Record highs for S&P and Nasdaq: Is the "Santa Rally" on its way?

Record highs for S&P and Nasdaq: Is the "Santa Rally" on its way?

Views 203K

Contents 122

2024 Market Recap: Bitcoin's Surge, Tech Rally, Commodity Shifts

The year 2024 was transformative and challenging for the global economy and financial markets. From shifts in macroeconomic policies to technological revolutions and geopolitical uncertainties, assets across the board demonstrated unique performance trajectories.

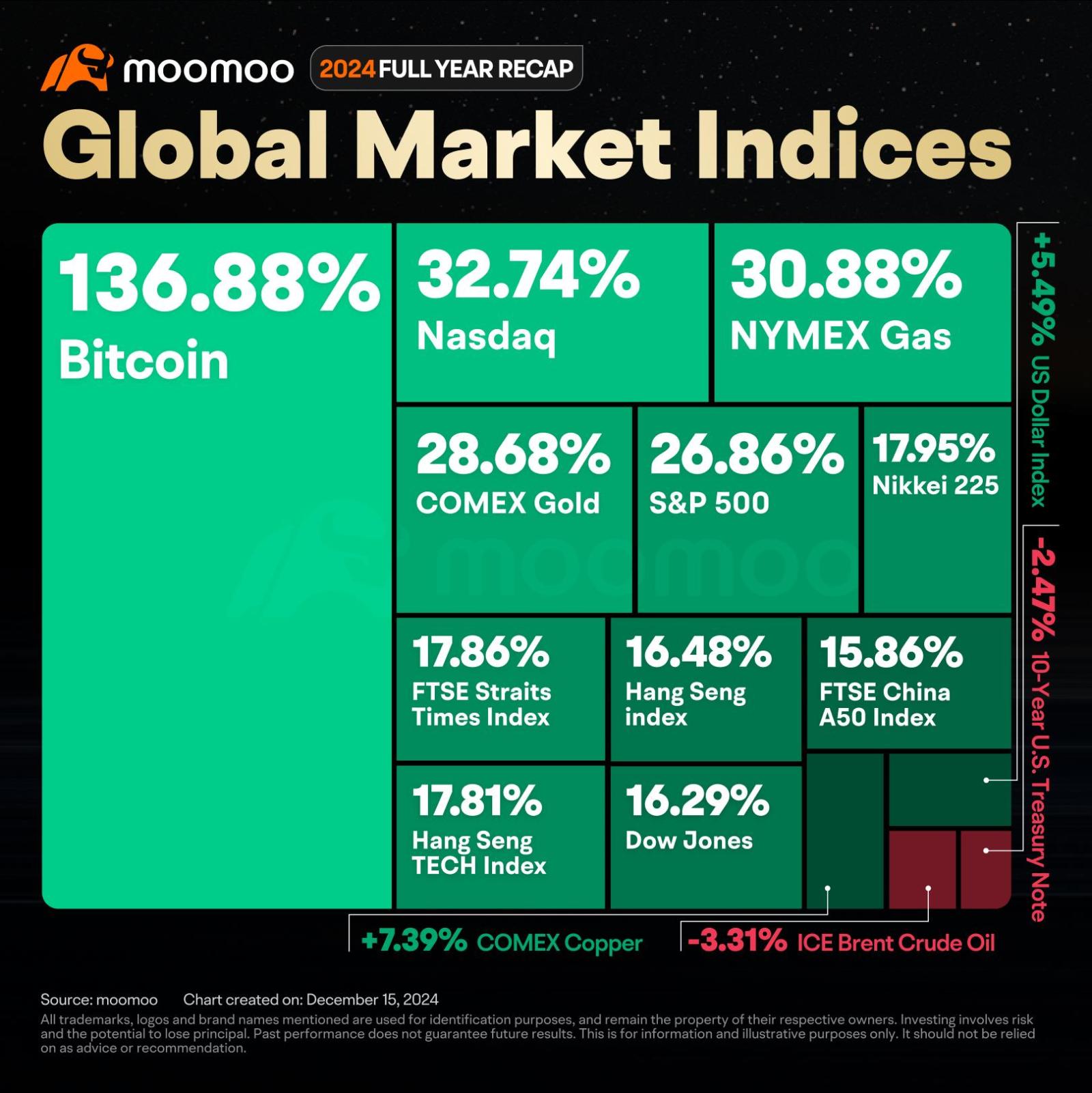

The market index performance chart provided by Moomoo highlights profound market differentiation and evolving trends in global capital markets.

Bitcoin's 136% Surge: What Are the Drivers?

Bitcoin, with an annual surge of 136.88%, stood out as the top-performing asset, reaffirming its appeal as digital gold. This staggering growth was driven by multiple factors. Analysts from JPMorgan attributed the rise to a significant increase in institutional investment in Bitcoin globally, spurred by its inflation-hedging properties and growing acceptance within mainstream financial markets.

The approval of multiple Bitcoin ETFs in the United States lowered investment barriers and significantly enhanced liquidity. Simultaneously, technological upgrades to the Lightning Network and broader adoption in payment scenarios attracted more long-term investors.

Moreover, Donald Trump's successful re-election as U.S. President in 2024 was seen as a key driver of Bitcoin's rally. Markets expect the Trump administration's regulatory stance on cryptocurrencies to be lenient, fostering further growth.

Analysts at Deutsche Bank suggested Trump’s policies might include reducing tax burdens on cryptocurrency transactions and promoting compatibility between the U.S. dollar and Bitcoin in international trade, thereby enhancing Bitcoin's global appeal.

Looking ahead, whether Bitcoin can sustain its current momentum remains a key focus for the market. Citigroup analysts believe Bitcoin might face heightened regulatory scrutiny in 2025, potentially testing market patience and confidence. However, they also noted that if sovereign currencies continue to depreciate amidst mounting inflationary pressures in major economies, Bitcoin’s appeal as a hedge could strengthen.

U.S. EquitiesSoar: Tech Stocks Take Center Stage

U.S. equities performed remarkably well in 2024, with the Nasdaq rising 32.74% and the S&P 500 gaining 26.86%. Goldman Sachs' chief strategist attributed this rally to the robust resurgence of tech stocks.

The commercialization of generative AI fueled exponential revenue growth for technology companies, with industry leaders such as Nvidia and Microsoft achieving record highs. Despite inflationary pressures earlier in the year, the Federal Reserve's dovish stance in mid-year provided ample liquidity support for the stock market.

Furthermore, U.S. companies returned significant capital to shareholders through stock buybacks and dividends, driving stock prices higher.

Asia-Pacific Markets Struggle to Keep Pace

Asia-Pacific markets underperformed U.S. equities overall. The Hang Seng Index rose by 16.48%, while the FTSE China A50 Index gained 15.86%. The market went through big ups and downs this year. By the end of September, it started to recover thanks to supportive policies and better access to funds.

In contrast, Japan's ultra-loose monetary policy supported a 17.95% increase in the Nikkei 225 Index.

Gold Shines, Oil Stumbles: Commodity Market Divergence

The commodities market displayed mixed performance. Gold, with a 28.68% gain, emerged as the preferred safe-haven asset. UBS reported that inflows into gold ETFs reached a three-year high, driven by geopolitical complexities and a weaker U.S. dollar. Natural gas prices rebounded strongly in 2024, rising 30.88%, largely due to global cold waves and supply chain disruptions.

In contrast, the crude oil market faced headwinds, declining by 3.31% for the year. Analysts at Morgan Stanley attributed this to the faster-than-expected energy transition to renewables, which suppressed crude oil prices.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more 6

6![]() 1

1