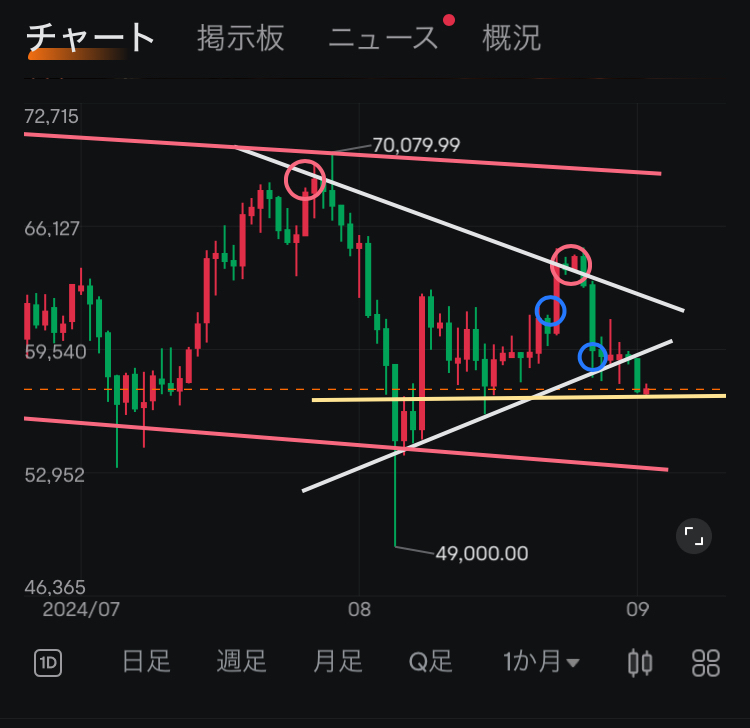

A drastic change from the previous uptrend! Are we seeing the formation of a double top pattern?

Technical analysis (Rating: 1.3/5)

- Just before the double top formation. The focus now is whether the price will decline to the 57,000 support level, which is the neckline of the double top formation that occurred on 8/16. After the completion of the double top pattern, there is a possibility of further decline to the range of 54,000-53,000.

- Although there is no clear indication of a downward trend reversal in Bitcoin based on fundamental analysis, concerns about "sharp trading" and "rising unemployment rate" are likely to continue the downward trend.

- The potential for further upward movement has been negated and there is a slight overselling scenario. However, there might be room for relief in the future.

・米半導体大手エヌビディア(NVDA.O), opens new tabは28日、第3・四半期(8─10月)の売上高が325億ドル(プラスマイナス2%)になると予想した。市場予想(317億7000万ドル)とほぼ一致する水準にとどまり、株価は引け後の時間外取引で6%下落した。

CME Bitcoin option analysis.

- Major calls: 55000, 65000

- Major puts: 55000~60000

There is a possibility of volatility around 55000.

・米半導体大手エヌビディア(NVDA.O), opens new tabは28日、第3・四半期(8─10月)の売上高が325億ドル(プラスマイナス2%)になると予想した。市場予想(317億7000万ドル)とほぼ一致する水準にとどまり、株価は引け後の時間外取引で6%下落した。

Candlestick chart (Rating: 1.5/5)

Candlestick chart (Rating: 1.5/5)

- Formed a large bearish candle on 8/27. It then declined while forming a doji.

After the decline,While observing the market,It is gradually declining, and there is room for further decline in the future.

(If the wait-and-see situation disappears, there is a possibility of a sudden change.)

☆Chart pattern x Resistance/Support line (Rating: 1/5)

- Chart pattern: Just before the double top.The focus will be on whether it will decline to 57,000, which is the neckline of the double top set on 8/16.After the completion of the double top, there is room for decline to 54,000 to 53,000.

- Resistance/Support line: Penetrating the white support line. The white support line is changed to a resistance line.

The focus will now be on whether it will fall to 57,000. In addition, when it rises"White support line (around 59,500)" "Blue support line (around 63,000)"are blocked as resistance lines.

☆Dow Theory x RGVI x Granville's Law (Rating: 1.5/5)

・Dow Theory: Concerns about "hard landing → soft landing expectation", "Powell's remarks" led to a decline from 8/23 to an upward trend reversal. However, influenced by US tech stocks, there was another rise followed by a downward trend reversal. Later,・PCE Deflator announcement, but no signs of an upward trend reversal.

・RGVI: Dead cross on 8/27. It is currently in a decline, but nearing a golden cross.

Granville's Law: It crosses above the 200-day moving average from the bottom, but then crosses below the 200-day moving average again.

"Halistrade concern" and "rising unemployment concern".From a Dow Theory perspective.Rick Rieder, BlackRockA clear reversal signal in the trend has not occurredUntil the trend is confirmed.The downtrend is believed to continue. Additionally,From Granville's Law, as it has once again fallen below the 200-day moving average.It can be considered as one temporary selling point.

- Moving Average Line × Volume Moving Average Line (Rating: 1/5)

- Moving Average Line: 5/21/50/75-day Moving Average Line Death Cross

- Volume Moving Average Line: Formation of Death Cross. Subsequently, the volume clearly decreased.

There is much room for future decline.

☆Ichimoku Cloud (Rating: 1/5)

- Reversal of two roles. The reversal of three roles is also likely to occur soon.

- BOLL × RSI × MACD (Rating: 2/5)

-BOLL: Fell from +1σ to -1σ.

-RSI: It reached 58 on 8/25, but has been ranging from 41 to 45 since 8/27, indicating a slight oversold condition.

-MACD: Dead cross from the negative territory. There is a possibility of a false signal.

->The upside potential has been negated and a slight oversold condition has emerged.There is room for easing in the future.

Unsupported feature.

Please use the mobile app.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

ぴるさん OP : It might be better to look at the polymarket instead of the charts until the current presidential election is over.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

J_M_RIN : I focus on long-term cup with handle patterns, so as long as that doesn't break down, I will remain bullish.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

ぴるさん OP J_M_RIN : ほんとそれなんですよね!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

この評価はあくまで短期トレンドなんです。

「中期トレンドの利下げ」「長期トレンドの半減期」はある以上buy and hold 一択ですね

J_M_RIN ぴるさん OP : For now, there won't be any short-term trading.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)