According to History, How the Stock Market Performs After Jackson Hole

After a strong rally of 14% in the first seven months of the year, the stock market has hit a roadblock with the onset of the August downturn, as evidenced by a 4% decline in the S&P 500 index.

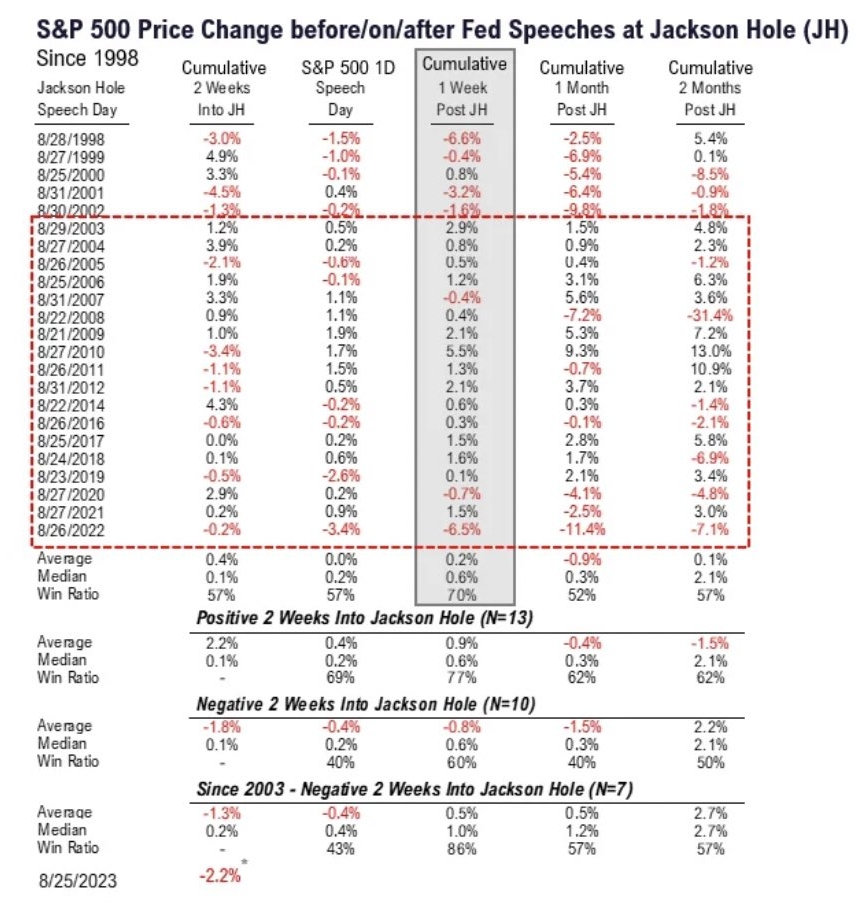

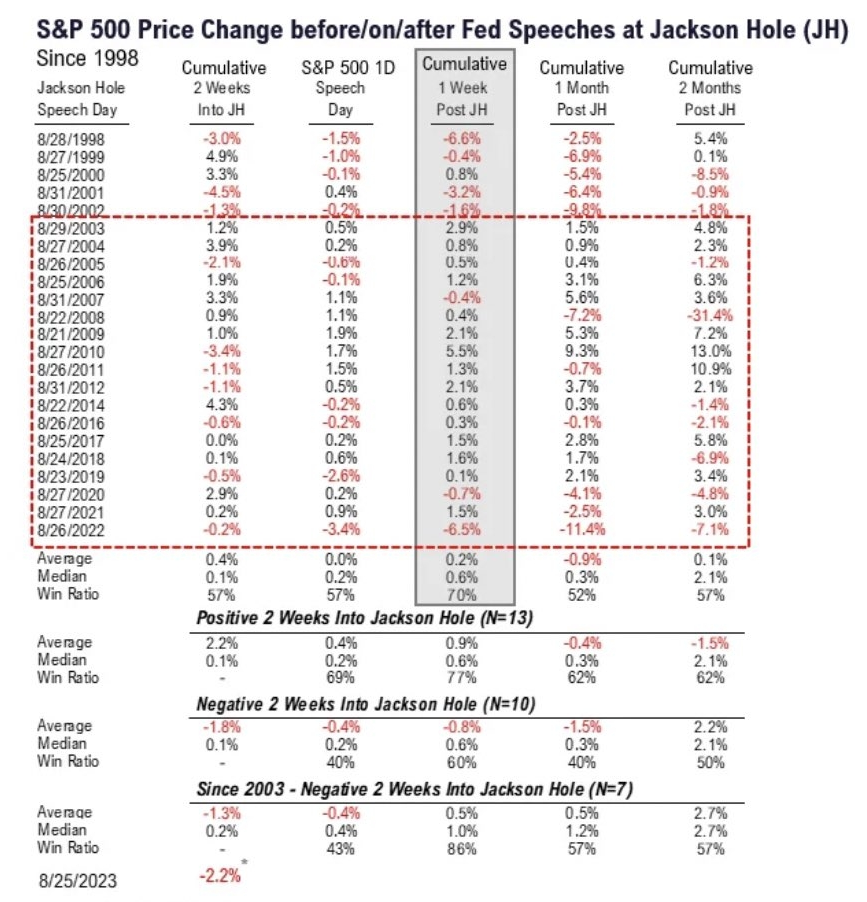

Jackson Hole could help turn things around in the long run. The symposium has a reputation as a market mover is due to the speeches given by former Fed Chair Ben Bernanke during periods of financial crisis and stimulus, which coincidentally occurred during the symposium held in late summer; however, this was largely an accident of timing rather than a deliberate plan to use Jackson Hole for policy announcements.

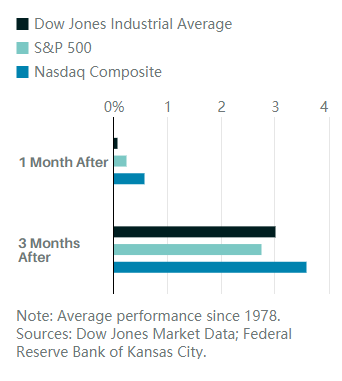

According to the data, the $Dow Jones Industrial Average (.DJI.US)$, $S&P 500 Index (.SPX.US)$, and $Nasdaq Composite Index (.IXIC.US)$ have all seen positive gains in the weeks following Jackson Hole. One month after the meeting, the Dow gained an average of 0.1%, while the S&P 500 rose an average of 0.3% and the Nasdaq climbed an average of 0.6%.

Those numbers improve as time goes on. In the three months following the event, the Dow gained an average of 3%, the S&P 500 rose an average of 2.8%, and the Nasdaq climbed an average of 3.6%.

So long as Powell doesn't throw any curveballs, the stock market might be on track to pick up steam again.

Top central bankers would have happily accepted today's economy, with downgraded inflation, stable unemployment rates, and slow but not stalled economic growth if it were offered last year. However, this does not mean that the world's leading central banks will consider their mission accomplished, and there are still concerns about inflation despite better economic numbers in the US, according to a Bloomberg survey.

Global government bond yields have already surged to the highest in more than a decade – with rates on benchmark 10-year debt reaching as high as 4.33% this month in the US and 4.75% in the UK – on expectations that the Jackson Hole crew aren't done hiking yet.

If those bets are on point, few corners of the financial world will escape the consequences.

Source: Bloomberg, Barron's, Financial Times

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

SpyderCall : September seasonality is the worst

矿野 : Powell's policy mistake