Advance data indicate Canada July GDP rebound is short lived

The Bank of Canada wants to see the Canadian economy strengthen to avoid undershooting the 2% inflation target already reached in August.

At first glance, the higher-than-expected 0.2% GDP rebound in July could alleviate the central bank's concerns and lower the odds of an acceleration in the pace of interest rate cuts.

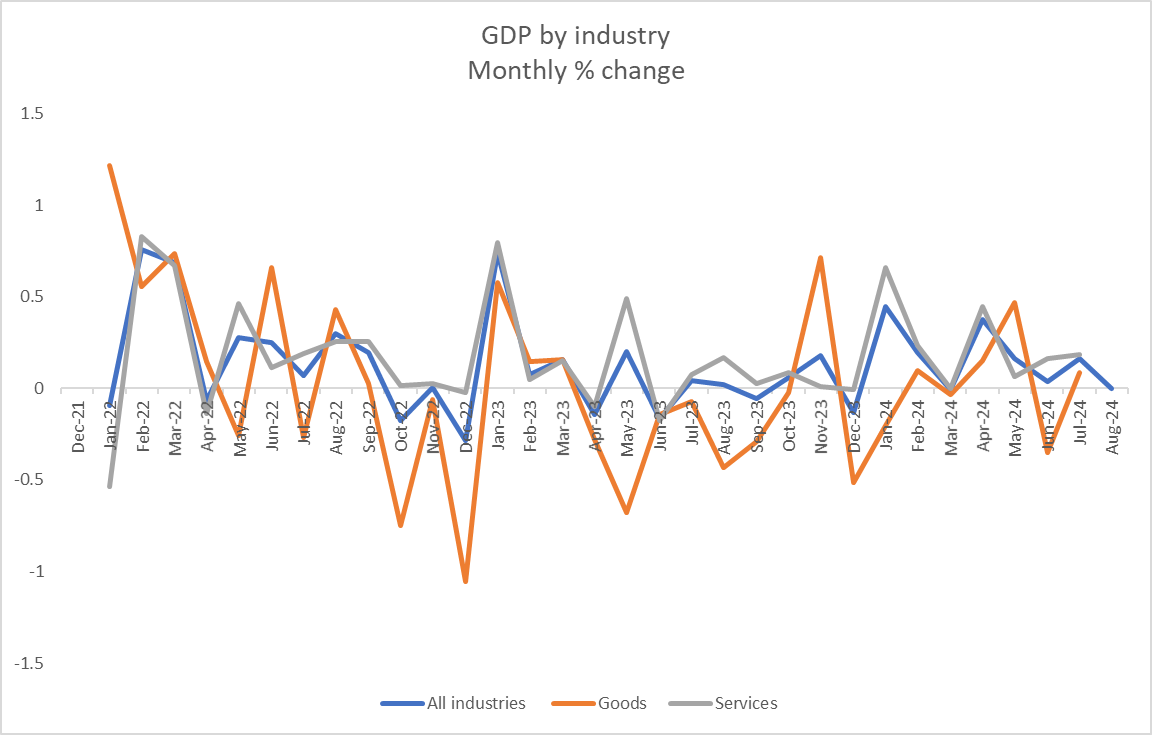

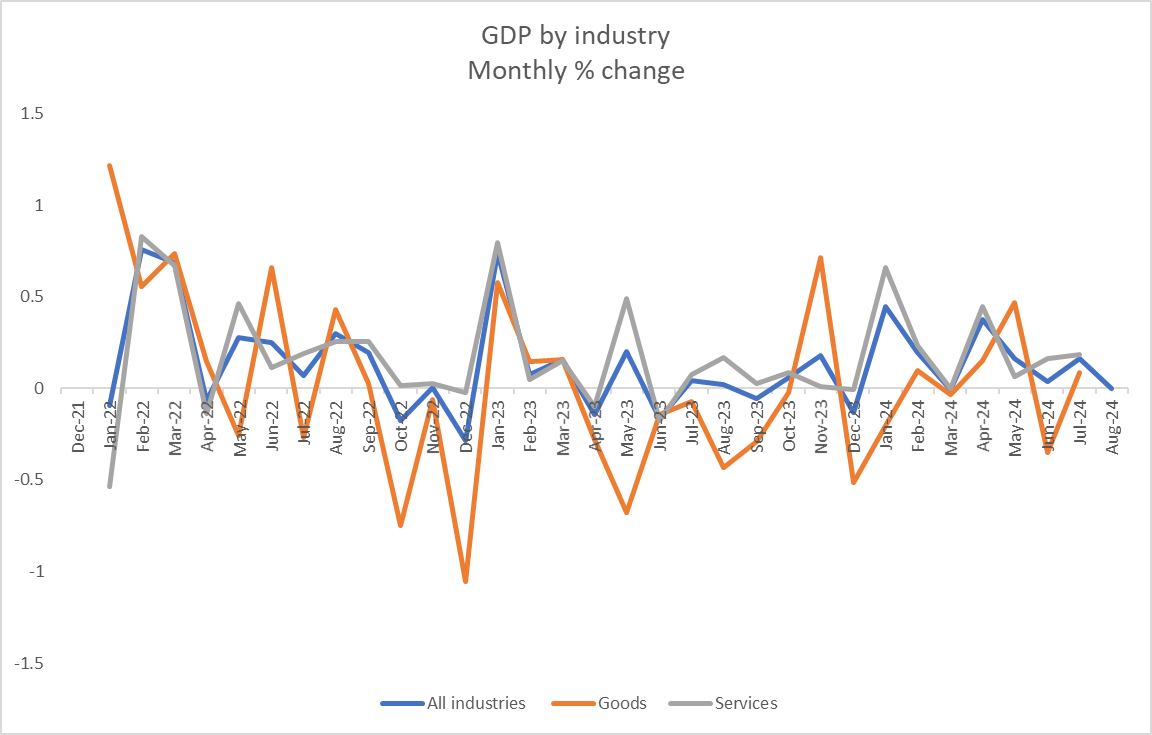

However, preliminary data for August point to growth stalling again, extending a slowing trend since April 2024, when GDP expanded 0.4% from the previous month.

GDP by industry

Data source: Statistics Canada

Which sectors supported growth in July?

Activity increased in 13 out of 20 industries in July, when services were up 0.2% and goods-producing sectors up 0.1%.

Services benefitted from gains of 1.0% in retail trade, the largest increase since January 2023. Also boosting services were a 0.3% advance in the public sector and a 0.5% expansion in finance and insurance. In July, the Bank of Canada announced a 25-basis point rate cut to 4.50%, following a previous 25-basis point cut in June. Market expectations about future interest rate announcements and ongoing geopolitical uncertainty contributed to market volatility over the month.

Within goods-producing industries, weakness in mining, quarrying, and oil and gas, as well as construction, was offset by gains elsewhere, including a 1.3% increase in non-durable manufacturing that drove overall manufacturing activity up 0.3%.

Main sectors' contribution to Canada's GDP change in July

Source: Statistics Canada

Impact of wildfires

The July GDP performance was commendable in light of the negative impact of wildfires on some sectors.

Source: Statistics Canada

What does it all mean for monetary policy?

With August advance estimate indicating that the July GDP rebound was short lived, the BOC will likely keep its focus on avoiding inflation falling too far below 2%.

That being said, the July rebound makes an acceleration in the pace of interest rate cuts unlikely in the short term, especially considering the mixed bag of recent data:

Consumer spending rebounds

Retail sales were up 0.9% in July on widespread gains. Volumes, more relevant to real GDP, increased 1.0%, consistent with July GDP report. Core retail sales, excluding gasoline, fuel and motor vehicles, expanded 0.6%. The advance estimate for August points to a further 0.5% increase in overall retail sales.

A mixed July payroll report

Payrolls rebounded 32,800 in July, more than erasing June's 22,900 drop. However, hiring was concentrated in 5 of 20 sectors, with health care and social assistance accounting for more than half of the hiring. The BOC is unlikely to read the July employment rebound as a sign of a strengthening labor market in and of itself, especially since job vacancies decreased a further 22,400 on the month.

More concerning was the pickup in average weekly earnings growth to 4.5% year-over-year from 4.2% in June.

Just a few days ago, Governor Tiff Macklem reminded the need to "stick the landing" and that it is "reasonable" to expect further rate cuts.

Today, the central bank is faced with a pickup in July GDP growth, consumer spending and weekly earnings gains but a stalling economic acticity in August.

Against this backdrop, the BOC might want to give itself more time before deciding whether to change the pace of rate cuts.

It is keeping a close eye on consumer spending, business hiring and investment. And so should you.

Stay up to date with the latest news from Moomoo News Canada.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment