5 Things to Know Before the Canadian Stock Market Opens Wednesday

Good morning mooers! Here are things you need to know about today's market:

●S&P/TSX 60 Index Standard Futures are trading at 1,323.70 ,down 0.05%.

●Canada's inflation rate deceleration raises odds of Bank of Canada rate cut in June

●Canada real estate: cottage market expected to bounce back in 2024, says Royal LepageL

●Oil eases from four-month high amid strengthening US dollar

●Sector to watch: TD Bank

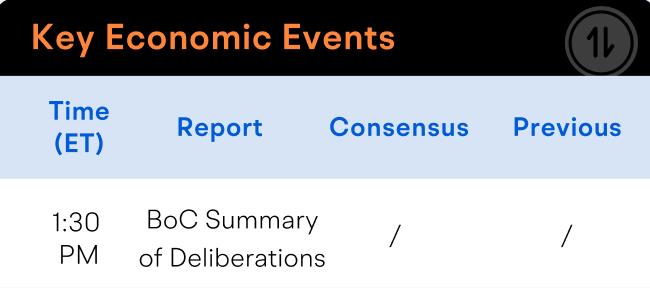

●Earnings Results & Economic Events: BoC Summary of Deliberations

Market Snapshot

Today, the Canadian dollar is trading at 73.55 cents US, a slight decrease from Tuesday.

The S&P/TSX 60 Index Standard Futures (SXF) are currently trading at 1,323.70, which is down 0.05% from the previous close.

Top Stories

Macro

Canada's Inflation Rate Deceleration Raises Odds of Bank of Canada Rate Cut in June

In February, Canada witnessed a deceleration in its inflation rate, signaling the possibility of an interest rate reduction by the Bank of Canada in the coming summer. Statistics Canada's data, disclosed on Tuesday, showed the consumer price index climbing 2.8 percent from the previous year, a slight decrease from January's 2.9 percent rise. Contrary to expectations of a 3.1 percent inflation uptick by economists, the slower inflation rate may clear the way for the central bank to consider trimming its overnight rate, according to economic experts.

Real Estate

Canada Real Estate: Cottage Market Expected to Bounce Back in 2024, Says Royal LePage

According to a fresh report from Royal LePage, the market for leisure properties in Canada is anticipated to experience a resurgence this year, with an average price growth of 5 percent expected in 2024.

Post a period of stabilization in demand subsequent to the heights achieved during the COVID-19 pandemic, Royal LePage forecasts that the median price for a single-family recreational home in Canada will climb by 5 percent, reaching $678,930 this year. This projection is derived from insights provided by the company's consortium of experts specializing in the recreational real estate sector, employing a weighted approach that considers regional sales data.

Commodities

Oil Eases From Four-month High Amid Strengthening US Dollar

Oil prices eased slightly on Wednesday, keeping above the $80 level and returning more than 5% gains in five trading days. The recent upside move comes amid increasing supply issues in Russia and the need to refill the US crude stockpile, swirling up demand. The most recent decline, meanwhile, can be attributed to a stronger US Dollar.

Stocks to Watch

TD Signs Deal With Indian Bank Hdfc To Attract Students Looking To Study In Canada

TD Bank Group has signed an agreement with an Indian bank in a bid to attract international students as new customers and make it easier for them to comply with visa requirements. As part of the Canada's requirements to apply for an expedited study permit, students are required to provide proof of financial support, which is accomplished with a guaranteed investment certificate.

Today's Economics Event

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

FARAMARZ AKBARY :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)