A quickie on markets: chances of Trump 2.0 in the White House. THREE THINGS YOU NEED TO KNOW

Here are some comments I shared this morning with Reuters and also on TickerTV during my interviews.

Donald Trump made his first apperance since the rally attack and also tapped JD Vance, 39, as his running mate, for the Republican party. This all happened on the same day that the Fed's Jerome Powell affirmed that inflation is heading toward the Fed's 2% goal, possibly paving the way for a near-term rate cut. So now the market is FULLY pricing in a rate cut in September. This a wildly positive for equities and continuation of the risk-on rally. Here is what you need to know

Sure markets are pricing in greater chance of Trump becomming US President again, but they are actually more excited about three rate cuts this year. So US stocks gained, the S&P 500 closing near its record high. Bitcoin extended its rally too but in the spotlight we had

- Rumble $Rumble (RUM.US)$ shares up 21%. This is Vance's firm Narya which owns roughly 7.2 million of.

- Trump Media $Trump Media & Technology (DJT.US)$ jumped 31% after Saturday's attack boosted his re-election bid.

More broadly let's remember this three things

1- Risk-on assets are generally supported under a pro-business potential Trump Republican-led party. With the chance of increased tariffs on China, commodities might be expected to outperform, which bodes well for some Asian markets, especially Australia and Indonesia.

2- Other risk assets, such as Bitcoin, seem supported under Trump 2.0 as he previously dubbed himself a champion for cryptocurrency at a San Francisco fundraiser in June. We don’t know specifics about his proposed crypto policy, but he slammed Democrats' attempts to regulate the crypto sector.

WATCH: $MARA Holdings (MARA.US)$ MARA and MicroStrategy $MicroStrategy (MSTR.US)$ which I mentioned on Friday and Monday as it was the 3rd most traded on moomoo last week. MSTR shares are down 27% from this year' highs and the thinking is Bitcoin and MSTR are oversold and could see increasing buying if Trump wins the election

3- Volatility– remember, volatility right now is calm as a farm. In US Presidential election years, markets are positive 80% of the time. Plus, momentum is strong amid earnings growth for the S&P 500 at 12%, and we now have three Fed rate cuts expected. That supports small caps, tech stocks, and commodities (with the USD likely to be pressured down).

- And in years where the S&P 500 has gained 10% in a half-year, the second half usually delivers positive returns 89% of the time

- But closer to the election, volatility usually picks up, especially around September and October. Then after an election, we usually see a rebound/relief rally as capital is put to work in December once we know who will be leading the US and what their policies are.

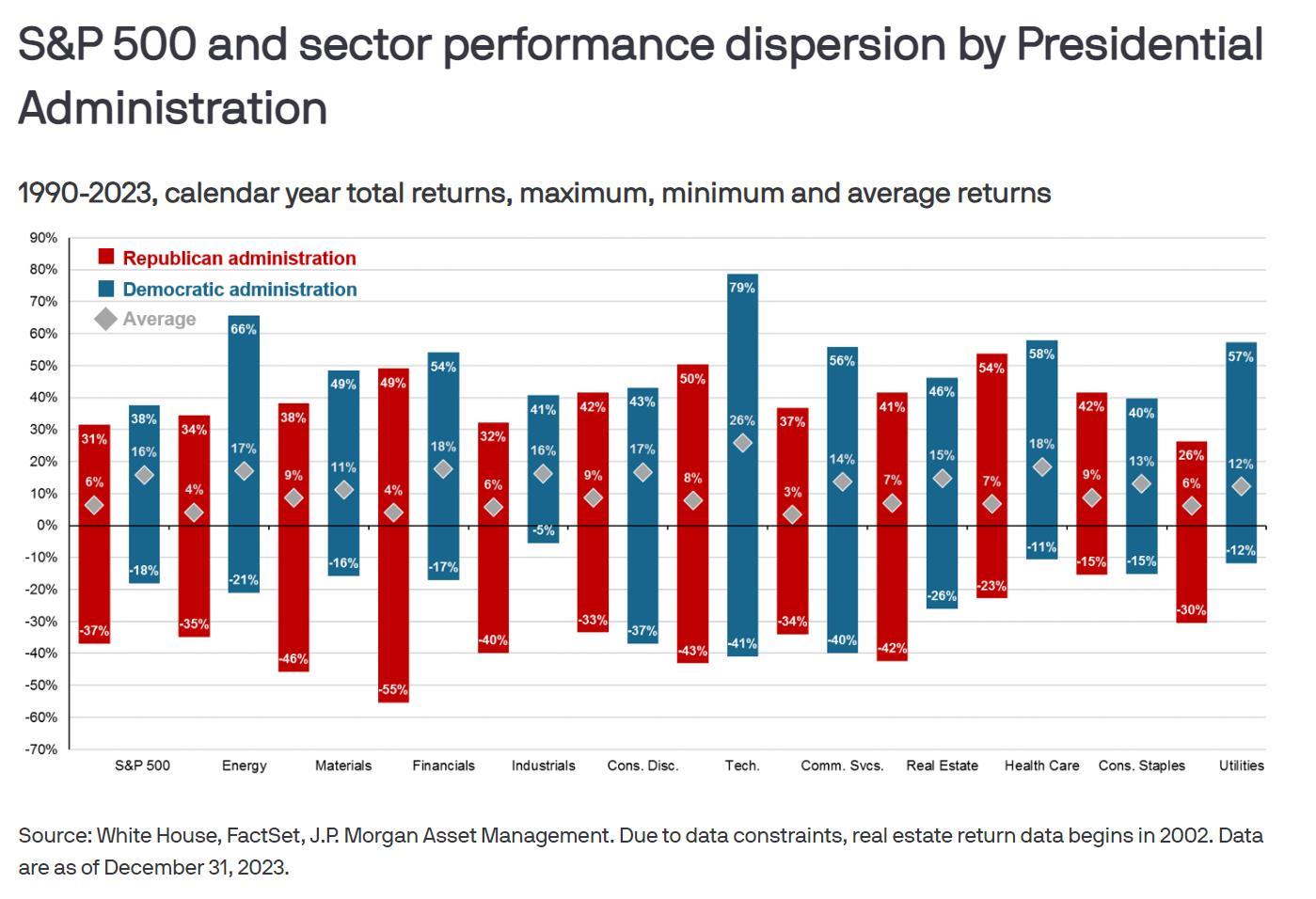

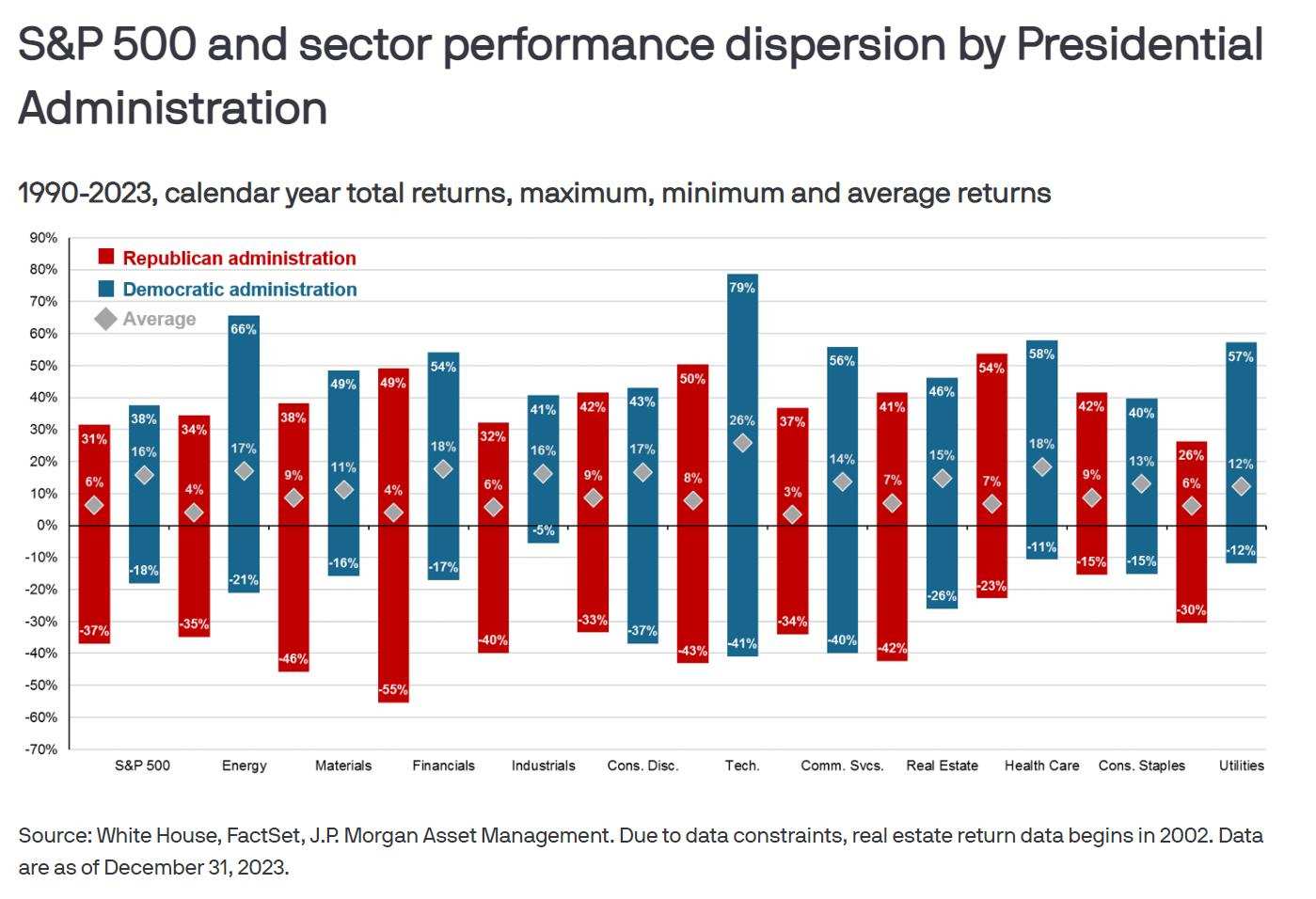

- In the meantime, repositioning portfolios based on past performance may be dangerous. So investors should instead focus on the fundamentals and where they see the most earnings growth, paying attention to what’s happening in the economy and markets.

- Being disciplined and patient can reward you handsomely.

Also remember.....July is the best month of the year to be invested in shares

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

151453268 witso : Disciplined and patient 🥹

🥹

Jessica Amir OP : That is it cowboy! LessssssGo!

Huimin_Gong : Being disciplined and patient.

151453268 witso Jessica Amir OP : Sorry Jess, i am a bit loose with emoji’s didnt mean to upset.But if your lookin for a boot scootin shoot out this cowboy’s ready for ya