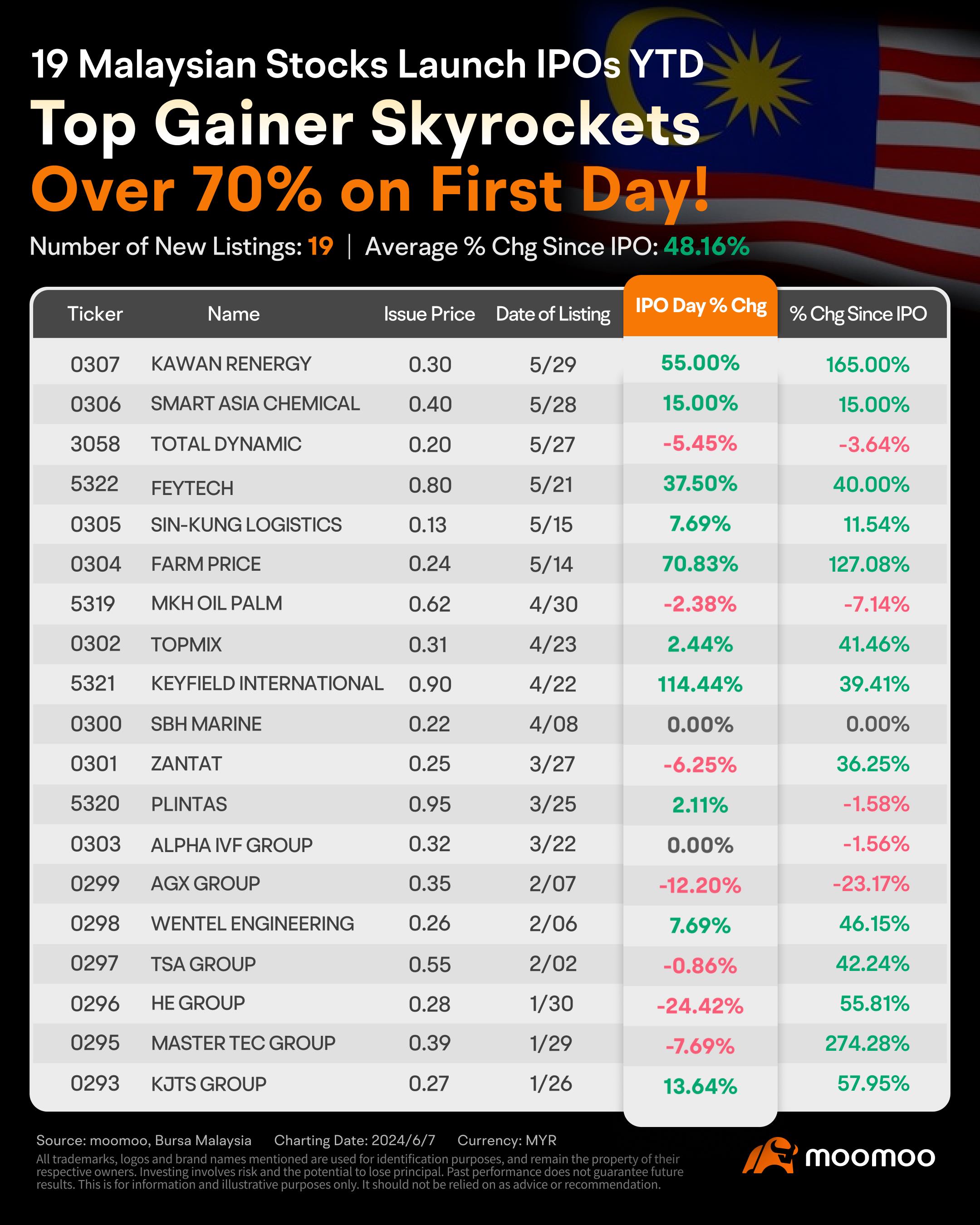

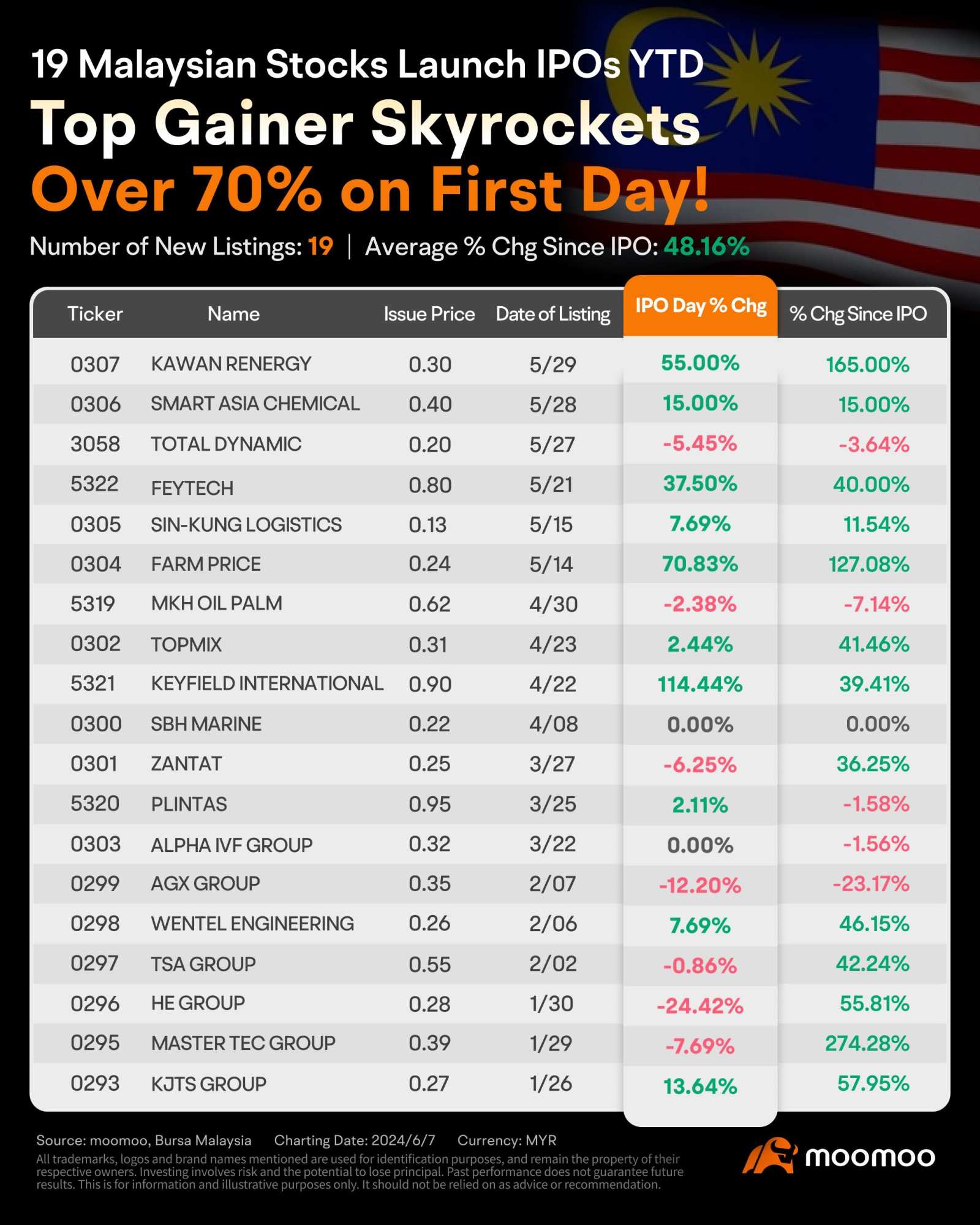

19 Malaysian Stocks Launch IPOs in 2024 YTD, Top Gainer Skyrockets Over 70% on First Day!

The Malaysian IPO market has been particularly vibrant since the beginning of 2024, with 19 companies having gone public by June 10th, spanning healthcare, agriculture, and technology. On their IPO day, these companies have enjoyed an average initial surge of 8.75%, with six of them experiencing an increase of over 10%.

Notably, three companies have seen their share prices soar by more than 50% on their debut on ACE Market, specifically Keyfield International at 114.44%, Kawan Renergy at 55.00% and Farm Price at a remarkable 70.83%.

More information can be found in the IPO Center, Please upgrade the app to the latest version for the best experience!

Kawan Renergy: A Surge Exceeding 50% During Its Debut

Kawan Renergy Bhd, a provider of engineering solutions, launched its IPO and listed on the ACE Market of Bursa Malaysia on 29 May. Its share price ascended by 55% on the IPO day. The company's offerings are extensively utilized in industries such as food processing, oleochemicals and chemical processing, oil and gas, waste recovery, power plants, and utilities.

Managing director Ir. Lim Thou Lai stated that these investments enable a more diversified income base that includes recurring income. Of the funds of MYR 33 million raised through the IPO, RM15 million or 45.5% will be allocated for working capital to give the group the financial flexibility to undertake more cogeneration plant projects. Additionally, RM7.5 million or 22.7% will be allocated for the investment of a new 2MW power plant and output improvements for the Bercham plant.

Lim said the strong response to its IPO reflected the capital market's trust in Kawan Renergy's capabilities and expansion strategy. "We are well-positioned to capitalise on opportunities in the industrial process equipment industry, spurred by increasing demand for higher renewable energy and co-generation plants to enhance energy efficiency."

Lim expressed optimism for the current year, anticipating a minimum double-digit growth or revenues surpassing RM100 million. He acknowledged the difficulty in making precise predictions due to the volatility of the business, yet he affirmed the group's confidence in meeting its earnings goals.

Farm Price Holdings: Soars Over 70% on ACE Market Debut

Starting as a Johor-based enterprise, Farm Price Holdings Bhd, a vegetable wholesaler and distributor, became Malaysia's first publicly-listed fresh produce distributor when it debuted on the ACE Market of Bursa Malaysia on May 14, experiencing a 71% surge in share price on the first day of trading.

Farm Price not only engages in the wholesale and distribution of fresh vegetables but also operates a retail store in Kulai, Johor, directly selling fresh vegetables, food and beverage products, and other groceries to end consumers. The company has regional distribution centers in the northern, central, and southern regions of Peninsular Malaysia and operates a centralized distribution center in Johor, serving both Malaysian and Singaporean markets.

Farm Price Managing Director Dr. Lawrence Tiong highlighted Farm Price's recognition of the substantial growth potential in the fresh vegetables sector. He also emphasized the company’s distinctive status as the first publicly-listed entity in the sector, providing it with leverage to capture a larger market share. He pointed that the company is poised for double-digit growth in revenue and profit for FY2024.

Tiong also noted that margin and sales are expected to improve thanks to rising demand from Singapore, where the company plans to set up a base for sales and marketing as part of its expansion plan.

The outlook for the Malaysian IPO market in 2024

Bursa Malaysia has indicated that the 2024 forecast for IPOs is set to meet a major KPI with an expected 42 IPO stocks listing across its Main Market, ACE Market, and LEAP Market, aiming for a total IPO market capitalization of MYR 13 billion.

Muhd Farrish Ishak, the Vice President of IPO Marketing at Bursa Malaysia, has voiced that the momentum is anticipated to intensify in the second quarter of the year. In fact, the number of IPOs so far in 2024 has already surpassed half of the previous record year of 2022.

Kenneth Leong, the Research Head at Apex Securities Bhd, has observed that the overall valuation for IPOs in 2024 is likely to stay inline with the levels seen in 2023. Nonetheless, there is a possibility for improved valuations if the Malaysian Ringgit strengthens and if Bursa Malaysia continues to see a sustained inflow of foreign funds to bolster the market.

Malaysia has recorded net foreign equity inflows exceeding RM1 billion in May 2024, making it the only ASEAN country in the month to achieve this milestone. Concurrently, the Malaysian Ringgit strengthened by 1.3% in May.

Mooers, are you optimistic about the prospects of Malaysia's IPO market? Please share your views~

Source: moomoo, bursa Malaysia, The Edge Malaysia

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Muhammad M A : Bursa IPOs have given me fantastic return since 2022. Be cautious and selective and IPOs will reward you handsomely. looking forward for the rest of 2024 IPOs and beyond with Moomoo.

freeNeasy : Looking forward to Moomoo MY's IPO subscription feature![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

AizatSaleh : Upcoming

- JPG $JPG (5323.MY)$

- OFS $OFB (0312.MY)$

- GOHUB $GOHUB (0311.MY)$

- UUE $UUE (0310.MY)$

- AGRICOR $AGRICOR (0309.MY)$

- KTI $KTI (0308.MY)$

Listed

- $KENERGY (0307.MY)$

- $SMART (0306.MY)$

- $DYNAMIC (03058.MY)$

- $FEYTECH (5322.MY)$

- $SINKUNG (0305.MY)$

- $FPHB (0304.MY)$

- $MKHOP (5319.MY)$

- $TOPMIX (0302.MY)$

- $KEYFIELD (5321.MY)$

- $SBH (0300.MY)$

- $ZANTAT (0301.MY)$

- $PLINTAS (5320.MY)$

- $ALPHA (0303.MY)$

- $AGX (0299.MY)$

- $WENTEL (0298.MY)$

- $TSA (0297.MY)$

- $HEGROUP (0296.MY)$

- $MTEC (0295.MY)$

- $KJTS (0293.MY)$

101550592 :

safri_moomoor : market Outlook Malaysia 2024

102188459 : Tq

104423482 : GOOD MORNING

XJJX : Can Moomoo buy an IPO?

70696867 XJJX : May can ask Cs for support

Moomoo Buddy XJJX : Dear client, which market are you referring? If you want to participate in Malaysia IPO subscriptions, you will need to open a CDS Account-IPO. If you have any questions, please feel free to contact us via MooMoo-Me-Customer Service-Online Inquiry or hotline (+60) 03 9212 0708 Thank you for your support! Have a nice day!

View more comments...