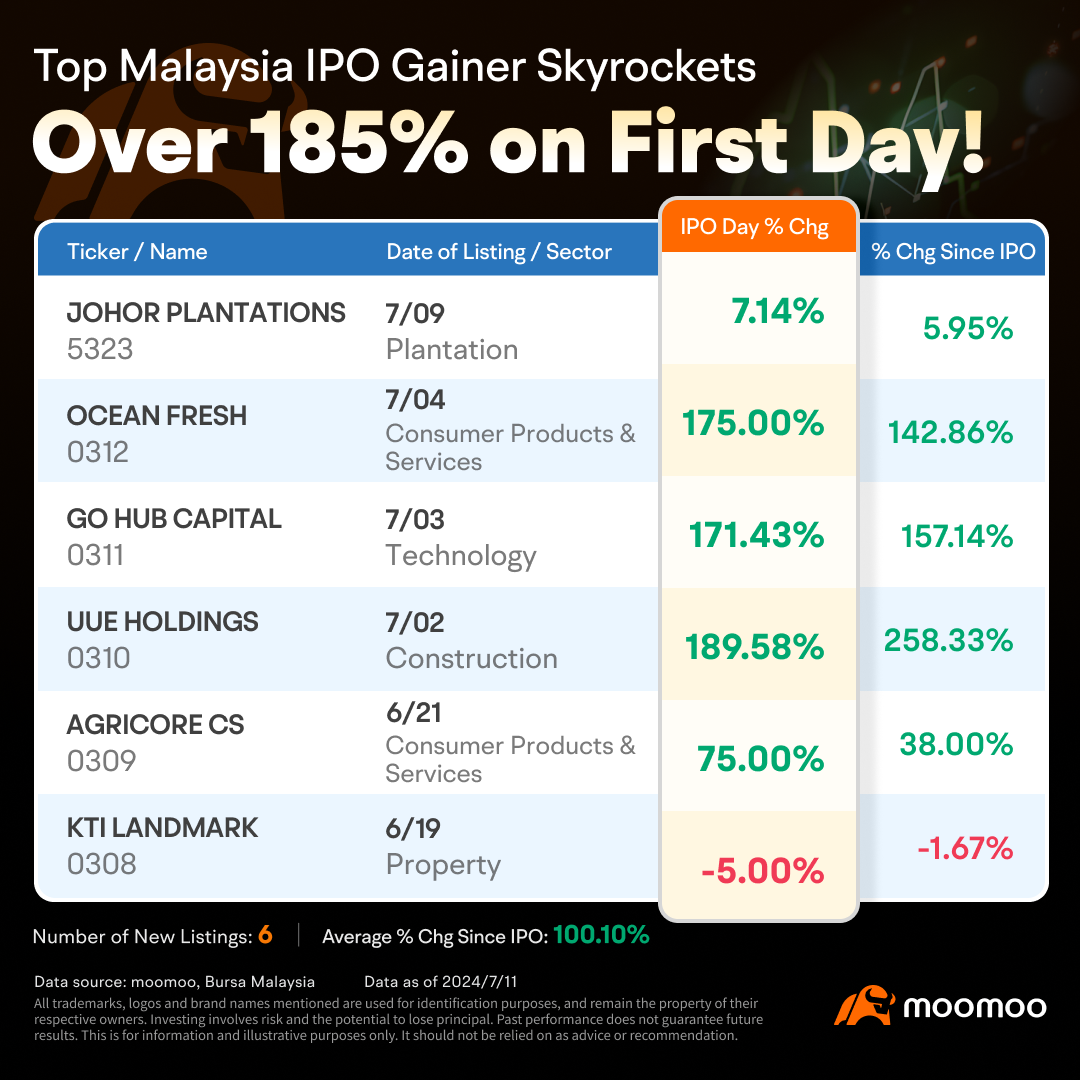

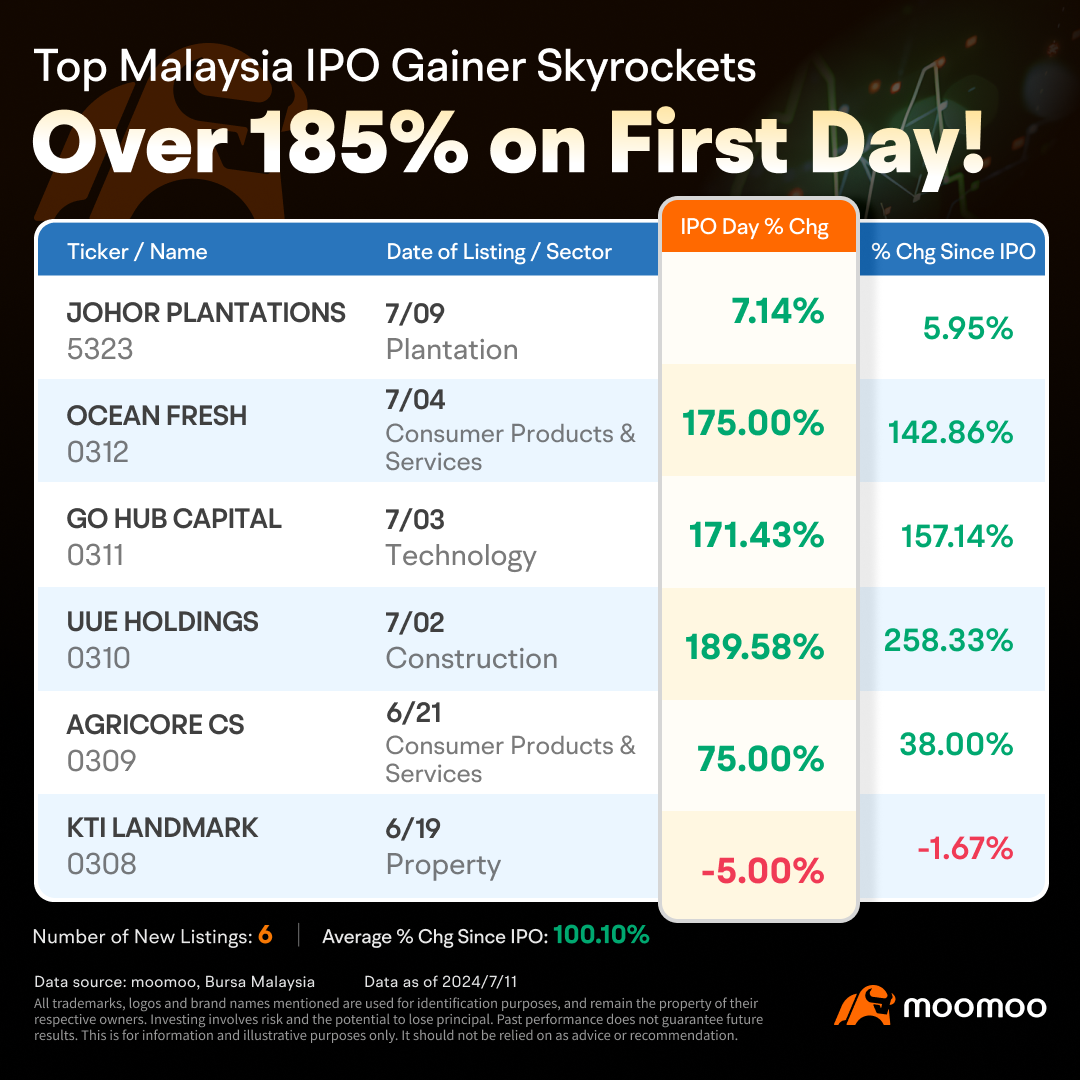

6 Malaysian Stocks Launch IPOs Since June 2024, Top Gainer Skyrockets Over 185% on First Day!

Deloitte reports that although the overall performance of Initial Public Offerings (IPOs) in Southeast Asia was lackluster in the first half of 2024, the Malaysian IPO market stood out.

According to Deloitte's "Southeast Asia IPO Market Review for the First Half of 2024," the Malaysia IPO capital market tops the Southeast Asia bourses in terms of total IPO funds raised. With new listings skewed towards smaller deal sizes, the Malaysian IPO performance continues to be underpinned by new listings on the ACE Market.

Since June 2024, the performance of the Malaysian IPO market has been noteworthy: The country has seen six companies go public, involving sectors including Plantation, Consumer Products & Services, Technology, Construction, and Property.

Out of these six companies, five recorded share increases on their IPO day, three of which saw gains exceeding 170%. These include OCEAN FRESH with a 175% jump, GO HUB CAPITAL with a 171.43% rise, and UUE HOLDINGS with an impressive surge of 189.58%.

Ocean Fresh, located in Pahang, is a frozen seafood processor and exporter, also providing processing services for clients in Malaysia, Turkey, China, Thailand, Vietnam, and Japan. The group made a strong debut on the ACE Market of the Malaysian Exchange, with its share price soaring by 175% on the first day of listing.

The group plans to utilize over half of its IPO proceeds, amounting to RM8 million, for capital expenditure on new cold storage facilities in Kuantan, Pahang, while an additional RM2.51 million will be allocated for working capital requirements. The remaining RM3.5 million is earmarked for estimated listing expenses. Executive Director Teoh Chee Han stated that the new cold storage facilities will enable the company to maintain higher inventory levels, increasing the existing cold room's maximum storage capacity from 1,700 tons to 4,700 tons.

In its first quarter (Q1) ended March 31, 2024, the company has recorded a net profit of RM2.5 million with its revenue stood at RM55.5 million. According to CGS-CIMB International, Ocean Fresh's revenue growth is attributed to higher selling prices, increased export income from key overseas markets, and the acquisition of new customers.

UUE Holdings made a strong showing on the ACE Market of Bursa Malaysia, opening with a 175% increase to 66 sen, and subsequently climbing to a peak of 70.5 sen, with a trading volume that soared to 212.32 million shares, making it the most active and highest-gaining stock on Bursa Malaysia.The big jump in share price makes UUE, whose core business is involved in underground utility engineering solutions, the best-performing IPO so far this year.

The IPO raised RM29.98 million, dedicated to the purchase of machinery and equipment to meet the needs of its ongoing projects as well as upcoming new projects.

Apex Securities Bhd, Mercury Securities Bhd, and TA Securities Holdings Bhd are all bullish on UUE, stating that the company's valuation is attractive with strong growth prospects, as it benefits from the rapid expansion in the utilities sector of the power and telecommunications industries.

Looking ahead, the group is planning various initiatives with the ambition to position itself as the preferred provider of underground utility engineering solutions in Malaysia and Singapore. If successful, the group might join the ranks of large corporations like Telekom Malaysia Bhd, which has previously been involved in the deployment and maintenance of the country's submarine 5G cables.

In a previous article, we systematically reviewed the performance of the Malaysian IPO market up before June 2024, with the most eye-catching being $KEYFIELD (5321.MY)$, which saw its share price soar by 114.44% on its IPO day. The other two companies have also seen their share prices soar by more than 50% on their debut on ACE Market, with $KENERGY (0307.MY)$ at 55.00% and $FPHB (0304.MY)$ at a remarkable 70.83%.

Here is the performance of the Malaysian IPO-listed companies prior to June 2024.

The outlook for the Malaysian IPO market in 2024

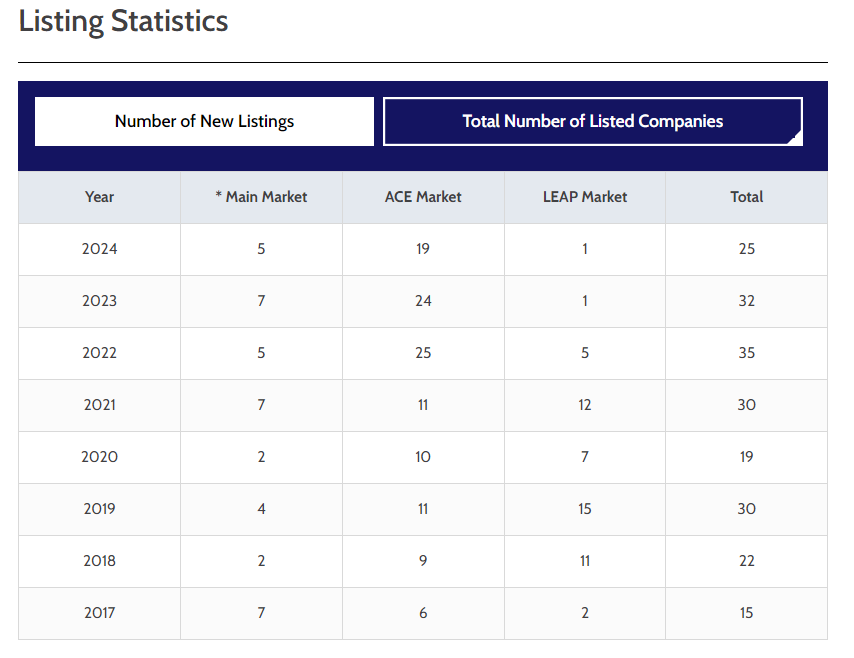

Bursa Malaysia Bhd is cautiously optimistic that it will be able to achieve the goal of 42 initial public offerings in 2024 with the pace picking up in the second quarter of the year, said its vice-president of IPO marketing, Muhd Farrish Ishak.

Bursa Malaysia has indicated that the 2024 forecast for IPOs is set to meet a major KPI with an expected 42 IPO stocks listing across its Main Market, ACE Market, and LEAP Market, aiming for a total IPO market capitalization of MYR 13 billion.

In fact, the number of IPOs up to 2024 has already surpassed 70% of the previous record year set in 2022.

Udhay Furtado, Citigroup's head of Asia, North Australia and Asia South ECM (Equity Capital Markets) origination and solutions, noted the recent lack of large listings in the Malaysian IPO market. The biggest listing deal in the past five years was Mr DIY Holdings Bhd, which raised RM1.5 billion in 2020. However, he anticipates this trend to change in the next 12 to 18 months.

"In the next 12 to 18 months, we should start to see [bigger IPO deals coming into play] across some sub-sectors such as consumer, telecoms infrastructure and technology," said Udhay Furtado in an interview. Furthermore, he holds an optimistic view on the prospects of the Malaysian IPO market and is confident that it will display a "better mix" in comparison to the past few years.

Source: moomoo, bursa Malaysia, The Edge Malaysia

Listed: $JPG (5323.MY)$ ; $OFB (0312.MY)$ ; $GOHUB (0311.MY)$ ; $UUE (0310.MY)$ ; $AGRICOR (0309.MY)$ ; $KTI (0308.MY)$ ; $KENERGY (0307.MY)$ ; $SMART (0306.MY)$ ; $DYNAMIC (03058.MY)$ ; $FEYTECH (5322.MY)$ ; $SINKUNG (0305.MY)$ ; $FPHB (0304.MY)$ ; $MKHOP (5319.MY)$ ; $TOPMIX (0302.MY)$ ; $KEYFIELD (5321.MY)$ ; $SBH (0300.MY)$ ; $ZANTAT (0301.MY)$ ; $PLINTAS (5320.MY)$ ; $ALPHA (0303.MY)$ ; $AGX (0299.MY)$ ; $WENTEL (0298.MY)$ ; $TSA (0297.MY)$ ; $HEGROUP (0296.MY)$ ; $MTEC (0295.MY)$ ; $KJTS (0293.MY)$

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

dxplay : Steady!

105167842 : Most of them 'pancut awal'

Keol90 105167842 : try $UUE (0310.MY)$

keithie :

105497821 : Yup

shamsury79 : Good

101550592 :

Paul Bin Anthony : good luck and today My son sick my pary to the lord give us the best and this learn give you back 10 persen and help someone homeless people are honest with me what's your help me tq Sir God bless

my pary to the lord give us the best and this learn give you back 10 persen and help someone homeless people are honest with me what's your help me tq Sir God bless  and your family tq

and your family tq

Paul Bin Anthony 105167842 : please try

103137702 :

View more comments...