Which of the top 20 star ETFs in the U.S. stock market is suitable for beginners in the U.S. stock market in 2024?

ETFs in the US stock market have matured and offer a wide range of products, including index-based ETFs, industry sector ETFs, emerging market ETFs, commodity ETFs, bond ETFs, real estate ETFs, and even leveraged and hedge ETFs. These ETFs can be traded with small amounts of capital during trading hours. Now, the ETF portfolios in the US stock market are highly diversified and can cover most of the hot money flows in the market. Therefore, even retail investors with relatively small capital can capture fund flows through ETFs, or position themselves in specific growth or defensive sectors, in order to keep up with the upward trend or adopt risk-avoidance strategies.

What is an ETF?

ETF stands for "Exchange-traded Funds". Investors can buy and sell ETFs during trading hours on various US stock brokerage and banking platforms by entering the corresponding stock codes. The transaction fees, taxes, and other costs are the same as those for individual stocks. ETFs are also known as "on-exchange funds".

Why do individual investors choose to invest in ETFs?

When individual investors choose to invest in ETFs or individual stocks, they face decisions involving multiple considerations. These two investment methods each have their own advantages and disadvantages, suitable for different investment strategies and risk tolerances.

ETFs usually track an index or a basket of stocks, so investing in an ETF is equivalent to indirectly investing in multiple companies. This significantly diversifies the risk of individual stocks. If one component stock performs poorly, its impact would be offset by the performance of other component stocks. Investing in individual stocks, on the other hand, means that investors concentrate all the risk in one company. If that company performs poorly, investors may incur significant losses.

ETF management fees are generally lower compared to actively managed funds, as most ETFs are passively managed, with lower costs in tracking market indexes. Furthermore, investing in ETFs does not require the time and cost for research and stock selection. Directly investing in individual stocks incurs no management fees, but investors need to put in time and effort for research and analysis. Additionally, frequent trading of individual stocks may result in higher transaction costs.

ETFs are suitable for long-term investment and overall market participation, especially when investors are bullish on the entire market or a specific industry. ETFs help investors achieve the average market returns through index investing, without worrying about individual stock fluctuations. Investing in individual stocks is suitable for investors who have the ability to identify potential quality stocks and are willing to take higher risks. Through individual stock investments, it is possible to achieve returns that far exceed the market average, but it may also come with significant risks.

Taking all the above points into consideration, both investing in ETFs and individual stocks have their advantages, but for individual retail investors, ETFs offer significant benefits including risk diversification, low costs, high transparency, flexible trading, and time savings. ETFs are particularly suitable for investors who want to participate in the market in a simple and efficient way, enjoy long-term growth, and are not willing to take on the specific risks of individual stocks.

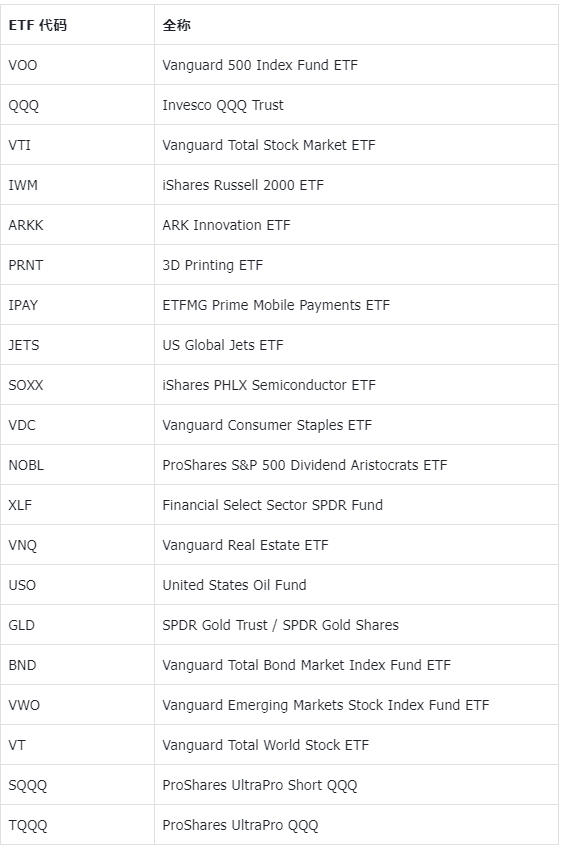

First, let's take a look at the list of the top 20 ETFs in the US stock market in 2024, and then we will introduce each of them one by one.

ETF tracking the S&P 500 Index: VOO (Vanguard 500 Index Fund ETF)

VOO tracks the S&P 500 index, which represents 500 large companies in the United States and basically covers large companies in various industries in the United States. It can be said that it is one of the indexes that best represents the overall stock prices of American enterprises. VOO includes well-known tech giants like Apple and Microsoft, as well as major US companies in various industries like JPMorgan and Home Depot. Investors buying ETFs linked to the S&P 500 are essentially buying stocks of major companies in the United States.

ETF Code

VOO

Issuer.

Vanguard Equity Index Group

Total Management Fee

0.03%

Recent 3-Year Returns

+8.02%

One-year return.

+22.63%

Three-month return.

+4.28%

Besides VOO, there are other ETFs linked to the S&P 500, such as SPY, IVV, SPLG, which have differences in management fees and tracking error.

Comparison of VOO, SPY, IVV, SPLG

What are SPY, IVV, SPLG?

SPY is an ETF launched by State Street Global Advisors; while IVV is provided by iShares; and finally SPLG is provided by SPDR State Street Global Advisors. Similar to VOO, SPY and IVV also track the S&P 500 index, allowing investors to achieve similar investment returns to the S&P 500 index without having to purchase shares of all 500 companies.

Comparison of VOO, SPY, IVV, SPLG

VOO, SPY, IVV, SPLG basically have the same functionality, allowing investors to hold shares of 500 large U.S. companies by buying ETFs at once, but it is worth noting the fund operating costs of each ETF.

In the U.S. stock market, the 'expense ratio (net value)' usually refers to the expense ratio of funds or investment products, a term commonly found in both funds, especially mutual funds and ETFs. It represents the proportion of fund management and operating expenses to the total net assets of the fund, usually expressed as an annual percentage.

Assuming an ETF has annual operating expenses of $1 million, and its average net assets are $0.1 billion, then the fund's expense ratio is 1%.

If you are a cost-conscious investor, the low costs of VOO, IVV, and SPLG may be more attractive than SPY. Conversely, for active institutional investors, they may focus on the high liquidity of SPY for convenient high-frequency trading.

Tracking the Nasdaq 100 Index ETF: QQQ (Invesco QQQ Trust)

QQQ aims to track the Nasdaq 100 Index, which includes 100 large local and international non-financial companies listed on the Nasdaq in the U.S., primarily focusing on technology stocks, including several major U.S. tech giants collectively known as the 'FAANG.' Although the Nasdaq 100 Index has rapidly grown in the past, investors should still be aware of QQQ's tech-heavy nature, as it captures the rise of tech stocks while also having relatively weak diversification ability.

ETF Code

QQQ

Issuer.

Invesco

Total Management Fee

0.20%

Recent 3-Year Returns

Increase of 8.62%.

One-year return.

Increase of 32.47%.

Three-month return.

Increase of 1.93%.

追踪全美市埸指数ETF:VTI (Vanguard Total Stock Market ETF)

VTI综合全美国的企业表现,以追踪CRSP US Total Market Index为目标,指数包含全美国大、中、小型逾3,500间企业,好处是能够达到将风险高度分散至全美国企业的效果。不过VTI成也分散、败也分散,它只有约26%持股属科技版块,Tesla等科技股的急速升浪为VTI带来的升幅有限。

ETF Code

VTI

Issuer.

Vanguard

Total Management Fee

0.02%

Recent 3-Year Returns

+6.22%

One-year return.

+22.38%

Three-month return.

+3.99%

Tracking the iShares Russell 2000 ETF, which tracks the US small-cap market index: IWM (iShares Russell 2000 ETF)

In addition to traditional US stock indexes such as the S&P 500 and Nasdaq-100, investors can also pay attention to the Russell 2000 Index, which represents US small-cap companies. It is compiled based on the stocks of the 2000 smallest listed companies in the US, and mainly reflects the situation of US small and medium-sized enterprises. Small-cap stocks perform differently from large-cap stocks as the economic environment changes, for example, Russell 2000 outperformed the S&P 500 during the economic turmoil period from 1999 to 2014.

ETF Code

IWM

Issuer.

iShares

Total Management Fee

0.19%

Recent 3-Year Returns

-3.28%

One-year return.

+13.13%

Three-month return.

+1.70%

Innovative Sector ETF: ARKK (ARK Innovation ETF).

ARK Invest, led by Cathie Wood, focuses on revolutionary innovation as its main investment theme. ARKK can be considered a combination of several innovative sectors under ARK Invest: it includes the "Robotics and Automation" theme under ARKQ, the themes of Internet and Cloud Computing under ARKW, the themes of Gene Editing and Biotechnology under ARKG, and the theme of Fintech under ARKF. As an active investment fund, the issuer will adjust the fund's portfolio ratio based on market conditions. However, past performance does not guarantee future results, and as the assets under management of ARK ETFs increase, it will become more difficult for them to replicate last year's multiple-fold growth.

ETF Code

ark invest

Issuer.

ARK ETF Trust

Total Management Fee

0.75%

Recent 3-Year Returns

-28.64%

One-year return.

+21.16%

Three-month return.

-4.28%

Tracking the 3D Printing ETF: PRNT (3D Printing ETF)

PRNT is also an ETF under ARK Invest, but it is a passive fund aimed at tracking the Total 3D-Printing Index, which reflects the stock performance of 3D printing companies in various countries. With the development of 3D printing technology, its services have expanded to fields such as healthcare, aviation, and construction, in addition to custom consumer products. The top five stocks with the highest index weight are XONE, HPQ, RSW, STMN, and TRMB.

ETF Code

The printer

Issuer.

ARK ETF Trust

Total Management Fee

0.66%

Recent 3-Year Returns

-18.45%

One-year return.

-6.03%

Three-month return.

-5.78%

Tracking the electronic payment ETF: IPAY (ETFMG Prime Mobile Payments ETF)

IPAY is an ETF that aims to track the performance of the Prime Mobile Payments Index, which includes 45 stocks related to electronic, smart, and credit card payments. The top five weighted stocks are Square, Mastercard, PayPal, FIS, and Visa. Investors can capture the demand for online shopping and electronic payments during the epidemic, but this ETF's total management fee is relatively high for a passive fund, and the risk is similar to other ETFs concentrated in a single sector, with weaker risk diversification effects.

ETF Code

IPAY

Issuer.

ETFMG

Total Management Fee

0.75%

Recent 3-Year Returns

-12.23%.

One-year return.

+14.54%

Three-month return.

+6.06%

Tracking Aviation ETF: JETS (US Global Jets ETF)

Under the COVID-19 epidemic, global air passenger demand has decreased significantly, and airline stocks have plummeted from pre-pandemic highs. However, with the emergence of vaccines, the market trend of "speculating recovery" has also led to a rebound in airline stocks. JETS aims to track the U.S. Global Jets Index, reflecting the stock performance of aviation-related companies in the United States. The top three stocks in this index are Southwest Airlines, American Airlines, and Delta Air Lines. However, the performance of airline stocks is also affected by factors such as oil prices, high inflation, and the pace of global travel industry recovery. Investors should also pay attention to the associated volatility.

ETF Code

JETS

Issuer.

U.S. Global Investors

Total Management Fee

0.6%

Recent 3-Year Returns

-8.09%

One-year return.

+11.39%

Three-month return.

+7.55%

Track the global semiconductor ETF: SOXX (iShares PHLX Semiconductor ETF)

SOXX tracks the Philadelphia Semiconductor Index and primarily reflects the stock performance of the global semiconductor industry, including companies involved in the entire chip manufacturing supply chain such as Intel, NVIDIA, Qualcomm, and Taiwan Semiconductor. Its biggest selling point is its success in capturing the global "chip shortage" during the pandemic, following the surge in semiconductor stock prices. SOXX may be helpful for investors seeking to benefit from the chip shortage opportunity.

ETF Code

SOXX

Issuer.

iShares

Total Management Fee

0.35%

Recent 3-Year Returns

+16.06%

One-year return.

+56.96%

Three-month return.

+9.59%

Track the Vanguard Consumer Staples ETF: VDC (Vanguard Consumer Staples ETF)

Even during the pandemic, there is still a strong demand for consumer staples, and the stock prices of related ETFs have already surpassed pre-pandemic levels, showing relative strength in defense. VDC aims to track the MSCI US IMI Consumer Staples 25/50 Index, which includes multiple US beverage, food, and houseware companies, reflecting the performance of the US daily consumer goods sector. The management fee is also relatively reasonable. The top five companies in the index are: P&G, Coca-Cola, Walmart, Pepsi, and Costco.

ETF Code

VDC

Issuer.

Vanguard

Total Management Fee

0.10%

Recent 3-Year Returns

+5.98%

One-year return.

+2.87%

Three-month return.

+4.64%

Capital preservation and high-yield ETF: NOBL (ProShares S&P 500 Dividend Aristocrats ETF)

If investors aim to preserve capital, the dividend aristocrats within the S&P 500 may eliminate the hassle of stock selection for investors. NOBL aims to track the S&P 500 Dividend Aristocrats Index, which includes companies that have increased their dividends for at least 25 years. These companies are primarily large-cap, blue-chip, and highly liquid stocks, including 3M, Abbott Laboratories, Otis Worldwide, and more. Although NOBL's overall performance may be attractive to conservative investors, it may lag behind the market due to the exclusion of growth stocks with lower dividends.

ETF Code

NOBL

Issuer.

ProShares

Total Management Fee

0.35%

Recent 3-Year Returns

+4.55%

One-year return.

+6.09%

Three-month return.

+2.42%

Tracking financial sector ETF: XLF (Financial Select Sector SPDR Fund)

XLF tracks the S&P Financial Select Sector Index, with Berkshire Hathaway and JPMorgan Chase, the largest bank in the US, accounting for over 12% of its weight. The business scope of the index components includes insurance, investment banking, commercial banking, consumer finance, and other areas. Due to the concentration of XLF's components in the financial sector, interest rates and economic conditions have a significant impact on the performance of the index components. Investors should pay attention to changes in interest rates, the pace of US economic recovery, and the actions of the Federal Reserve in response to high inflation.

ETF Code

XLF

Issuer.

SPDR State Street Global Advisors

Total Management Fee

0.09%

Recent 3-Year Returns

+5.61%

One-year return.

+23.84%

Three-month return.

+4.54%

Track real estate ETF: VNQ (Vanguard Real Estate ETF)

In addition to buying corporate shares in the stock market, investors can also invest in real estate through real estate investment trusts (REITs) in the stock market. VNQ is one such ETF that tracks the MSCI US IMI/Real Estate 25-50 Index. It consists of several large, medium, and small REITs in the United States. Investors can indirectly invest in the entire American real estate market through VNQ, but the volatility of the local real estate market also directly affects the price of VNQ. For example, VNQ experienced a significant drop following the burst of the U.S. housing bubble in 2007.

ETF Code

VNQ

Issuer.

Vanguard

Total Management Fee

0.12%

Recent 3-Year Returns

-3.56%

One-year return.

-0.46%

Three-month return.

-4.36%

Track oil price ETF: USO (United States Oil Fund)

In April 2020, the price of WTI crude oil futures contracts dropped to negative, and USO listed on the US stock market tracks the spot price of oil through investing in WTI crude oil futures contracts on the New York Mercantile Exchange. The benefit of USO is that it allows investors to easily invest in oil-related assets in the US stock market, capturing the upward trend of oil price recovery after the pandemic. However, investors should be aware that the crude oil ETF involves trading futures contracts and carries the risk of price spreads when rolling over contracts. Therefore, in some cases, USO may not fully track the increase in oil price, and the long-term performance of holding USO has been disappointing.

ETF Code

USO

Issuer.

USCF Investments

Total Management Fee

0.70%

Recent 3-Year Returns

+22.01%

One-year return.

+16.59%

Three-month return.

+10.95%

Gold Price Tracking ETF: GLD (SPDR Gold Trust SPDR Gold Shares)

After the Federal Reserve's "Unlimited QE", the US money supply increased and market risk aversion increased. Gold has become a popular investment target in some markets. If investors are interested in investing in gold, they can buy gold ETFs through GLD during US stock trading hours. GLD is backed by physical gold spot, which is stored in trust banks. By buying GLD, investors indirectly own physical gold, avoiding the buy-sell spread issue of traditional gold transactions. However, there is also the same ETF (listed as 2840) in the Hong Kong stock market. Investors can choose where to purchase based on trading costs or tax factors.

ETF Code

GLD

Issuer.

SPDR State Street Global Advisors

Total Management Fee

0.40%

Recent 3-Year Returns

+8.85%

One-year return.

+15.90%

Three-month return.

+12.25%

Tracking Bond ETF: BND (Vanguard Total Bond Market Index Fund ETF)

In addition to investing in stocks, REITs, or commodities, investors can also invest in the bond market through bond ETFs. BND combines various investment-grade bonds in the United States, including government bonds, corporate bonds, and mortgage-backed securities (MBS), but excluding Treasury Inflation-Protected Securities (TIPS) and municipal bonds. BND has a low management fee of 0.04% and all the bonds held are rated BBB or higher by Standard & Poor's, with over 40% being U.S. government bonds and over 30% being BBB and A-rated bonds. Investing in bonds can provide stable returns and a certain degree of asset protection even during economic downturns, but investors should not expect bonds to generate high growth or substantial returns.

ETF Code

BND

Issuer.

Vanguard

Total Management Fee

0.03%

Recent 3-Year Returns

-3.49

One-year return.

-1.36%

Three-month return.

-2.93%

Track emerging markets ETF: VWO (Vanguard Emerging Markets Stock Index Fund ETF)

In the US stock market, investors are not limited to investing in the American financial economy, but can also invest in different emerging markets through ETFs. VWO aims to track the "FTSE Emerging Markets All Cap China A Inclusion Index", which includes 4,000 to 4,500 stocks from 24 emerging market countries, covering various emerging markets in Latin America, Europe, and Asia. The top five countries are China, Taiwan, India, Brazil, and South Africa, accounting for 80% of its weight. Investors should pay attention to whether the investment regions of various emerging market ETFs suit their preferences, and also be aware that these cross-market ETFs diversify risks and dilute returns.

ETF Code

VWO

Issuer.

Vanguard

Total Management Fee

0.08%

Recent 3-Year Returns

-3.95%

One-year return.

+9.34%

Three-month return.

+6.78%

Track global market ETF: VT: Vanguard Total World Stock ETF

In addition to diversifying investments across multiple emerging markets, investors can also diversify investments in companies around the world through global ETFs. VT aims to track the FTSE Global All Cap Index, which includes large, medium, and small-cap stocks (with a focus on large-cap), with management fees as low as 0.08%. It allows investors to invest in over 8,000 companies globally at the same time. Over 50% of VT holdings are US companies, followed by Japan, the UK, China, and others. The advantage of global ETFs is that investors don't have to worry about which market or stock to invest in, but since it invests in the overall global market, it naturally becomes difficult to outperform the market.

ETF Code

VT

Issuer.

Vanguard

Total Management Fee

0.10%

Recent 3-Year Returns

+3.91%

One-year return.

+16.78%

Three-month return.

+3.96%

Introduction to Leveraged and Hedged ETFs

What is a Leveraged ETF?

Leverage is a concept that allows you to increase the value of your position in the financial market without additional capital. In investing, the funds used to open and maintain leveraged trades are called margin, which is also known as margin trading.

What is a Hedged/Inverse ETF?

Inverse ETFs track related indexes, but their returns are inversely proportional to the index. If the index rises, the price of the inverse ETF falls; if the index falls, its price rises. The China Securities Regulatory Commission (CSRC) stipulates that such products cannot be called "ETFs," but rather leverage and inverse products (L&I products), which are traded in the same way as ordinary stocks and ETFs.

3x S&P Inverse ETF: SQQQ (ProShares UltraPro Short QQQ)

ETFs not only provide diversification across different markets, indexes, sectors, and commodities, but now they can also provide hedging or leverage effects. Among them, SQQQ is an ETF that represents "triple short" of the NASDAQ index. With the 7% single-day circuit breaker drop in the US stock market, SQQQ investors can gain a return of nearly 21% on that day. SQQQ allows larger investors to hedge their NQ positions with only one-third of their capital, protecting their assets. Although some risk-tolerant investors may use this to short the US market, it is not advisable for all investors to be overly speculative.

ETF Code

SQQQ

Issuer.

ProShares

Total Management Fee

0.95%

Recent 3-Year Returns

-38.23%

One-year return.

-55.87%

Three-month return.

-4.94%

3x S&P 500 Leveraged ETF: TQQQ (ProShares UltraPro QQQ)

What is TQQQ? In contrast to SQQQ, TQQQ aims for a three-fold return on a daily basis to the Nasdaq. That is, when the Nasdaq rises by 7%, TQQQ targets a rise of 21%. However, both situations require investors to be aware of the "oscillation loss" of leveraged products. When the market enters a horizontal market condition (i.e. most market conditions), the stock price will actually fall below the original price after rising by 21% and then falling by 21%. Therefore, neither of them should be used for long-term holdings and can only be used for short-term trading.

ETF Code

TQQQ

Issuer.

ProShares

Total Management Fee

0.20%

Recent 3-Year Returns

Increase of 8.62%.

One-year return.

Increase of 32.47%.

Three-month return.

Increase of 1.93%.

What are the differences between Hong Kong Stock ETF and US Stock ETF?

Now investors can use ETFs for investment in both the Hong Kong stock market and the US stock market. How should investors choose between Hong Kong Stock ETF and US Stock ETF? Below is a detailed comparison:

There are more types of US Stock ETFs.

There are over 2,000 ETF products for investors to choose from in the US stock market, while there are only over 200 in the Hong Kong stock market. Even within the same type of ETF in the US stock market, there are multiple choices, which means investors can choose from ETF products with better liquidity, lower management fees, and less tracking error within the same type of ETF products.

Management fees for US stock ETFs are generally lower.

Due to the competition among ETF issuers in the US stock market, reducing management fees has become one of the means for ETFs to attract investors. For example, the management fee for VOO, which tracks the S&P 500 index in the US stock market, is only 0.03%, but if you want to buy a similar ETF in the Hong Kong stock market, the management fee would be around 0.18%.

Trading volume for US stock ETFs is generally higher.

The trading activity in the US stock market is generally higher than in the Hong Kong stock market. Investors should be aware that low trading volume ETFs may make it difficult for funds to enter or exit the market quickly, and price fluctuations resulting from low trading volume may also expose investors to additional risks.

Comparison of trading platform fees is required as they differ.

Some trading platforms charge different transaction fees for Hong Kong and US stocks. If the desired ETF is listed on both the Hong Kong and US stock markets, investors should consider buying it in the market with lower transaction fees.

The dividend tax rate in the US is as high as 30%.

Some ETFs will distribute dividends to investors, but the tax rates on dividend income vary due to different international and US tax agreements. Investors should also consider other related expenses, and dividends should not be overly emphasized in the US stock market.

How to buy ETFs?

Investors can buy ETFs in the US stock market through major brokerages and banking platforms. Some platforms also offer commission-free and platform-free services.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment