After Holding Rates Steady for the Sixth Time, Will the Bank of Canada Make Its First Rate Cut in June?

The Bank of Canada kept interest rates at five per cent on Wednesday, its sixth consecutive hold since the last increase in July 2023. But governor Tiff Macklem said a June cut was “within the realm of possibilities.”

At a news conference after the decision, Macklem said central bankers are confident in the inflation progress they’re seeing and have seen since January, but they need to see it for longer to make sure it is sustained rather than a blip.

What reports raise bets on a rate cut in Canada?

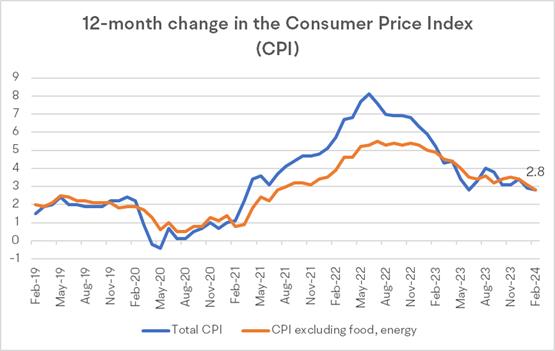

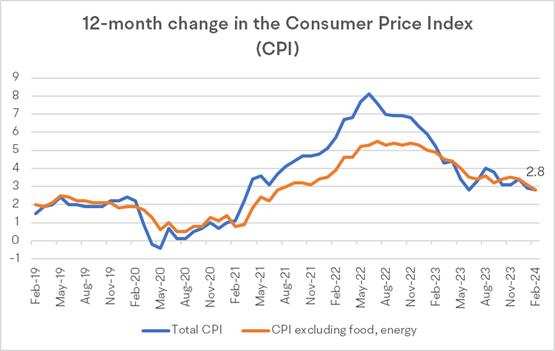

Canada's February inflation slows unexpectedly, ramping up June rate cut bets

Canada’s inflation numbers for February slowing to 2.8 per cent year over year instead of rebounding to 3.1 per cent as most analysts predicted. And closely-watched core inflation measures eased to more than two-year lows, prompting investors to increase their bets for a June rate cut.

The Bank of Canada’s preferred measures of inflation fell below the three per cent target for the first time since April 2021, Stephen Brown, deputy chief North America economist for Capital Economics Ltd., said in a note.

“While the data support our view that inflation will fall to two per cent sooner than the bank anticipates,” he said, “governor Tiff Macklem has told us that the bank needs to see at least ‘a few’ encouraging data points before it cuts interest rates.”

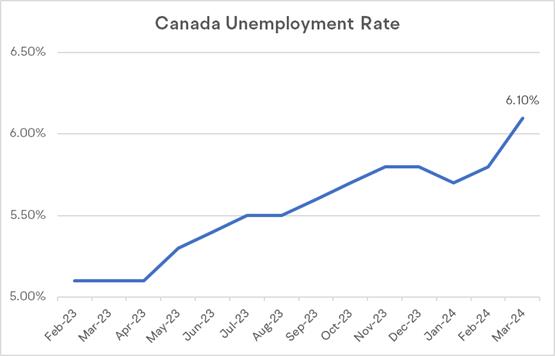

Canada's unemployment rate jumps to 6.1%, raising bets for June rate cut

Canada’s labour market stalled in March, as it lost 2,200 jobs and the unemployment rate increased to 6.1 per cent, raising bets that the Bank of Canada will come off the sidelines and cut rates in June.

"While markets had been pushing back expectations for a first Bank of Canada interest rate cut following strong GDP data to start the year, labour force data should see them pulling those expectations forward again closer in line to our expectation for a first move in June." CIBC economist Andrew Grantham wrote in a research note.

"Combined with the recent run of soft CPI prints, these numbers should have the Bank of Canada easing policy around the middle of this year,"Desjardins managing director and head of macro strategy Royce Mendes wrote in a research note.

How have economists reacted to the Bank of Canada's interest rate decision?

“The rhetoric coming from the central bank shows it is still waiting for sustained progress before considering cuts,” according to Warren Lovely, chief rates strategist and managing director at National Bank Financial.

“If things continue to evolve the way we expect on inflation, it will be appropriate to lower interest rates this year,” he said. “We didn't get that cut today, but it seems like it's coming just with a little bit more CPI evidence in hand.”

Lovely believes a cut in July is most likely, though June is possible.

“I think what we can expect is the Bank of Canada cutting interest rates two to three times this year,” he said.

Tu Nguyen, economist of RSM Canada, said she expects Canadians will see the first cut in June.

“Waiting any longer would risk repeating the mistake made in 2022 of acting too little too late,” she said.

“It is undeniable that inflation has slowed, and core inflation is steadily declining. More disinflationary is in the picture given the weakening labour market at home and China’s export of deflation abroad.”

Source: BNN Bloomberg, Financial Post

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

FARAMARZ AKBARY :