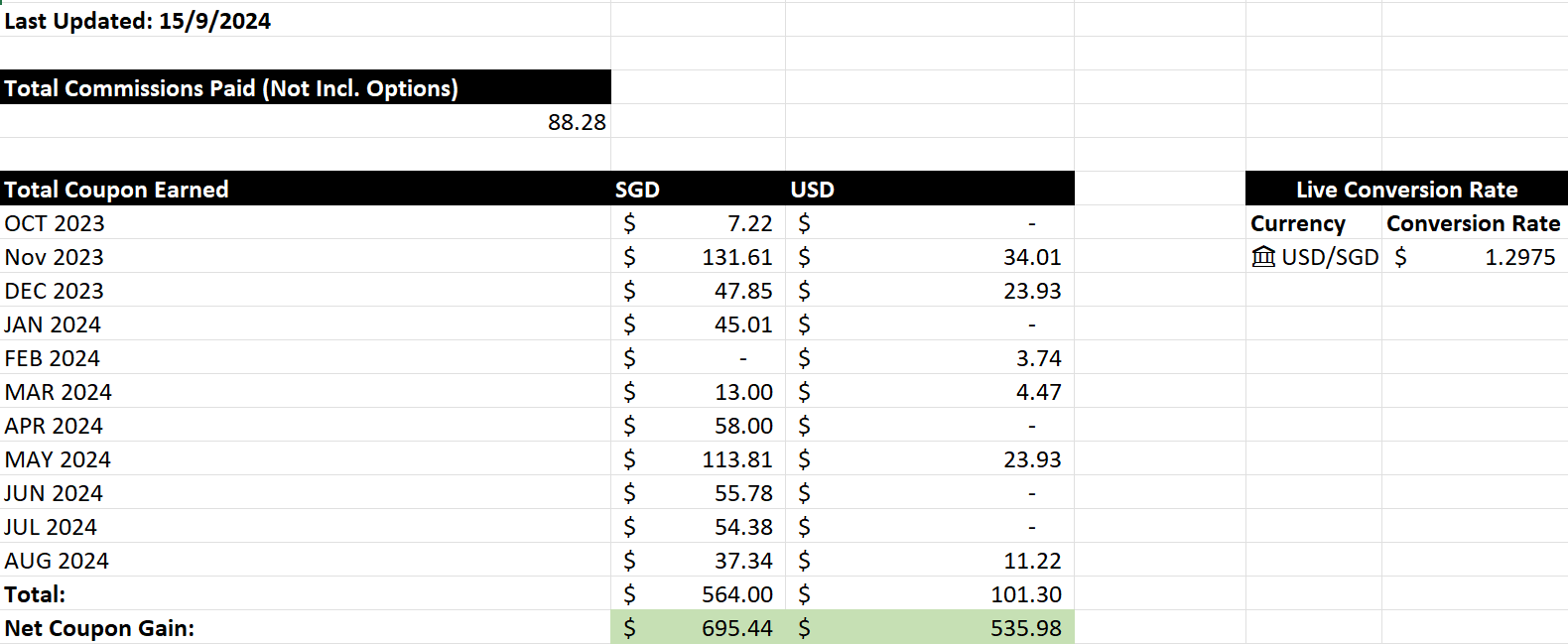

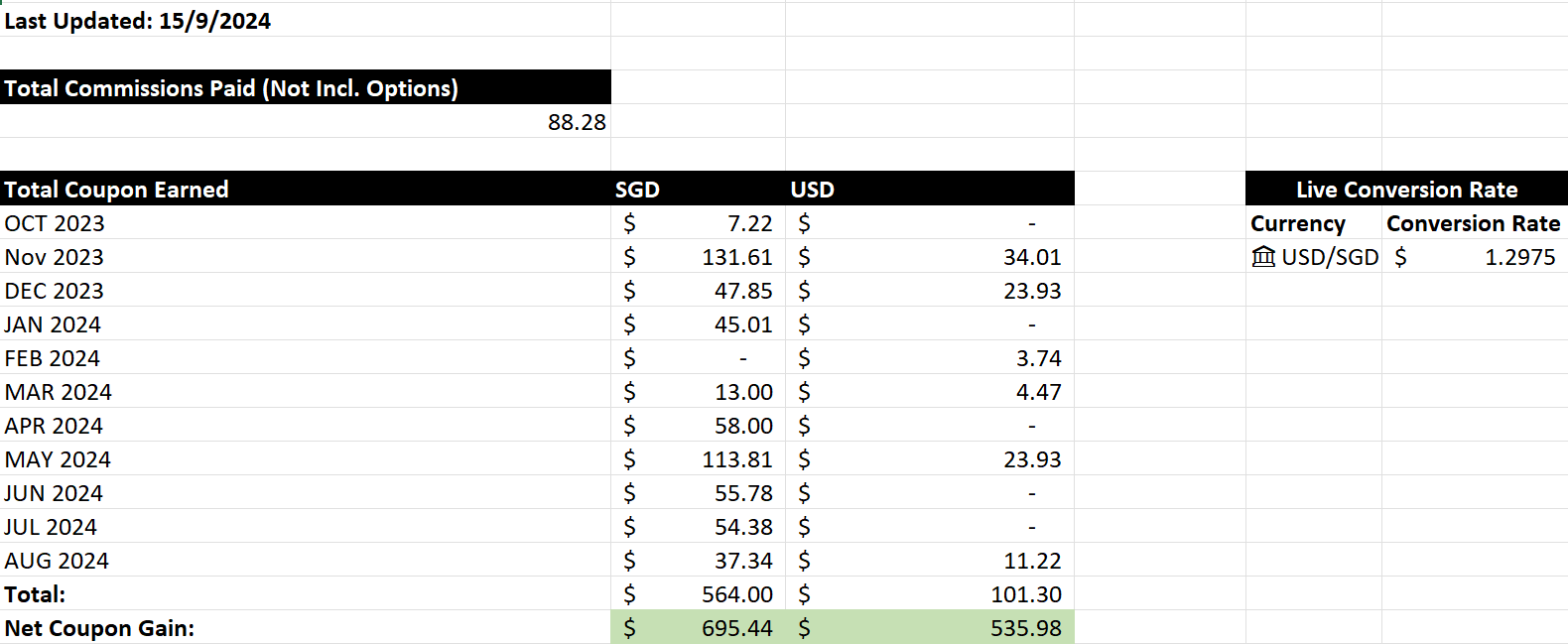

690 SGD in coupons since last October?!?!?!

I will be reaching my One Year Anniversary on Moomoo very soon, and I decided to finally tally down just how much in coupons Moomoo has given me (Not including free stocks) over the course of my 1 year investment journey (I started when I was 18).

Right, so what we're looking here is the total coupon values i've received for every month starting October, 2023.

Technically my usage of Moomoo only started on November onwards but October was when I opened the account.

The largest payout months were in November and May, likely due to events (like the infamous fishing game) probably taking place during that time. ![]()

I also notice that the coupon yields average around 30-50-ish per month, which is quite alot. ![]()

Moomoo has always been seen as one of those generous brokerages that give out a bunch of coupons through their expansive collection of Events, including the ability to convert points into coupons or oddly, merchandise. ![]()

If not for the guidance and aid of my fellow friends over at the Moomoo SG event & promo group chat (now known as the Market Mingle and Promo Picks server), I probably wouldn't have been able to win the fishing game or optimize on whatever in-between promotions there were, likely would've missed out some points here and there too.![]()

![]()

So if you want to know how to min-max all your coupons, id consider joining the group/server to be more informed. ![]()

![]()

![]() (They do post non-SG events and promos too, but not guarenteed to do so.)

(They do post non-SG events and promos too, but not guarenteed to do so.)

BTW, for any stock coupons, if they were Singapore Stocks, i usually placed them in safe bank stocks such as $DBS Group Holdings (D05.SG)$ , $OCBC Bank (O39.SG)$ or $STI ETF (ES3.SG)$ , if they were USD, i placed them into $Apple (AAPL.US)$ , $Coca-Cola (KO.US)$ or $SPDR S&P 500 ETF (SPY.US)$ .

Note: None of these stocks/investments constitute investment advice, they are examples of "safe" stocks backed by either their low historical volatility or backing from large institutions (They are part of a major index or owned by someone like $Berkshire Hathaway-B (BRK.B.US)$ ).

FYI the USD to SGD conversion rates use live data via Excel's (Date > Currencies) data type feature.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Dakota10 : Well done!

ps choa : How to get the coupons?

103656173 : I could not use my stock coupons to buy ETF. How did you do that?

Win9883 : can share how u get the coupon?

Thy GoD OP 103656173 : some don't include etfs, it depends on the t&c of the coupon, the next best thing is to use it on the large cap stocks that make up an index, which was why I chose apple, but any blue chip stock you trust in should do the same thing. (not investment advice still, you are still taking risk.)

Thy GoD OP Win9883 : from random events here and there, whether promotional or post-based, you can find them announced via the event & promo group chat or server that I mentioned.

103656173 : I looked for that chat group, but the search did not bring it up. I searched with both the old and the new names.

Thy GoD OP 103656173 : https://snsim.moomoo.com/share/server/7aowW?lang=en-us

NewXplorer : great

103656173 Thy GoD OP : No wonder I could not find it. I had to update my app to join after clicking on the link you provided.

View more comments...