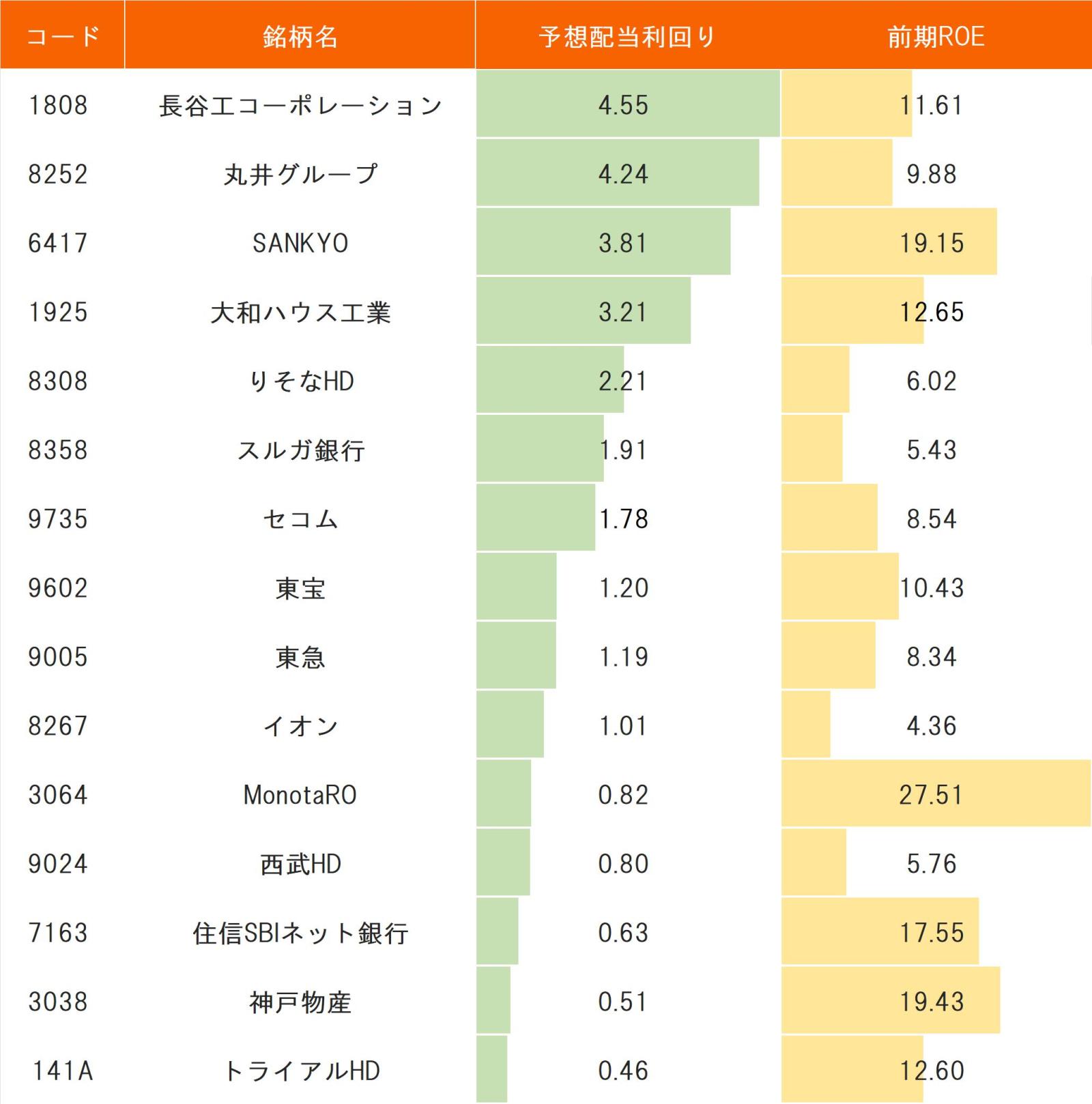

The Nikkei Stock Average showed a rapid recovery from the major crash on August 5, but after reaching a return high on September 2The market has been sluggish.It continues. In particular, the progress of yen appreciation is weighing on the overall market. Following Bank of Japan (BOJ) board member Junko Nakagawa's positive stance on policy normalization on September 11, the yen sharply appreciated to the mid-140 yen level against the US dollar.On the 13th, it temporarily rose to the upper 140 yen level and updated its year-to-date high.It was done.Narrowing of the interest rate differential between Japan and the United StatesIt is once again recognized that there are characteristics such as "defensive", "yen strength benefits and yen strength resistance" in sectors such as retail, transportation, information communications, pharmaceuticals, and electricity and gas, which are attention-grabbing."Defensive" and "yen strength benefits and yen strength resistance" are characteristics of sectors such as retail, transportation, information communications, pharmaceuticals, and electricity and gas, which are attention-grabbing.」「Sectors such as retail, transportation, information communications, pharmaceuticals, and electricity and gas have characteristics such as "defensive" and "yen strength benefits and yen strength resistance", which are attention-grabbing.Attention is focused on domestic demand stocks in sectors such as retail, transportation, information communications, pharmaceuticals, and electricity and gas, which have characteristics such as "defensive" and "yen strength benefits and yen strength resistance".Domestic demand stocks in sectors such as retail, transportation, information communications, pharmaceuticals, and electricity and gas are attracting attention.From September to November, attention is focused on events such as the monetary policy meetings of Japan and the US, the election of the leader of the Liberal Democratic Party, and the US presidential election.From September to November, there will be events such as the monetary policy meetings of Japan and the US, the election of the leader of the Liberal Democratic Party, and the US presidential election.Due to the continuation of large events, there is a possibility that the preference for defensive domestic stocks with few variables will continue for a while. Check domestic stocks with high domestic sales ratio (over 85%) that have significantly increased.