A Beginner's Guide: How to Invest ETFs on moomoo?

Are you afraid to invest because you lack time or expertise? Today, we will introduce an investment tool to you ——ETF, to provide you with more abundant investing choices on moomoo.

What's ETF?

An ETF (Exchange Traded Fund) invests in a variety of assets like stocks, bonds, commodities, etc.

Unlike traditional mutual funds, ETFs are a very time-saving and efficient tool especially suitable for beginners who are just learning about financial investment, which may help you save time and effort while investing.

For example, ETFs can be traded on an exchange just like stocks, which means their prices are readily visible and trades can be executed quickly.

However, this characteristic also means that ETFs can be more volatile than average mutual funds.

How to Choose ETF?

Choosing an ETF that is suitable for you can be daunting, especially with over 3,000 options available in the U.S. market alone.

Additionally, ETFs invest in various asset classes, including stocks, commodities, bonds, foreign currencies, real estate, volatility, and mixed assets, furthermore, of whose assets have many subcategories.

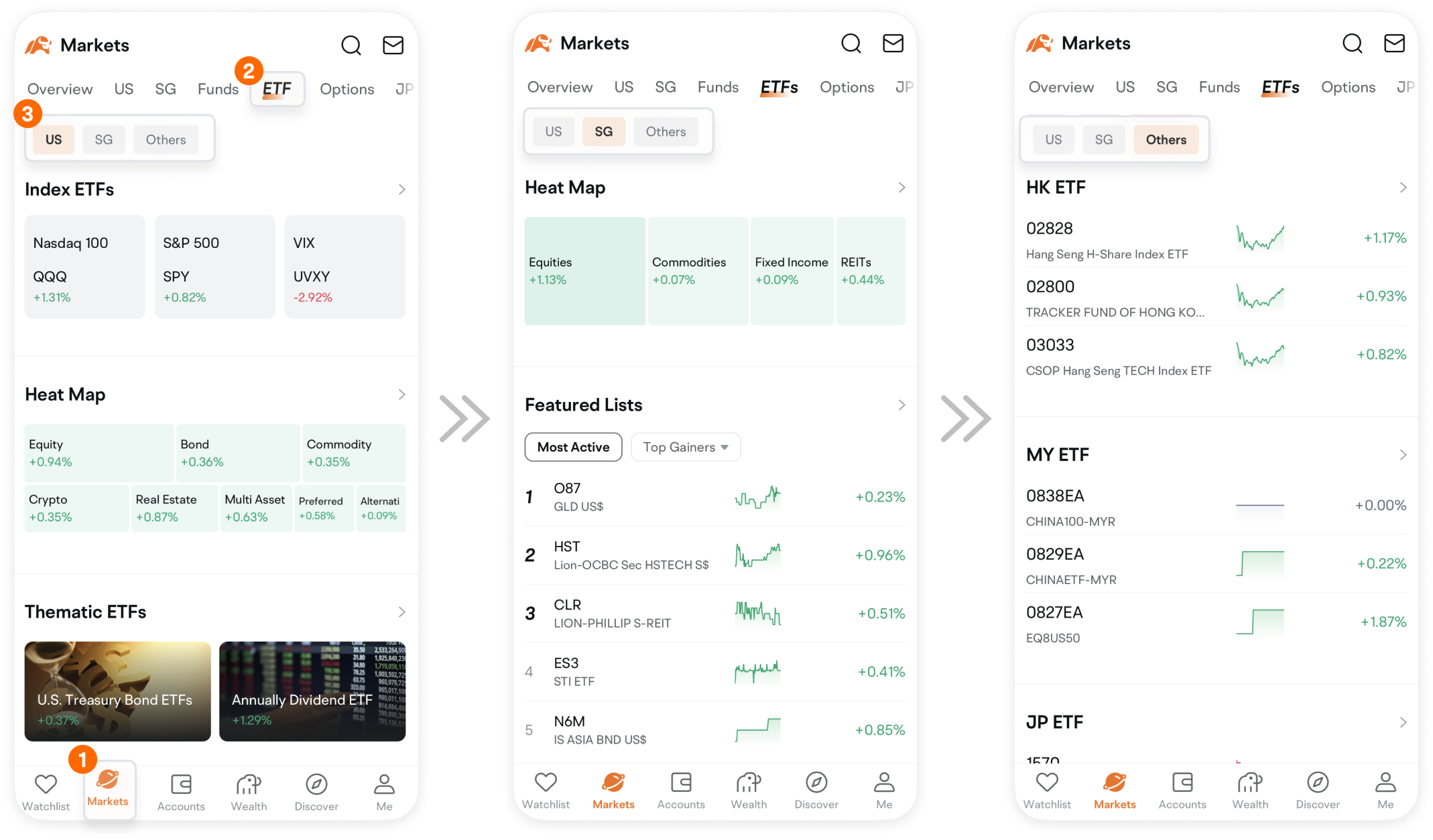

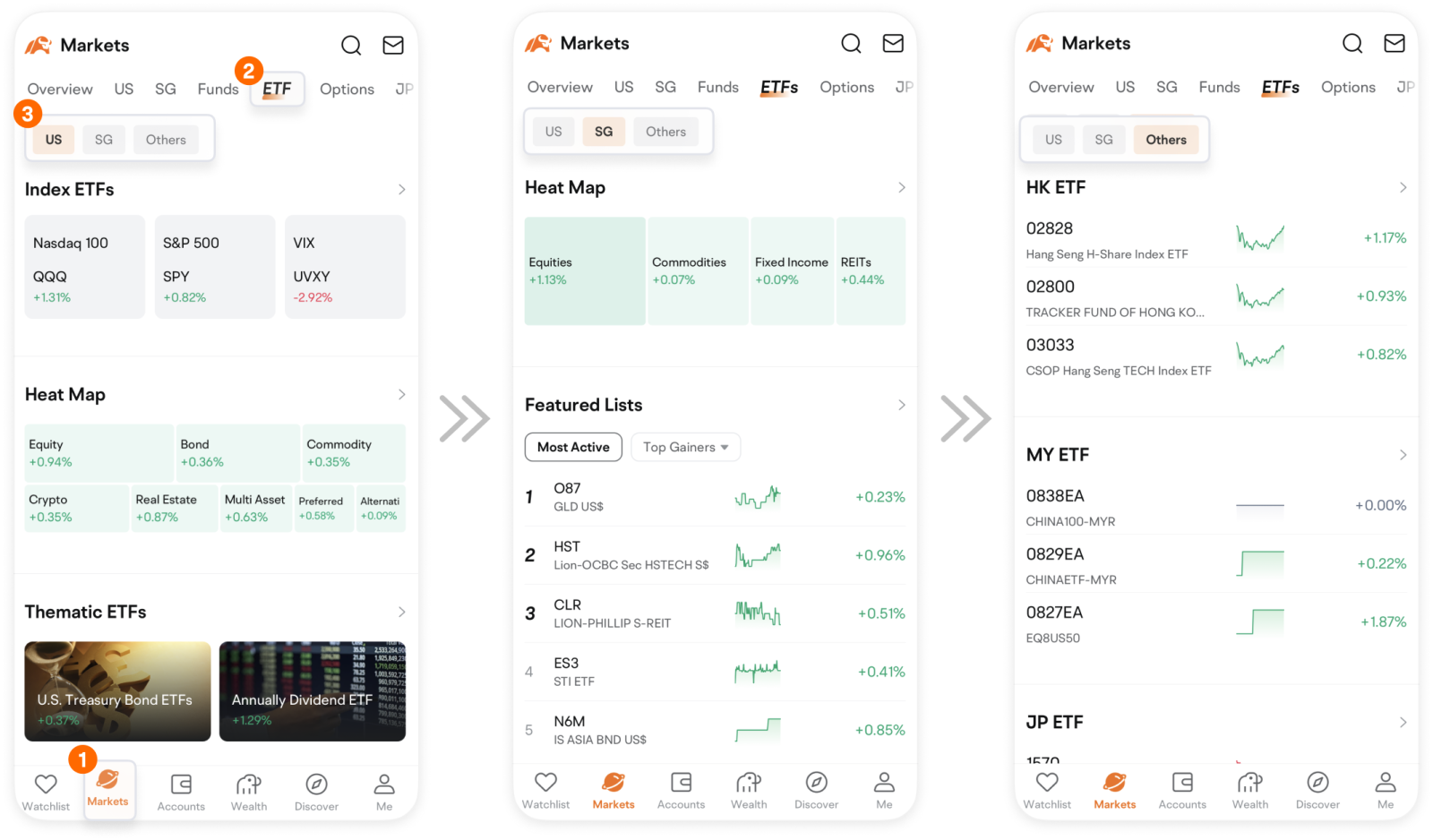

Luckily, moomoo can help users categorize them by different countries, themes, investment strategies, etc.

1. You can view ETFs in different markets on moomoo.

2. You can view ETF rankings, fees, turnover rates, and more according to different investment strategies.

Index ETFs: track the performance of a specific market index, offering a simple and low-cost way to invest broadly in the market.

Levaraged ETFs: use financial derivatives and borrowing to amplify the daily returns of an underlying index, typically offering 2x or 3x returns but also carrying higher risk.

Inverse ETFs: profit from a decline in the value of an underlying benchmark index, essentially providing the opposite performance of the index.

Take index ETFs as an example, and here is how we can find them on moomoo:

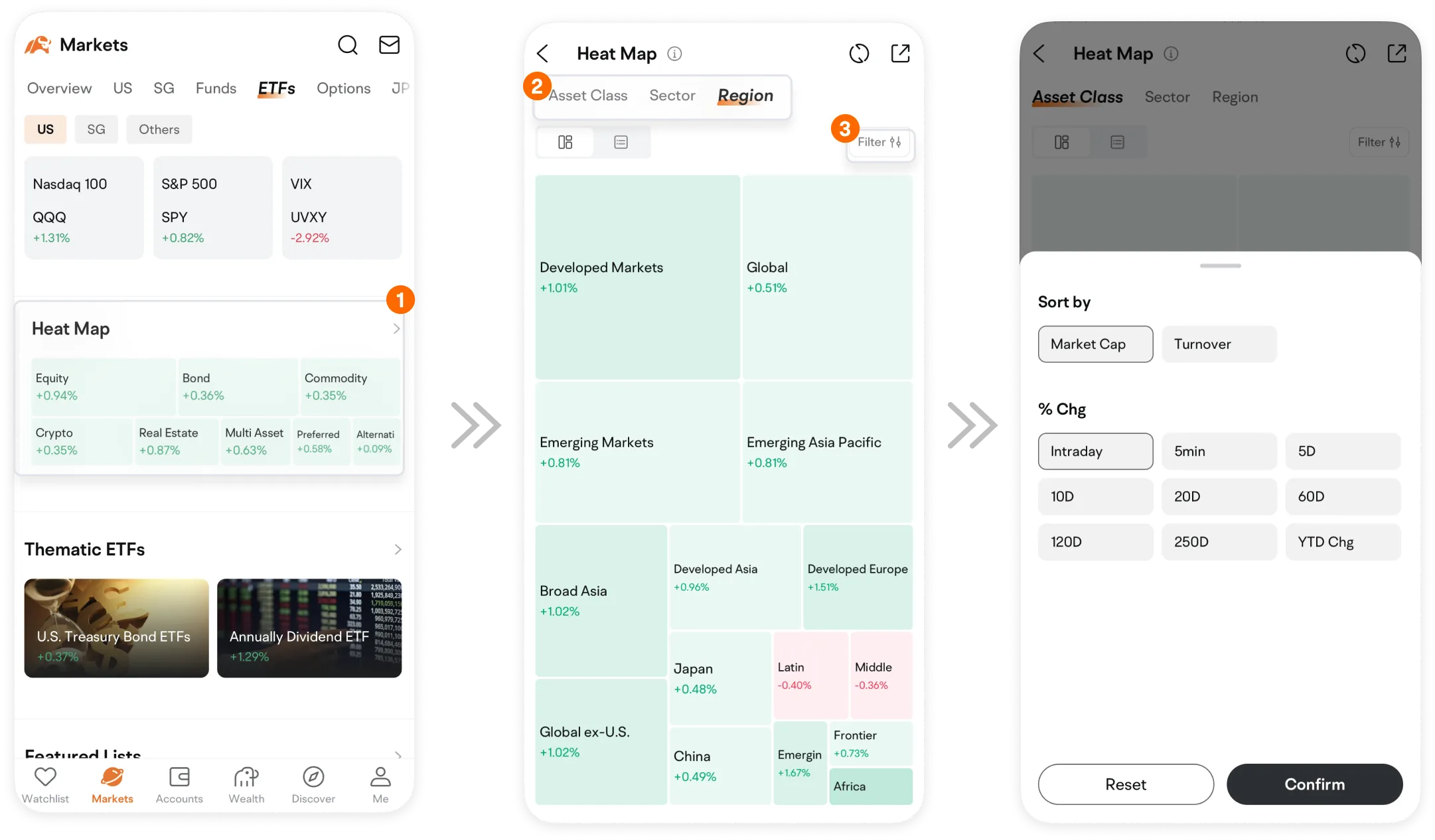

3. More awesome to explore>>Thematic ETFs and Heat map

What’s even more noteworthy is that moomoo offers Thematic ETFs and Heat map features. You can select ETFs that interest you based on the latest market trends and capitalize on investment opportunities.

For instance, the heat map can be drawn by Market Cap, Volume, and Turnover. The heat map, based on Market Cap, offers a visually intuitive representation where stocks with a larger market value are depicted with proportionally larger sectors. This design not only enhances the visualization but also gives you a clearer insight into the distribution and significance of different ETFs within the market.

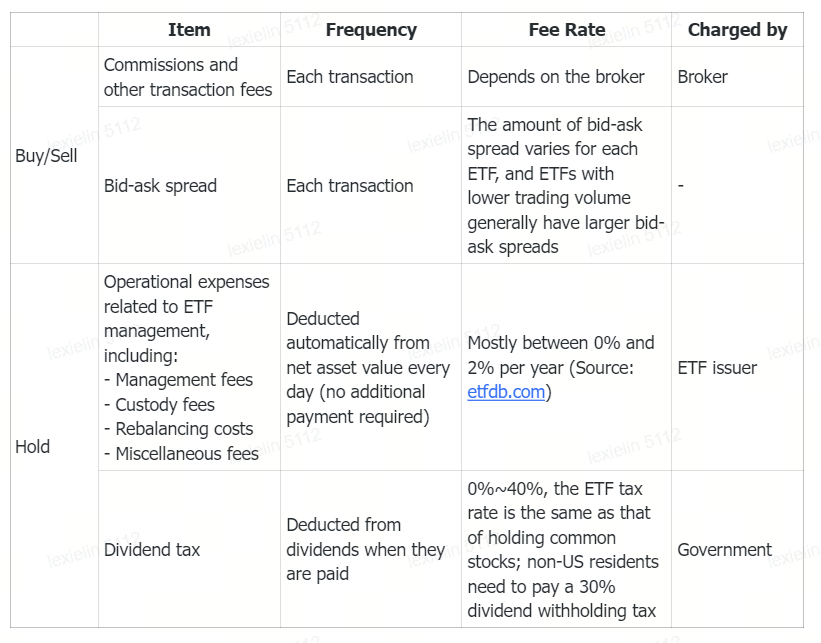

How Much Do They Cost?

Having explored the selection of ETFs on Moomoo, let's address a vital consideration that affects all investors—the trading expenses and management fees associated with ETFs.

They can be divided into three categories: commissions and transaction fees, operating expenses related to ETF management (including management fees, custodial fees, etc.), and bid-ask spreads.

Discover more and embark on your ETF investment adventure now! >>> ETF Complete Guide

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

I Am 102927471 :

1016551418 : rocket

cheng leong :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

151891691 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Katrina Reyes :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

NEPSE : Go

151286157 : very informative

kiteve1 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

151307827 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

151737576 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...