Meta stocks have risen 50% year to date! What will happen next to NVIDIA in “Mag7”?

The Magnificent Seven AI competition continues in 2024. However, when viewed from stock price performance, it appears that the gap between these tech giants is widening.

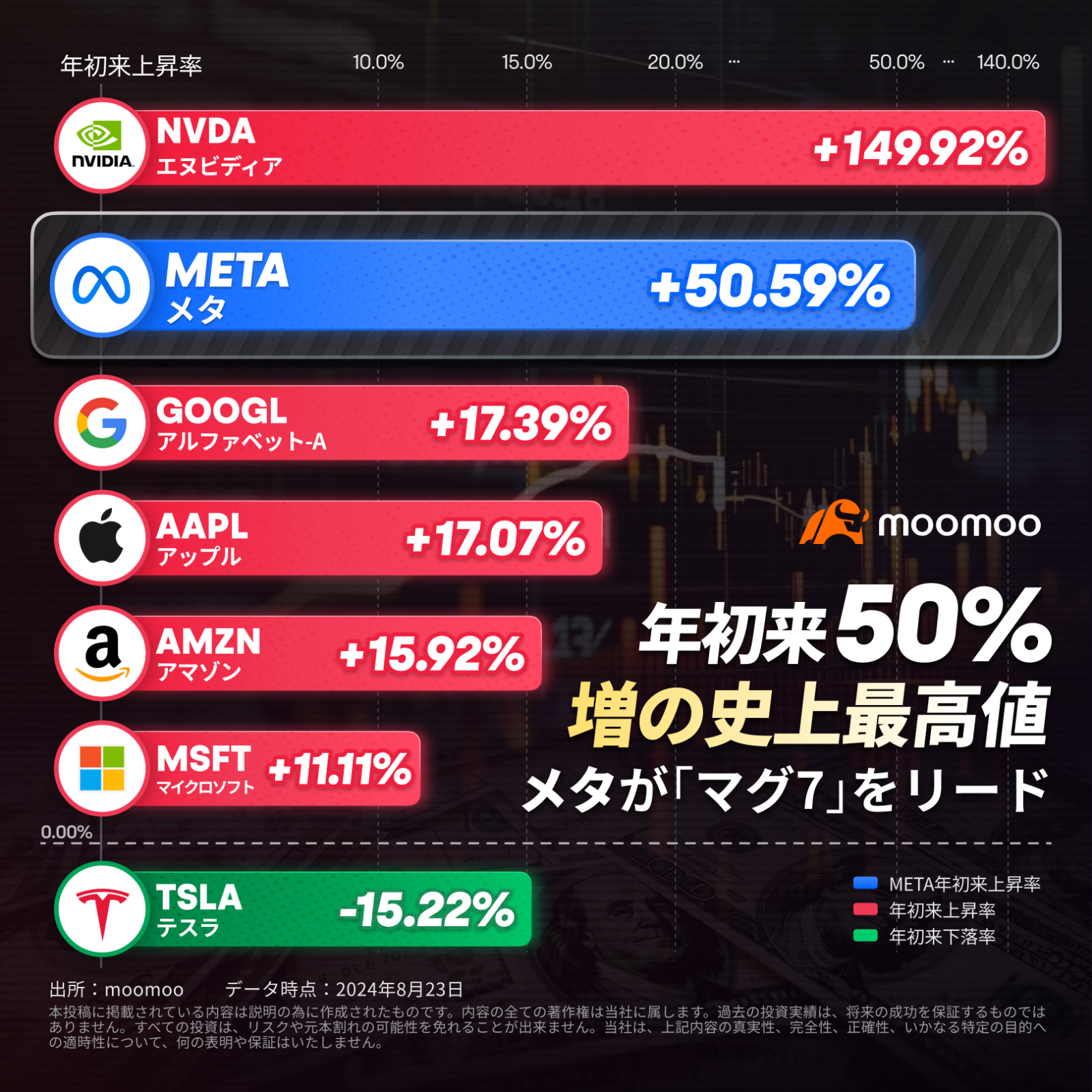

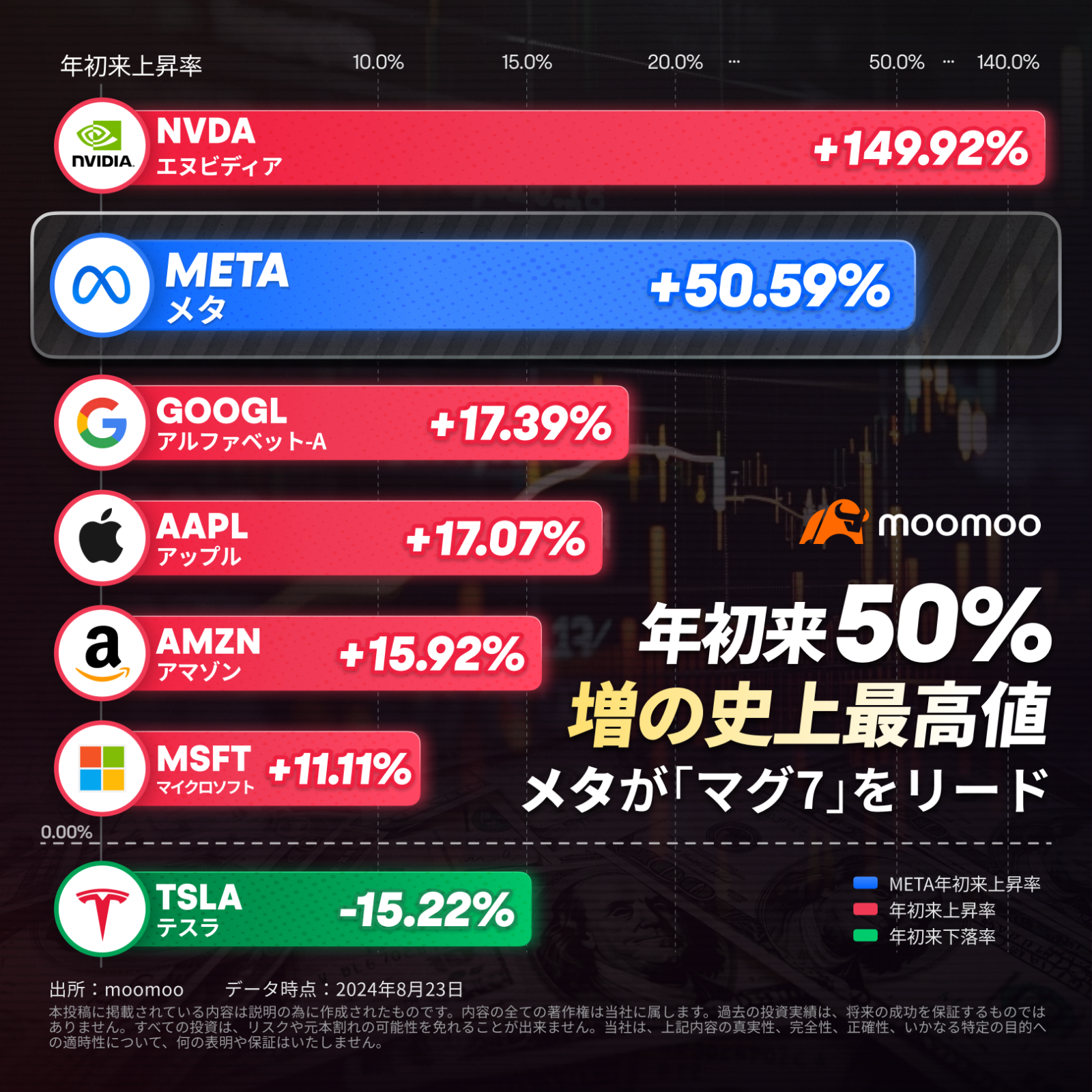

Looking at the year-to-date rate of increase, $Meta Platforms (META.US)$IsA rise of 50% or moreThey are doing it, and the chip giant's $NVIDIA (NVDA.US)$It falls short of the approximately 150% increase ofFar ahead of the other 5 tech giantsIt's there. This year, $Alphabet-A (GOOGL.US)$with $Apple (AAPL.US)$is 17% or more, $Amazon (AMZN.US)$is close to 16%, $Microsoft (MSFT.US)$has risen by more than 11%, $Tesla (TSLA.US)$has recorded a decline of 15% or more.

Looking at the year-to-date rate of increase, $Meta Platforms (META.US)$IsA rise of 50% or moreThey are doing it, and the chip giant's $NVIDIA (NVDA.US)$It falls short of the approximately 150% increase ofFar ahead of the other 5 tech giantsIt's there. This year, $Alphabet-A (GOOGL.US)$with $Apple (AAPL.US)$is 17% or more, $Amazon (AMZN.US)$is close to 16%, $Microsoft (MSFT.US)$has risen by more than 11%, $Tesla (TSLA.US)$has recorded a decline of 15% or more.

In this fiscal season, as concerns about returns due to huge AI investments are growing, investors are feeling impatient with high-tech companies that profit from large-scale AI investments.

Meta also unexpectedly raised the lower limit of capital investment for the full year due to AI investment, but total sales for the 2nd quarter and advertising revenue for the main business exceeded expectations by 20% or more, and for the 3rd quarterThe median sales guidance also exceeded expectationsAs a result, it has become easier for the market to believe in meta's “AI monetization” scenario.

Furthermore, since Meta only raised the lower limit of its capital investment forecast for the full year by 2 billion dollars, and left the upper limit unchanged,Investors' concerns about the disorderly expansion of capital investment have been mitigated to some extentIt was done.

Meta's Chief Executive Officer Zuckerberg (CEO) said in a telephone conferenceAI investment will provide a major boost to the company's advertising businessPerhaps, he stated that optimization of advertisement distribution using AI will not only improve advertisement effectiveness, but also raise the level of engagement and improve user experience by improving content recommendation engines.

Meta's investment in AI infrastructure is difficult to generate short-term returns, but ZuckerbergEarly layout is importantI think so.

Furthermore, Meta's recent good news continues.

Meta is at the Connect Conference to be held on September 25thThe first AR glasses were also shownIt seems (rumor has it that the code name is “Orion (Orion)”).

So far, with the successful commercial sale of TOC products, meta is gaining even more momentum.

According to Reuters, in the fourth quarter of 2023 alone, the number of Ray-Ban Meta shipments surpassed the number of first-generation products Ray-Ban Stories shipped throughout the entire life cycle, reaching 1 million.

This trend is expected to continue in 2024, and there is a possibility that the expected number of shipments for the full year will exceed 1.5 million, and currently the state of being sold out continues.

Apart from this, Meta announced Meta-external Agent and Meta-External Fetcher, which are new web crawlers for collecting internet data to train AI models. This allows unlimited access to data by circumventing the robots.txt rule.

Tigress Financial's target stock price for Meta PlatformsRaised from $575 to $645It maintained a “strong buy” rating. He stated that due to the increase in Meta's cash flow, it is possible to continue investing in artificial intelligence projects that lead to increased user engagement, better content, and more effective advertising experiences.

Bank of America sees Meta as an attractive company due to strong growth and AI opportunities, raised the target stock price from 550 dollars to 563 dollars and “bought” it, and evaluated Meta as one of the top AI companies.

Furthermore, investor demand for meta hedging is accompanied by a recovery in market sentiment,It quickly cooled down from historic panic levelsIt's out.

The number of put buyers dropped drastically, and Cole buyers began to returnThus, this change in preferences has led to a drastic decline in the put call skew index, which measures the difference in demand between puts and calls.

Source: moomoo

ー MooMoo News Evelyn

This article uses automatic translation for some of its parts

ー MooMoo News Evelyn

This article uses automatic translation for some of its parts

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment