Adobe: The Future Investment Potential of the Creative Software Giant

Welcome to follow me, let's communicate together!

Adobe, with its leading position in the content creation software domain, continues to maintain robust revenue growth and profitability. However, the market is always full of uncertainties, and Adobe's stock price is not immune to fluctuations. This article will delve into Adobe's fundamentals and assess whether it is a worthy target for investors.

First, let's examine Adobe's core value. As a leader in digital experience software, Adobe boasts a strong product portfolio that creates a formidable competitive moat. Additionally, artificial intelligence is emerging as a new growth engine for Adobe. Despite fierce competition, the vast potential market size is sufficient for Adobe to secure a significant share.

However, Adobe's journey is not without challenges. Regulatory issues, data privacy concerns, and high valuation pressures are obstacles it must confront. Nevertheless, Adobe continues to exhibit strong financial performance and market position.

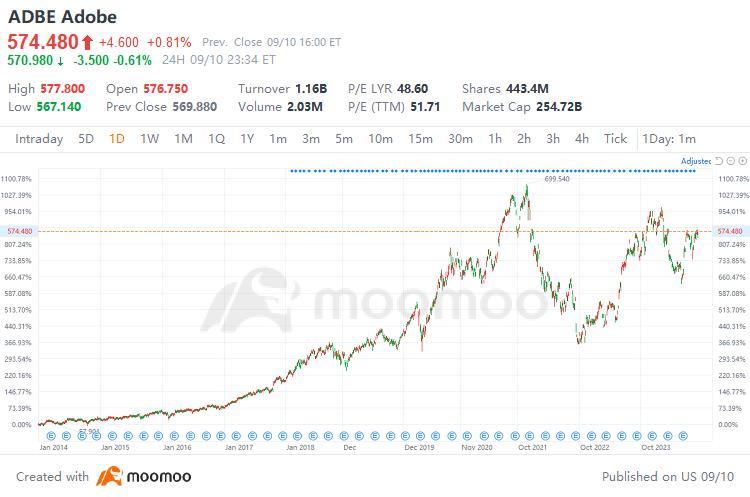

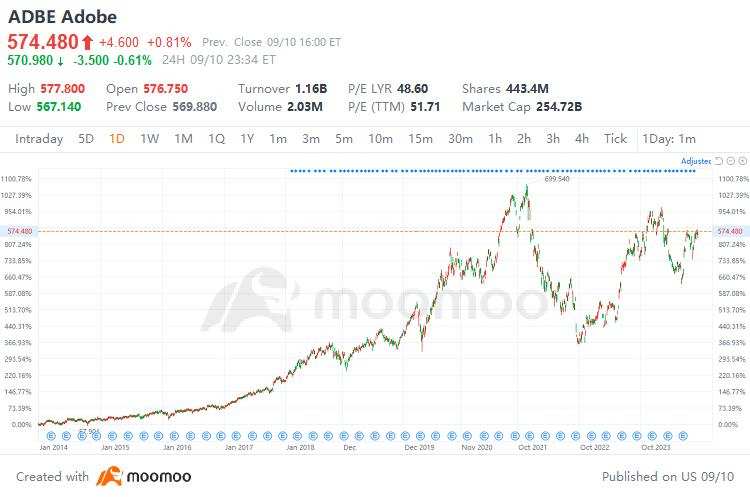

From a financial perspective, Adobe's stock price has grown by approximately 574.48% over the past decade, with a compound annual growth rate of 23.46%, which is undoubtedly an impressive record. Its consistent revenue growth, with only slight fluctuations even during the pandemic, is attributed to its high profit margins and stable subscription-based revenue model. Adobe's business model is robust, with sustained growth momentum driving its annual earnings increases.

Further analysis reveals that Adobe's ROE and ROIC are both above industry averages, demonstrating its excellent profitability. Although ROE has recently declined due to ongoing investments in AI and cloud services, this is largely an investment in future growth. Adobe's gross margin has remained stable and has slightly increased over the past five years, a direct benefit of its subscription model.

In terms of financial stability, Adobe's balance sheet is strong, with a debt-to-equity ratio of approximately 1.02 in Q2 2024 and a current ratio above 1, indicating good debt repayment ability and liquidity. Although Adobe does not pay regular dividends, its low debt levels provide financial flexibility for future expansion.

Regarding valuation, Adobe's PE ratio is 48.60, higher than the long-term market average, but within a reasonable range compared to its historical PE. Based on conservative calculations of diluted earnings per share, Adobe's valuation is slightly above the current stock price, suggesting that the stock may be slightly overvalued relative to its intrinsic value.

In summary, Adobe demonstrates strong profitability, stable financial health, and sustained innovation potential. Despite regulatory and competitive challenges and high valuation pressures, Adobe's deep involvement in AI and its global expansion strategy provide a solid foundation for future growth. For long-term investors, Adobe remains a noteworthy choice. However, given the current valuation levels, investors might need to wait for a more opportune entry point.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Deltaman099 : Indian rooted ceo some are good but many others are bad! Starbucks and ibm are two good examples.