC.US)$、 $American Express (AXP.US)$、 $Coca-Cola (KO.US)$Chevrons still occupy the top 5 positions.

Berkshire's balance of US stock holdings was 279.9 billion69 million dollars at the end of the second quarter,$52.1 billion decrease from the end of the first quarter ($332 billion)I did it. BerkshireThe number of stock sales exceeded the number of purchases for 7 consecutive quartersIt's there.

ー MooMoo News Evelyn

Source: Nihon Keizai Shimbun, Berkshire Hathaway official website

This article uses automatic translation for some of its parts

Mr. Buffett suggested at the Berkshire general shareholders' meeting held in May that Apple's ownership ratio would be lowered for tax reasons. He pointed out that if the US government wants to fill in the widening budget deficit and raise capital gains taxes, this year's “small sale of Apple” will benefit Berkshire shareholders in the long run.

Meanwhile, cosmetics retail stocks have plummeted this year $Ulta Beauty (ULTA.US)$を0.69 million new shares were acquiredI made that clear. In the second quarter, Alta Beauty shares held by Berkshire had a market value equivalent to 0.2 billion66 million dollars. The company's stock price is on the 14th10% or more increase from the closing price on the same day due to overtime tradingI did it.

Alta Beauty's unique market position, which spans popular cosmetics and luxury brands, may also be one of the reasons why Mr. Buffett is bullish. DA Davidson analyst Michael Baker points out that the reason Alta's stock price is under pressure is partly due to new competitiveness with rival Sephora. In the luxury cosmetics category, Alta Beauty's market share is being squeezed, and although the company's market share momentum is weakening, it is still growing in the popular cosmetics category.

Aerospace and electronics companies $Heico (HEI.US)$It was also newly acquired.

Furthermore, Berkshire held a total of 6.12 million shares in US cloud computing companies at the end of the first quarter $Snowflake (SNOW.US)$Shares held byFull saleI did it. It is the second sale after Apple in the second quarter, but the ratio of Berkshire's portfolio to 0.03% is relatively small.

Not limited to Snowflake, Berkshire is a media group during the second quarter $Paramount Global-A (PARAA.US)$All 7.53 million shares held by were sold.

Also a retailer of hard flooring and related accessories $Floor & Decor (FND.US)$, major oil and gas companies $Chevron (CVX.US)$, the telecommunications giant's $T-Mobile US (TMUS.US)$etc. also reduced the number of shares held.

When viewed from the total market value of stocks bought and increased, Berkshire is in the second quarter $Occidental Petroleum (OXY.US)$Shares held byIncreased the most. 7.26 million shares were bought up, and the total market value reached 0.4 billion 58 million dollars. The number of shares heldUp nearly 70% from 4.3 million shares in the first quarterI did it. In June, which is the first month of the second quarter, Berkshire held a total of approximately 7.3 million shares of Occidental Petroleum in a nine-day transaction until 6/17, and purchased it at a price close to 60 dollars per share.

Major non-life insurance company that first disclosed in the previous quarter $Chubb Ltd (CB.US)$I bought more. Arbitrage transactions have been reported many times until now $Sirius XM (SIRI.US)$It also continued to increase the number of shares held.

After intense overselling, there was no change in Berkshire's major holdings. apple, $Bank of America (BAC.US)$、 $American Express (AXP.US)$、 $Coca-Cola (KO.US)$Chevrons still occupy the top 5 positions.

Berkshire's balance of US stock holdings was 279.9 billion69 million dollars at the end of the second quarter,$52.1 billion decrease from the end of the first quarter ($332 billion)I did it. BerkshireThe number of stock sales exceeded the number of purchases for 7 consecutive quartersIt's there.

ー MooMoo News Evelyn

Source: Nihon Keizai Shimbun, Berkshire Hathaway official website

This article uses automatic translation for some of its parts

![[13F] Mr. Buffett, the god of investment,'s secret portfolio revealed?! Apple stock holdings were cut in half and new cosmetics retail stocks were acquired](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240815/1723720290422-1508a17b53.png/big?area=105&is_public=true)

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

ありがとう星 : Even if the number of shares held by Apple is reduced (halved), the ratio is the highest

KAZU SUN : $280 billion is...

already, if you get this far, it won't matter if you lose 100 million a day lol

S0LTY KAZU SUN : Because if it's -1% it means 2.8 billion (US dollars)

Isn't about 1 billion yen moving in 5 minutes

Shin Miko : Does selling all of the snowflakes mean there's no investment advantage?

しゅうちゃん_Rm : Buffett doesn't think of him as a god.

This is because I almost always have a better return on my investment.

There are also unrealized gains from long-term holdings for which profit has not been determined, but even without that, my annual annual rate is definitely higher than Buffett's in terms of investment yield.

Naturally, the amount under management is extremely different, so the return on investment does not come true.

However, including capital gains and income gains, long-term double compound interest dividend yields with various investment methods, investment yields (before profit determination), unrealized gains from capital gains during long-term holdings with growth expectations, high yields and yields on investment amounts that raised fund turnover due to short- to medium- to short-term swing trades over a period of one year, and comprehensively determined profits over one year have raised yields of more than double Buffett's yield I don't think Buffett is the god of investment.

Also, investment in innovation stocks has now already started with senior gold mining stocks, and junior gold mining stocks, which are making profits that rise slightly later, due to the freezing of US dollar funds to Russia due to Biden's mistake, led to a dollar collapse crisis or hegemony dispute as a key currency from leaving the dollar due to a boomerang return called the collapse of the dollar, leading to a dollar collapse crisis or hegemony dispute as a key currency, and gold holdings have increased the gold portfolio from the early stage of the rise in gold prices due to gold holdings.

There are 7 types of gold investment methods, but in addition to spot holdings, senior gold mining stocks were mainly bought and increased in the early stages as gold ETFs and gold mine stock investments. Since around April of this year, the rise in gold prices will have an impact on the company's profit margins, and investment in 8 surplus junior gold mining stocks and low-ranking gold mining stock ETFs that would perform about 6 times that of senior gold mining stocks has increased.

Also, like Buffett and many institutional investors, they have increased their portfolio of investments in short-term US bonds with good yields before US interest rate cuts.

As a premium ticket, they increased their holdings of US bonds because they could aim for capital gains due to high yields when interest rates were determined and interest rates were cut.

While it is said that it is common in the US to incorporate US bonds from an inverse correlation with less risk than US stocks, less than 10% of Japanese individual investors hold US bonds, and it is said that they are unaware of investment opportunities before and after such US interest rate cuts.

Also, there are many people who incorporate cash into diversified investments or portfolios in the true sense of the word, predict when the overall market price crashes, hold 20 to 30 percent cash or funds with high liquidity, and are unaware of the opportunity to prepare excellent stocks at bargain prices during the crash.

The current major crash also began more than six months ago, and since August of this year to the end of the year, there will be a major crash starting with the United States or China, so while purchasing US stocks, profits have been determined and the cash holding ratio and amount of cash have increased.

Buffett can prepare for these because he has a source of information, and he has produced enormous wealth by turning the losses of many individual investors into opportunities.

From such profits, and into innovative companies, institutional investors famous for investing large amounts of money in companies that benefit from the 3rd energy-related petroleum revolution due to increased demand for electricity, companies that cause an AI medical revolution due to drug discovery due to the AI revolution, shortening DNA analysis time with genomics, and destructive cost reductions, and TaaS related companies, etc. are making huge investments.

Individual investors have no choice but to benefit by scrutinizing information and investing in small amounts within the risk tolerance range before it becomes a topic of conversation.

If such investment destinations achieve rapid growth over the time of the internet revolution, I think that is when institutional investors such as Buffett will make huge profits through upfront investments, and yield performance will not come true.

However, not because he has foresight, but because he has sources of information and guides, so I don't think Buffett is a god.

However, it must be acknowledged that the wealthy class with enormous wealth, leveraging financial power with overwhelming funds, will increase assets and widen as long as diversified investments and risk management are carried out, but rather than Buffett's ability, in an investment world where funds produce assets because of amazing financial power, it is the financial power of those who have money, and it is difficult to understand why Buffett is revered as the god of investment.

There are people who are more visionary among the wealthy institutional investors, and isn't Elon Musk one of them?

I don't want to imitate Buffett's stock.

If the timing of buying and selling are different, the results are different, which does not mean it is good to imitate them.

However, not limited to Buffett, there is an impact on stock prices due to institutional investors or the movement of the top 10, which is the main shareholder of the stock, and they are aware if they hold the same stock.

It's hard to understand why they are taking only Buffett brands.